Your Guide to a Private Equity Case Study

Master the private equity case study with our expert guide. Learn the frameworks, steps, and best practices to succeed in your PE interview.

Think of a private equity case study as a live simulation of an investor's biggest challenge: deciding whether to buy a company. You're given a business problem—a potential investment opportunity—and your task is to analyze it from every angle and recommend a course of action. It's the core of the PE interview process.

What a Private Equity Case Study Really Tests

Facing a private equity case study for the first time can feel like being asked to solve a complex financial mystery with the clock ticking. It’s not just a test of your Excel skills. It’s a full-blown simulation designed to mirror the high-stakes decisions an investment professional makes every single day.

Picture yourself as a consultant hired to vet a major acquisition. Your job is to dig through the data, identify the real story, and present a rock-solid recommendation. Firms use this simulation to see if you have what it takes. They’re less interested in a single "right" answer and more focused on how you think and build your argument. If you're new to this, getting a handle on the basics of a case study interview is the perfect starting point.

Core Skills on Trial

The entire exercise is designed to see how you perform under pressure and to test a specific set of skills crucial for a career in private equity. While the company and industry might change from case to case, what they're looking for stays the same.

Firms are really zeroing in on three key areas:

- Quantitative Acumen: How sharp are your numbers skills? Can you build a financial model from scratch, calculate returns like IRR (Internal Rate of Return) and MoIC (Multiple on Invested Capital), and use that data to back up your claims?

- Commercial Judgment: Can you see the bigger picture beyond the spreadsheet? This is about business intuition. You need to spot the real-world risks and opportunities—things like competitive threats, market shifts, or hidden operational problems.

- Communication and Persuasion: Can you take all that complex analysis and distill it into a clear, convincing investment recommendation? How you present your findings is just as critical as the analysis itself.

At its heart, a private equity case study challenges you to form and defend an investment thesis. It's not just about crunching numbers; it's about building a narrative that explains why an investment will—or will not—generate significant returns for the firm's investors.

Ultimately, the goal is to see if you can blend rigorous analytical work with sharp commercial instincts. A successful candidate moves beyond the spreadsheet to tell a compelling story about how value will be created, proving they have the well-rounded skillset needed to succeed as a PE investor.

Building Your Analytical Toolkit

To really nail a private equity case study, you need more than just raw intelligence. You need a specific set of analytical frameworks. Think of these as the specialized tools in a master woodworker's shop—each one is designed for a precise task, but they all work together to build the final piece. Getting comfortable with these models is the first step to crafting an investment thesis that holds up under pressure.

These frameworks are the language of private equity. They’re how you take a mountain of raw data and turn it into a clear story about risk, return, and how you’re going to make money. Let's break down the three most important tools you’ll be using.

The Leveraged Buyout (LBO) Model

The Leveraged Buyout (LBO) model is the absolute heart of almost every PE case study. At its core, an LBO is just buying a company using a healthy dose of borrowed money (debt), with the company's own assets often serving as collateral for the loans.

It’s a lot like buying an investment property. You might put down 20% of your own cash (the equity) and get a mortgage for the other 80% (the debt). The goal is simple: use the rental income to pay off the mortgage and other costs, and eventually sell the house for a nice profit. An LBO applies that exact same logic to buying a business, using the company’s cash flow to pay down the acquisition debt.

This model answers the most important question of all: "What’s the highest price we can pay for this business and still hit our target return?" That return is almost always measured by the Internal Rate of Return (IRR) and Multiple on Invested Capital (MoIC).

Commercial Due Diligence

If the LBO model is the financial skeleton of your deal, then Commercial Due Diligence (CDD) is the flesh and blood. This is where you step away from the spreadsheet to figure out if the business is actually any good. It’s all about investigating the company and its market to see if the story the numbers tell is real.

Think of it as kicking the tires before buying a used car. You wouldn't just look at the price. You’d pop the hood, check the engine, and see if the model has a reputation for breaking down.

CDD requires you to dig into a few key areas:

- Market Analysis: Is this a growing market or a dying one? What are the big trends shaping the industry?

- Competitive Landscape: Who else is out there? Does our target company have a real, defensible advantage, or are they just another player in a crowded field?

- Customer Base: Who buys their stuff? Are they loyal? Is the company dangerously reliant on just a couple of huge clients?

