How to Calculate the Size of a Market Accurately

Learn how to calculate the size of a market with our complete guide. Master TAM, SAM, SOM, and proven methods for business strategy and consulting interviews.

Figuring out the size of a market is all about calculating the total amount of money a product or service could possibly make in a specific arena. This isn't just some abstract exercise; it's a make-or-break step for getting funding, proving a business idea has legs, and making smart investments. It’s about understanding the full scope of the opportunity in front of you.

What Market Size Is and Why It Matters

Imagine you want to open a new high-end Italian restaurant. You wouldn't just pick a random street corner and cross your fingers. You'd dig into the neighborhood's details: How many people live nearby? What's their average income? How often do they eat out, and how much are they willing to spend? That gut-check process is exactly what we call market sizing in the business world.

Defining your market size is really about quantifying the potential "customer pond" you're fishing in. It's the critical first step that shapes almost every decision that follows. Without it, you're flying blind, unable to answer the tough questions that investors and stakeholders are guaranteed to ask.

The Strategic Importance of Market Sizing

Getting a handle on your market's potential isn't just about slapping a big number on a pitch deck. It's a powerful strategic tool that guides your business from day one through every stage of growth. A solid analysis helps you:

- Assess Business Viability: Is the customer base big enough to actually support your business and deliver a decent return?

- Secure Funding: Investors need to see a believable path to big returns, and that always starts with a large, reachable market.

- Allocate Resources Effectively: Knowing the size of the prize helps you justify how much to spend on product development, marketing, and sales. A bigger market might call for a more aggressive growth plan.

- Identify Growth Opportunities: A deep dive can uncover untapped niches or adjacent segments that are perfect for future expansion.

Take the global artificial intelligence market, for example. It jumped from $233.46 billion to $294.16 billion in a single year—a 25.9% increase. Numbers like that are exactly why companies feel confident pouring massive investments into AI. You can find more of these kinds of market insights on ExplodingTopics.com.

Ultimately, market sizing transforms your business idea from a hopeful concept into a quantifiable opportunity. It’s the evidence that proves your venture is not just a passion project, but a commercially sound enterprise worth pursuing.

This kind of analysis is a cornerstone of any solid market entry strategy framework, as it sets the stage for how you'll compete and win. For a great primer on the concept, this practical guide on What is Market Sizing? offers some really valuable insights for founders.

Understanding TAM, SAM, and SOM

Sizing up a market isn't about landing on one single, perfect number. It's more like peeling an onion—each layer gets you closer to a more focused and realistic picture of your actual business opportunity. To do this, we use a simple but powerful framework built on three concepts: TAM, SAM, and SOM.

Getting a handle on these terms is absolutely critical. They take a big, fuzzy idea ("the market for X") and turn it into a concrete, actionable plan. It’s a structured way to think about your ultimate potential, the specific slice you're going after, and what you can realistically bite off in the near future.

TAM: The Total Addressable Market

First up is the Total Addressable Market (TAM). This is the big, blue-sky number. It represents the total possible revenue for a product or service if every single potential customer on earth bought it. Think of it as the absolute ceiling on your opportunity, a world where you face no competition and have endless resources.

Let's say you're launching a new vegan restaurant in a major city. Your TAM would be the entire global spending on restaurant food. It’s a massive, impressive number—much like the $13.2 trillion in global private market assets under management in 2024 shows how big "total markets" can be—but it’s not a practical target for your single location. It's the "what if" number.

SAM: The Serviceable Available Market

This is where we bring things back down to earth. The Serviceable Available Market (SAM) is the chunk of the TAM that your business can actually reach, defined by your product's niche, your geographical limits, and your business model. It answers the question, "Of everyone out there, who could realistically buy my specific product?"

For our vegan restaurant, the SAM isn't the global restaurant market. It’s the total spending on dining out by people within a 10-mile radius of your location. You’ve immediately filtered out anyone who lives too far away to be a regular customer. You're defining your playground.

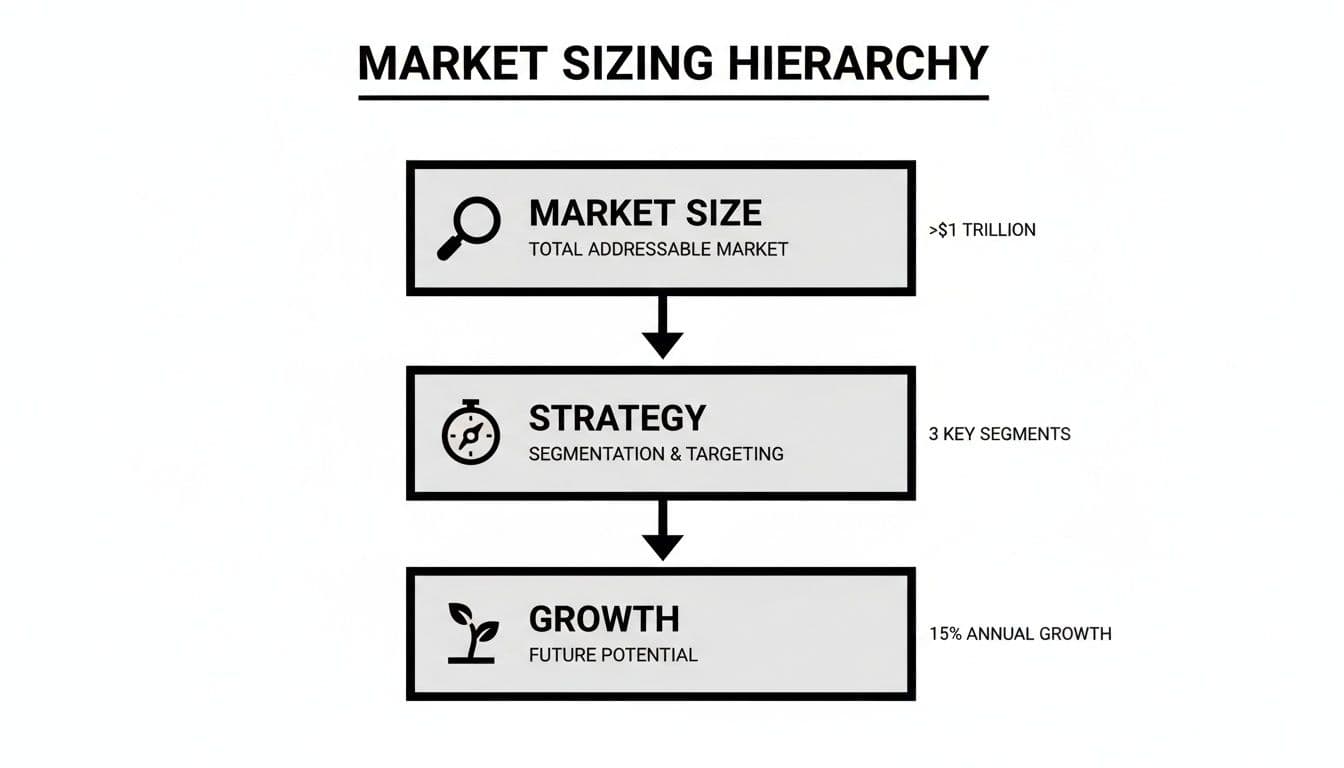

This hierarchy diagram shows how market sizing acts as a funnel, moving from a broad vision to a targeted strategy that can actually drive growth.

As you can see, understanding your market size isn't just an academic exercise; it's the foundation upon which your entire strategy and growth plans are built.

SOM: The Serviceable Obtainable Market

Finally, we get to the most important metric for your immediate plans. The Serviceable Obtainable Market (SOM), often just called the target market, is the piece of the SAM you can realistically capture. This is where you have to be honest about your competition, marketing budget, sales capacity, and brand awareness.

Back to our restaurant. Your SAM is everyone who dines out within a 10-mile radius. Your SOM, however, is the portion of those diners you think you can win over in your first one to two years. Given the other vegan and non-vegan restaurants competing for their business, maybe you aim to capture 5% of the local vegan/vegetarian diners and 1% of the "flexitarians." That's your initial goal.