- Company Strengths & Weaknesses: What makes this company special? And where is it vulnerable? This could be anything from its brand to the strength of its management team.

Commercial due diligence is the process of building conviction. It’s about verifying the story the numbers tell and uncovering the qualitative risks and opportunities that a spreadsheet alone can't reveal. A strong private equity case study presentation hinges on this qualitative analysis.

Operational Analysis

Finally, Operational Analysis zeroes in on how you can make the company better once you own it. Private equity firms aren’t just passive investors; they’re active owners. Their goal is to roll up their sleeves and create value by making the business more efficient and profitable.

This analysis is your "value creation plan." You're looking for specific levers to pull. Can you cut costs by re-negotiating with suppliers? Can you boost revenue by expanding into a new region?

This forward-looking view is absolutely critical. For instance, PE firms in 2024 were dealing with high interest rates and more regulatory hurdles. In response, strategies in 2025 shifted beyond simple buyouts to include more creative deals like add-on acquisitions and take-privates, often financed by the booming private credit market. This kind of adaptability shows why having a clear plan to improve a company's performance is non-negotiable. You can read more about these private equity highlights and the future outlook on Dechert.com.

To tie this all together, these three frameworks work in concert to build a complete investment thesis. Each one answers a different, but equally vital, question about the potential deal.

Key Frameworks for PE Case Study Analysis

| Framework | Core Question | Key Components to Analyze |

|---|---|---|

| LBO Model | What's the maximum price we can pay to hit our return target? | Sources & uses of funds, debt schedule, cash flow projections, exit assumptions (EBITDA multiple), IRR, and MoIC. |

| Commercial Due Diligence | Is this a good business in an attractive market? | Market size & growth, competitive landscape, customer analysis, barriers to entry, company's competitive advantage. |

| Operational Analysis | How can we improve this business and create value? | Revenue enhancement opportunities (pricing, new markets), cost reduction initiatives, operational efficiency improvements, M&A strategy. |

Mastering how to blend the quantitative rigor of the LBO model with the qualitative insights from due diligence and operational analysis is what separates a good case study from a great one.

A Repeatable Process for Solving Any Case

When you're staring down a private equity case study, your best friend isn't a calculator—it's a process. Having a structured, repeatable framework is what separates a panicked, scattershot analysis from a calm, methodical takedown of the problem. It turns what feels like a mountain of data and pressure into a series of manageable steps.

Think of it as your playbook. A good process gives you a clear path from the moment you get the prompt to your final recommendation, ensuring you hit every critical point, even when the clock is ticking. Let's walk through a proven, seven-step approach that works for just about any PE interview scenario.

Step 1: Deconstruct the Prompt

The second you get the case materials, time is your enemy. Before you even think about opening Excel, take a few minutes to read—and I mean really read—what’s being asked of you. One of the easiest ways to fail a case study is to solve for the wrong problem.

Nail down the core question. Is this a straightforward "go" or "no-go" LBO decision? Are you supposed to evaluate a few different bids? Or maybe you need to map out strategic options for an existing portfolio company? Get out a highlighter and mark the key constraints, like the investment hold period or specific return hurdles (IRR or MoIC) the firm is targeting.

Step 2: Structure Your Analysis

Once the objective is crystal clear, it’s time to sketch out a plan of attack. This is where you outline the main workstreams you'll need to build a compelling investment thesis. Don't dive into the weeds yet; just create the high-level buckets for your analysis.

A solid structure usually looks something like this:

- Financial Analysis: What are the real drivers of revenue and costs? What are the key outputs I need from my LBO model?

- Commercial Due Diligence: What are the top three questions I must answer about the market, the competition, and the customers?

- Operational Opportunities: Where can we actually create value here? And what are the biggest risks that could blow this whole deal up?

Organizing your thoughts this way keeps your analysis focused and stops you from getting lost chasing irrelevant details.

Step 3: Run a Quick Paper LBO

Before you get bogged down in a complex, multi-tab financial model, do a quick and dirty "paper LBO." This is a back-of-the-envelope calculation to see if the deal is even in the right ballpark. It gives you a fast, directional read on whether the returns are plausible.

A paper LBO is your first filter. You make a few high-level assumptions about the purchase price, how much debt you can get, EBITDA growth, and the exit multiple. With just those inputs, you can quickly estimate the potential IRR and MoIC. If those numbers are miles away from the firm’s target, that’s a massive red flag.

This sanity check helps you decide if the deal is worth a deeper look or if your thesis should actually be about why this investment is a bad idea.

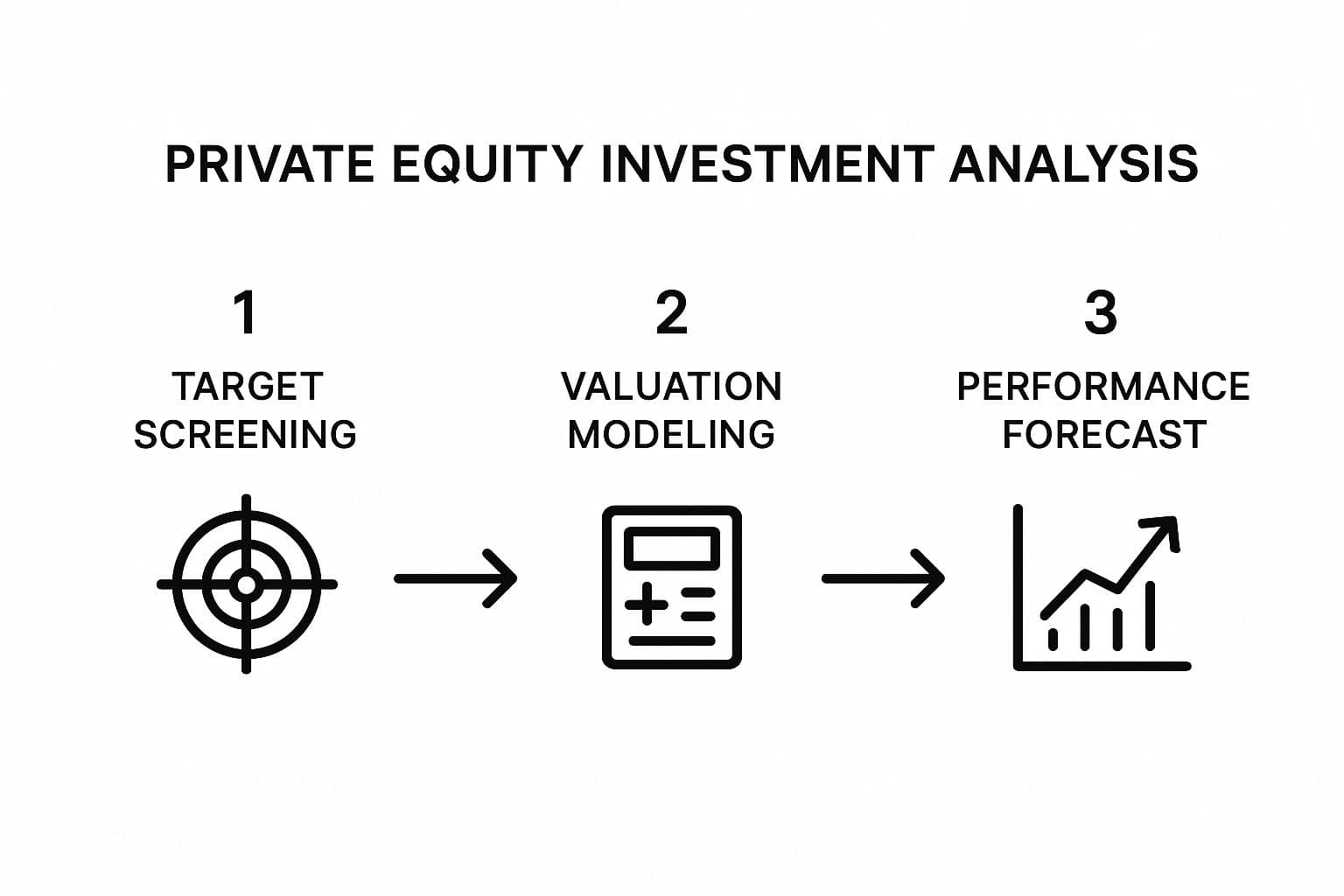

The typical flow of investment analysis moves from this broad screening to much more granular financial work.

As you can see, each stage builds on the last, funneling you from a high-level assessment toward a specific, data-backed conclusion.