To make these distinctions crystal clear, here’s a quick breakdown.

TAM vs SAM vs SOM: A Quick Comparison

| Concept | What It Measures | Key Question It Answers | Example (For a New Vegan Restaurant) |

|---|---|---|---|

| TAM | The total global demand for a product category. | How big is the universe of potential buyers? | The total spending on all restaurant meals worldwide. |

| SAM | The segment of the TAM your business model can serve. | Who can I realistically reach? | The total spending on restaurant meals by people living within a 10-mile radius. |

| SOM | The portion of the SAM you can realistically capture. | What share of the market can I win in the short term? | The revenue you project from capturing 5% of local vegan diners in the first 2 years. |

This table helps illustrate how the scope narrows from a massive, theoretical market to a specific, actionable target.

Ultimately, the TAM-SAM-SOM framework is an incredible tool for grounding your ambition in reality.

TAM shows investors the scale of the dream, SAM defines your battlefield, and SOM outlines your initial plan of attack. It proves you've thought about not just "how big could this be?" but also "how will we actually start winning?"

By breaking the market down this way, you create a credible story that connects a grand vision to a tangible, step-by-step plan. It’s a must-do exercise for any founder, strategist, or consultant.

Choosing Your Method: Top-Down vs. Bottom-Up Analysis

When you need to figure out how big a market is, you've got two main ways to go about it. Imagine you’re asked to estimate the crowd size at a big game. You could start with the stadium's official capacity and guess what percentage of seats are full. Or, you could count the number of people in one section and multiply that by the total number of sections.

That's the core difference between top-down and bottom-up analysis. One isn't necessarily better than the other; they just come at the problem from opposite directions. In fact, the most bulletproof analyses use both to see if their numbers tell a similar story.

The Top-Down Approach: A View from 30,000 Feet

The top-down method starts with the biggest, broadest number you can find and systematically carves it down to what’s relevant for you. Think of it as using a telescope—you start with a wide view of the entire sky and slowly zoom in on your specific star.

You’ll typically begin with a massive market figure from an industry report by firms like Gartner or Forrester, or even government data. Then, you apply a series of logical filters to get to your segment.

For example, if you're launching new business intelligence software, you might start with the total global spending on data analytics. That market was estimated at $69.5 billion and is projected to hit $302.0 billion, according to some data analytics market research. From that huge number, you'd then start slicing away—filtering by company size, specific industries, and geographic regions that you're targeting.

This approach is popular because it's fast and does a great job of framing the big-picture opportunity. It's perfect for an initial investor pitch or a high-level strategy meeting.

- Pros: Quick to put together if you have good third-party data. Excellent for showing the total potential prize.

- Cons: Can be overly optimistic. You’re at the mercy of how well the source data aligns with your specific niche.

The biggest pitfall here is that your assumptions for narrowing down the market can be a bit loose, which might lead to a final number that looks impressive but is hard to defend.

The Bottom-Up Approach: Building Brick by Brick

The bottom-up approach does the exact opposite. You start with the smallest, most fundamental units of your business and build your way up to a total market size. It’s like building a wall one brick at a time.

This method is all about your own data and concrete assumptions. You figure out how many individual customers you could realistically reach, what they would actually pay for your product, and what your sales channels can handle.

A bottom-up analysis forces you to get real about your go-to-market strategy. It answers the critical question: "How many units can we actually sell, at what price, and through which channels?"

This grounding in operational reality makes the bottom-up number incredibly credible, especially to seasoned investors and your own internal finance teams. It’s the basis for solid financial modeling.

- Pros: Generates a far more realistic and defensible market size that’s directly tied to your business model.

- Cons: It's a lot more work. You'll need to do more digging, whether through primary research or by making very detailed, granular assumptions.

So, Which Method Should You Use?

Here’s the thing: it’s not an "either/or" choice. The best analysts use both methods in tandem to create a compelling and well-rounded picture.

Start with a top-down analysis to frame the macro opportunity. This answers the first big question: is this market even big enough to be interesting?