Step 4: Dig into Due Diligence

Okay, now it’s time to get into the qualitative meat of the case. Using the information packet, you'll conduct your commercial and operational due diligence. Scour the documents for clues about the company's market position, any competitive moats it has, and how healthy its customer relationships are. This is where you build the story behind the numbers.

For example, a recent case about a UK education provider showed that students were price-sensitive because they couldn't afford to pay tuition upfront. The winning thesis wasn't just about financial engineering; it was built around the insight that offering deferred payment options could unlock massive growth. That's the kind of gem you find in diligence.

Step 5: Formulate a Clear Investment Thesis

With your quantitative and qualitative findings starting to take shape, you need to synthesize everything into a single, coherent investment thesis. This should be a clear, punchy statement that explains exactly why this is—or isn't—a great investment.

Your thesis has to tell a complete story. It should connect the company's strengths to your value creation plan and, ultimately, to the financial returns. A strong thesis sounds something like this: “We should acquire Company X. It’s a market leader with incredibly sticky customers, and by rolling out a few key cost-cutting initiatives and expanding into one new geography, we can generate a 25% IRR over a five-year hold.”

Step 6: Construct the Full Financial Model

With a clear thesis in hand, you can now build the full LBO model in Excel. This is the quantitative engine that proves your thesis. Your model needs to be clean, well-organized, and flexible enough to run sensitivities on your key assumptions, like revenue growth or the exit multiple.

Step 7: Present a Compelling Recommendation

Finally, you have to package it all up into a persuasive recommendation. Whether you're building a slide deck or writing a memo, your communication needs to be sharp and structured. Lead with your conclusion—the "go" or "no-go" call and your core thesis—right up front. Then, use the rest of your presentation to walk through the supporting evidence from your model and diligence. This top-down approach ensures the investment committee gets your main point immediately and then sees how you got there.

Putting Theory into Practice: A Real-World LBO Example

Frameworks are great, but the rubber really meets the road when you apply them to a real deal. Let's step out of the theoretical and into a practical scenario: a hypothetical take-private LBO of a mid-sized B2B software company we'll call "SaaSCo."

We'll follow the thought process of an analyst, Sarah, as she uses a classic seven-step framework to figure out if this deal is worth pursuing.

Step 1: Breaking Down the Prompt and Sizing Up the Deal

Sarah gets the case study packet: a brief memo, three years of financials, and some market data. The prompt is straightforward: "Evaluate the opportunity to acquire SaaSCo, a public software firm, and take it private. Our fund targets a 25% IRR over a five-year hold. You have 48 hours to present your recommendation."

Right away, she flags the hard constraints: a 25% IRR hurdle and a five-year clock. The target company, SaaSCo, sells subscription-based project management software. Her first pass is just to get the basic facts straight.

- Company: SaaSCo

- Business Model: B2B Software-as-a-Service (SaaS)

- Key Financials: $100M in revenue, $30M in EBITDA, growing at a steady 5% per year.

Step 2: The Back-of-the-Envelope LBO

Before diving into a massive spreadsheet, Sarah does a quick "paper LBO" to see if the deal is even in the ballpark. She uses some reasonable, high-level assumptions based on what a stable software business can support.

- Entry Price: Similar public companies are trading around 10x EBITDA. So, she pencils out an entry price of 10.0x $30M = $300M.

- Debt: A business like this could probably handle 5.0x EBITDA in debt, which is 5.0x $30M = $150M.

- Equity Check: Simple math. The equity needed from the fund is the rest: $300M - $150M = $150M.

- The Exit: Assuming EBITDA keeps growing at 5% annually, it should hit about $38.3M in five years. If they can sell for the same 10x multiple, the exit value is $383M.

After paying back the $150M of debt, the fund would walk away with $233M. A quick calculation shows the Multiple on Invested Capital (MoIC) is $233M / $150M ≈ 1.55x. That’s… not great. It almost certainly won't hit the 25% IRR target.

This initial check tells her something critical: just buying and holding won't work. They'll have to find a way to create real value.

Step 3: Digging for the "So What?" in Diligence

Now, Sarah goes deep into the case materials to find the story behind the numbers. And she finds it. SaaSCo's customer churn is a sky-high 20% for its small and medium-sized business (SMB) clients. But for its enterprise clients? A rock-solid 3%.

Why the huge difference? The sales team's incentives are all wrong. They get paid for signing up new logos, no matter how small. So, they spend all their energy chasing tiny, high-churn accounts instead of landing the big, sticky enterprise fish. This is the operational flaw she was hunting for—the point where a case study becomes less about finance and more about business strategy.

This kind of operational deep-dive is more important than ever. In the first quarter of 2025, global PE deal activity hit $444.9 billion. While that was a small dip overall, U.S. investment actually climbed to $234 billion, proving that great deals with a clear improvement plan are still in high demand. Finding an angle like SaaSCo's sales problem is precisely what separates a winning bid from the rest. For anyone prepping for these interviews, knowing how to spot and solve these issues is crucial; our private equity interview guide covers this kind of thinking in much more detail.

Step 4: Crafting the Investment Thesis

Armed with this insight, Sarah can now form a powerful, actionable investment thesis:

We should acquire SaaSCo. The company's baseline performance is mediocre, but there's a huge, untapped opportunity to drive growth and profitability by overhauling its sales strategy. By realigning incentives to focus on high-value enterprise clients, we can slash customer churn, expand margins, and ultimately drive an IRR well above our 25% target.

This thesis works because it connects a specific operational problem directly to a financial outcome. It’s not just about buying the company; it’s about having a clear plan to fix it.

Step 5: Building the Model to Tell the Story

Sarah now builds her full LBO model, but with a twist. She creates an "Upside Case" that shows what happens when her thesis plays out. She models the financial impact of shifting the sales team's focus from SMBs to enterprise customers, which lowers customer acquisition costs and dramatically reduces churn.

The table below gives you a simplified look at the key assumptions and outputs driving her "Upside Case" scenario.

Sample LBO Model Assumptions and Outputs

This table shows how Sarah translated her strategic thesis into financial projections. Notice how each assumption directly ties back to her plan to refocus the sales team on more valuable enterprise clients.

| Metric/Assumption | Value | Impact on Analysis |

|---|---|---|

| Entry Multiple | 10.0x LTM EBITDA | Sets the initial purchase price at $300M. |

| Debt / EBITDA | 5.0x | Determines the capital structure: $150M Debt, $150M Equity. |

| Revenue Growth | Accelerates from 5% to 8% | Reflects lower churn and more stable revenue from enterprise deals. |

| EBITDA Margin | Expands from 30% to 35% | Driven by lower sales & marketing spend chasing low-value customers. |

| Exit Multiple | 11.0x EBITDA | A higher multiple is justified by higher-quality, more predictable earnings. |

| Projected 5-Year IRR | 27.5% | Crosses the fund's 25% hurdle. |

| Projected MoIC | 3.1x | A very strong return showing significant value was created. |

By connecting the dots from operational change to financial return, Sarah's model becomes a powerful storytelling tool.

Her final presentation opens with a clear "go" recommendation, immediately followed by her investment thesis. She then uses the model's outputs not as a series of boring numbers, but as evidence to support her narrative. She shows exactly how fixing the sales team's incentives leads directly to hitting the fund's return targets, turning a complex analysis into a persuasive investment story.

Common Mistakes and How to Avoid Them

Even the sharpest candidates can stumble during a private equity case study. The clock is ticking, the data is rarely perfect, and the pressure is on. But what trips most people up isn't a complex modeling error—it's usually a fundamental mistake in how they approach the problem.

Think of these common pitfalls as a map of the minefield. By knowing where others go wrong, you can navigate your analysis with more confidence and make sure your hard work shines through in your final recommendation.

Mistake 1: Getting Lost in the Model

One of the biggest traps is treating the LBO model as the main event. It’s easy to get sucked into perfecting every formula and formatting detail, only to look up and realize you have no time left to figure out what the numbers actually mean. Remember, the model is just a tool, not the answer.

A pristine spreadsheet that supports a weak or nonexistent story is an automatic fail. Your interviewers will be far more impressed by a solid, directionally correct model that backs up a well-reasoned investment thesis than they will be by a beautiful but useless financial work of art.

How to Avoid It:

- Time-box your modeling. Give yourself a strict, non-negotiable time limit for building the model.

- Do a "paper LBO" first. Before you even open Excel, do some back-of-the-envelope math to get a rough feel for the potential returns.