Then, construct your bottom-up case to prove you have a realistic plan to capture a piece of it. When your top-down "telescope view" and your bottom-up "brick-by-brick" calculation land in the same ballpark, you've got a powerful sanity check. That convergence is what makes your market sizing story not just a number, but a truly convincing argument.

How to Calculate Market Size with Real Examples

It’s one thing to talk about top-down and bottom-up analysis in theory, but the real magic happens when you start applying them. This is where we get our hands dirty and turn abstract ideas into hard numbers.

By walking through a couple of real-world examples, you'll see exactly how to structure the math. More importantly, you'll understand the logic behind each step. Think of these examples as building blocks—a repeatable framework you can use for your own projects.

Top-Down Example: Eco-Friendly Dog Toys

Let’s say we're launching a new line of premium, eco-friendly dog toys in the United States. Our business model is direct-to-consumer, meaning we only sell online. Our goal is to calculate the Serviceable Available Market (SAM).

We’ll start with a huge, established market number and slice it down, layer by layer, until we get to our specific niche. This is the classic top-down approach in action.

Step 1: Start with the Total Market (TAM) First, we need a reliable figure for the entire U.S. pet industry. Industry reports show that total spending on pet supplies hits around $60 billion a year. That massive number is our starting point, our TAM.

Step 2: Filter for the Relevant Category Next, we need to zoom in on just the toy segment. A little digging shows that pet toys make up about 8% of the total pet supplies market.

- Calculation: $60 billion (Total Market) × 8% (Toy Segment) = $4.8 billion

So, the total market for all pet toys in the U.S. is $4.8 billion.

Step 3: Apply a Species-Specific Filter Our toys are only for dogs. Looking at the data, dog owners are responsible for roughly 65% of the spending on pet toys.

- Calculation: $4.8 billion (Total Pet Toys) × 65% (Dog Owner Spending) = $3.12 billion

We’re getting closer. The addressable market just for dog toys is $3.12 billion.

Step 4: Account for the "Eco-Friendly" Niche Our main selling point is sustainability. Market surveys suggest that about 25% of dog owners actively look for—and are willing to pay more for—eco-friendly products.

- Calculation: $3.12 billion (Dog Toy Market) × 25% (Eco-Conscious Consumers) = $780 million

Step 5: Factor in Your Sales Channel Finally, we have to account for our online-only strategy. E-commerce represents about 35% of all pet toy purchases.

- Calculation: $780 million (Eco-Friendly Dog Toys) × 35% (Online Sales Channel) = $273 million

Conclusion Using a top-down approach, we've estimated the Serviceable Available Market (SAM) for online, eco-friendly dog toys in the U.S. to be $273 million. This is the total annual revenue pie available to all companies playing in our specific, online niche.

Bottom-Up Example: Mobile App Development Agency

Now, let's flip the script and build a market size estimate from the ground up. Imagine we’re a new agency specializing in building mobile apps for early-stage North American startups.

This method is all about making logical, defensible assumptions about a single customer and then scaling that up. The strength of any bottom-up analysis lives and dies by the quality of these assumptions.

Step 1: Identify the Number of Potential Customers We'll start by figuring out how many new startups are founded each year in North America. Credible sources put this number around 1.5 million.

Of course, not all of them need a custom mobile app. Let’s make a reasonable assumption that only 10% have a business model where a mobile app is a core component.

- Calculation: 1,500,000 (New Startups) × 10% (Need a Mobile App) = 150,000 potential clients

Step 2: Estimate the Average Revenue Per Customer Next, what's a typical project worth? Based on our pricing for a standard Minimum Viable Product (MVP) app, we estimate an average project cost, or Annual Contract Value (ACV), of $50,000.

Step 3: Calculate the Total Potential Market (SAM) With these two figures, we can now calculate our Serviceable Available Market (SAM). This is the total potential revenue if every one of those startups hired an agency like ours.

- Calculation: 150,000 (Potential Clients) × $50,000 (Average ACV) = $7.5 billion

This $7.5 billion represents the total annual market value for our specific services in North America.

Step 4: Determine a Realistic Target Market (SOM) Finally, let's get real. What piece of that pie can we actually capture in the first few years? This is our Serviceable Obtainable Market (SOM). Given we're a new agency with a limited marketing budget, aiming for 0.1% of the market is a conservative but achievable goal.

- Calculation: $7.5 billion (SAM) × 0.1% (Market Share Goal) = $7.5 million

Conclusion Using a bottom-up approach, our estimated Serviceable Obtainable Market (SOM) is $7.5 million in annual revenue. This number is grounded in our actual operational capabilities and go-to-market strategy, making it a much more credible target for our business plan. It also sets a solid foundation for more granular forecasting, aligning perfectly with the kind of financial modeling best practices that investors want to see.

Mastering Market Sizing for Interviews

Market sizing questions are a rite of passage in interviews for consulting, finance, and product management. Don't be fooled—they aren't just a math quiz. Interviewers use these prompts to see how you think on your feet, break down a massive problem, and make sound judgments under pressure.

The secret isn't about landing on some magical, "correct" number. It’s about showcasing a structured, defensible thought process. You need to start broad, narrow your focus with clear logic, and constantly double-check your own work.

What the Interviewer is Really Looking For

When an interviewer asks you to estimate the size of a market, they’re listening for specific cues that signal your competence. They want to see you confidently take an ambiguous question and build a logical framework around it from scratch.

Here’s a peek inside their checklist:

- Structured Thinking: Do you immediately lay out a clear plan, like a top-down or bottom-up approach, to tackle the problem?

- Logical Assumptions: Are the numbers you're pulling out of thin air actually believable? More importantly, are you stating them clearly before you start calculating?

- Problem Decomposition: Can you take a huge, intimidating question and slice it into small, easy-to-solve pieces?

- Communication: Are you guiding the interviewer through your logic step-by-step, or are you just muttering numbers to yourself?

How you perform on these points is a direct reflection of how you’ll handle messy, real-world client problems. Nailing this shows you can create order from chaos, which is the core of any strategy role.

Quick Formulas to Use on the Spot

While every case is different, most market sizing problems boil down to a handful of fundamental formulas. Having these in your back pocket gives you a reliable toolkit when the pressure is on.

The most common setup you'll use is some form of a bottom-up calculation:

Market Size = (Total # of Potential Customers) × (Penetration Rate %) × (Purchase Frequency per Year) × (Average Price per Purchase)

For instance, if you were asked to size the annual market for coffee in a city, you'd start by estimating the population. From there, you'd make assumptions about what percentage of them drink coffee, how many coffees they buy each week, and what the average cup costs. Each of those elements is an assumption you have to state out loud and be ready to defend.

Another critical technique is what we call the "sanity check." Once you have an answer, take a step back and ask, "Does this number feel right?" If you calculate that the Canadian toothbrush market is $5 billion, a quick check would show that means every person is spending over $125 a year on toothbrushes—which is obviously wrong. A sanity check is your best friend for catching huge errors before you present your final answer.

For more practice, our complete guide on market sizing interview questions is packed with more prompts and frameworks.

Quick Reference for Market Sizing Interviews

To help you make faster and more credible assumptions during an interview, it's smart to have some key data points memorized. Think of this table as a cheat sheet for the most common figures you'll need.

| Data Point | Common Assumption / Value | When to Use It |

|---|---|---|

| U.S. Population | ~330 Million | For any U.S.-based market sizing problem. |

| Global Population | ~8 Billion | For global market sizing or international cases. |

| Average Household Size (U.S.) | ~2.5 people | When estimating demand for household goods or services. |

| Life Expectancy (Developed Nations) | ~80 years | Useful for calculating lifetime value or total users over time. |

| Smartphone Adoption (U.S.) | ~85-90% | For estimating the user base for mobile apps or services. |

| Internet Penetration (Global) | ~65-70% | For sizing digital products with a global reach. |

Committing these numbers to memory will not only speed up your calculations but also show the interviewer that you came prepared.

Common Market Sizing Mistakes to Avoid

Getting market sizing right is as much about dodging common mistakes as it is about crunching the numbers perfectly. A small error at the start can easily snowball, throwing off your entire strategy and making your conclusions totally unbelievable. Let's walk through the traps I see people fall into all the time.

The biggest and most common mistake? The “everyone is my customer” fallacy. This is when you look at the giant TAM number and present it as your target. Just because the global market for, say, coffee is worth billions doesn't mean your new artisanal coffee shop can capture all of it. TAM is a ceiling, not a floor.

Key Takeaway: You have to ground your analysis in reality. Investors would much rather see a credible, well-thought-out plan to win a specific niche (your SOM) than a baseless claim to take over an entire industry.

Overlooking Data Quality and Bias

Another classic pitfall is grabbing the first number you find from a single report and running with it. Not all data is created equal. Some sources are biased, some are outdated, and using bad data will poison your entire analysis from the start. It’s absolutely critical to know how to evaluate information sources before you trust them.

The best practice here is to triangulate. Always try to find two or three reputable sources that point to a similar conclusion. Think about the market research industry itself—it grew to over $82 billion by expertly blending data from all kinds of places, from digital analytics to old-school surveys. You can find more details in this market research industry statistics report. Following that multi-source approach gives you a much more defensible and accurate picture.

Making Overly Optimistic Assumptions

Look, every market sizing estimate is built on assumptions. That’s unavoidable. The problem is when those assumptions are built on pure wishful thinking instead of sound logic. An analysis based on hope will get torn apart the moment a sharp investor or stakeholder starts asking questions.

To avoid this, write down every single assumption you make and be ready to defend it. Think through the "why" behind each one. Here’s what I mean:

- Weak Assumption: "We'll capture 10% of the market in our first year." Why? Based on what? This is just a number plucked from thin air.

- Strong Assumption: "Our sales team can handle 200 demos a month. Based on our pilot program's 5% conversion rate, we project capturing 0.5% of the market in year one." See the difference? This assumption is tied directly to real-world capacity and data.

By steering clear of these common blunders, your market size calculation becomes more than just a number. It becomes a credible, compelling story about what your business can realistically achieve.

Your Top Market Sizing Questions, Answered

Alright, you've got the methods down, but when the rubber meets the road, a few practical questions always pop up. Let's tackle some of the most common ones I hear from analysts and founders.

Where Do I Even Start Looking for Reliable Data?

Great question. Finding solid data is half the battle, and honestly, the secret is to never trust a single source. You want to triangulate your numbers—find a few different data points that tell a similar story.

Here's my go-to list of starting points:

- Government Data: It's free, it's robust, and it's usually the gold standard. Check out places like the U.S. Census Bureau or the Bureau of Labor Statistics. These are treasure troves for demographic and economic stats.

- Industry Research Reports: Big names like Gartner, Forrester, and IBISWorld do the heavy lifting for you. Their reports can be pricey, but you can often get free access through a university or local library portal.

- Public Company Filings: Don't sleep on this one. Public companies have to disclose a ton of information in their 10-K reports. Digging through a competitor's filings can give you incredible insights into their view of the market.

The key is to cross-check everything. If two or three independent sources are all pointing to a similar number, you can be pretty confident you're on the right track.

How Can You Size a Market That Doesn't Exist Yet?

This is the classic innovator's dilemma. You can't just Google the market size for a brand-new product category, so you have to get a bit creative. The trick is to look for proxies based on current behavior.

My favorite way to approach this is using the "jobs-to-be-done" framework. Forget about your new product for a second and focus on the problem it solves. The real question is: how many people are already spending money trying to solve that problem with clunky, imperfect solutions? That's your starting point.

Think about it this way: before Uber and Lyft existed, you would have sized the "ride-sharing" market by looking at what people were already paying for. You'd add up spending on taxis, public transit, and even the costs of owning a car—all the different things people "hired" to get from Point A to Point B.

How Often Should I Re-Do My Market Size Analysis?

A market size estimate isn't something you carve in stone. It's a snapshot in time, and markets are constantly moving targets thanks to new tech, shifting consumer tastes, and economic cycles.

For a startup or a new venture, I'd recommend revisiting your analysis at least annually. You should also definitely update it before any major strategic move, like raising a new round of funding or making a big product pivot. This keeps your strategy grounded in reality, not based on last year's assumptions.