- Focus on the drivers. Spend your brainpower on the assumptions—like revenue growth and margin improvements—not on perfecting the cell borders.

Mistake 2: Making Baseless Assumptions

Another classic mistake is pulling assumptions out of thin air. Why is revenue growing at 8%? Why are you using an 11x exit multiple? Just saying "I assumed..." without a strong "because..." is a massive red flag.

Every single one of your key assumptions needs to be anchored in your commercial due diligence. This proves you can connect the dots between what’s happening in the market and what it means for the financials—which, at its core, is the job of a private equity investor.

The strength of your entire private equity case study rests on the credibility of your assumptions. Each one should be a mini-conclusion drawn from your analysis of the market, the competition, and the company's operational levers.

Mistake 3: Failing to Tell a Clear Story

A lot of candidates present their work as a disconnected series of facts and figures. They'll talk about market size, then jump to the company's financials, then spit out the LBO outputs, all without weaving it together into a coherent narrative.

Your final presentation has to tell a story. Start with the "so what"—your investment thesis—and then use the data from your analysis to prove it, piece by piece. The numbers are your evidence; they aren't the story itself.

How to Avoid It:

- Lead with your recommendation. State your "go" or "no-go" decision right up front.

- Build a logical argument. Each slide or section should build on the last, all pointing back to your central thesis.

- Connect the numbers to the strategy. Don't just say, "The IRR is 27%." Instead, say, "We project a 27% IRR, which is driven by our plan to fix the sales incentives, ultimately expanding margins by 500 basis points."

This narrative is especially crucial when you think about the exit. The U.S. private equity exit market roared back to life in 2024, with 1,501 exits generating $413 billion—a 49% jump from the previous year. This isn't just an interesting statistic; it proves that having a clear and believable path to a profitable exit is a must-have for any solid investment thesis. You can get a deeper dive into this by exploring more on the 2025 private equity market outlook.

Answering Your Top Case Study Questions

Even with a solid game plan, you're going to hit some tricky spots in a private equity case study. The pressure is on, the data is often sparse, and you're expected to navigate that ambiguity like a pro. This is where the real test begins. Let's walk through some of the most common questions and curveballs you'll face.

How Should I Balance My Time?

Time management is one of the biggest hurdles. I've seen countless candidates fall into the trap of spending 80% of their time buried in Excel, only to surface with minutes left to figure out what it all means. That’s completely backward.

A much better way to think about it is the 40/40/20 rule:

- First 40%: Just focus on understanding the business. Tear apart the prompt, dig into the commercial and operational questions, and start forming a real investment thesis. This is your foundation.

- Next 40%: Now, build the LBO model. With your thesis in hand, you know exactly which drivers and sensitivities matter. You're building a tool to test your ideas, not just a generic spreadsheet.

- Final 20%: Pull it all together into a killer presentation or memo. This is where you craft the story, create the charts that pack a punch, and get ready to present your case with confidence.

Following this approach ensures your model serves your story, not the other way around.

What if I Have Limited Information?

Feeling like you're missing key data is normal—in fact, it's by design. Interviewers want to see how you handle incomplete information because that's the reality of the job. Getting paralyzed by this is the worst thing you can do.

The key is to make logical, defensible assumptions and, most importantly, to state them clearly. Don't just pull a number out of thin air; explain your reasoning. For example, if you're missing market growth figures, you might say, "Given this is a mature industry with strong incumbents, I'm assuming a conservative 2% annual growth rate, roughly in line with GDP."

Your ability to articulate the why behind your assumptions is more important than the assumption itself. It demonstrates commercial judgment and shows you can think on your feet.

This skill is a huge part of what firms are looking for. For a deeper dive into the interviewer's mindset, our complete guide to private equity interview questions has a ton of extra advice.

How Do I Present a No-Go Decision?

A lot of candidates think they have to recommend "yes" on the deal to impress the firm. This is a classic mistake. A well-reasoned "no-go" recommendation is often far more powerful. It shows you're a disciplined investor whose first priority is protecting capital.

Here's how to present a "no-go" decision with impact:

- Lead with Conviction: Don't bury the lede. Start by stating your conclusion clearly: "After a thorough analysis, my recommendation is that we pass on this investment opportunity."

- Acknowledge the Positives: Briefly touch on what makes the deal attractive at first glance. This proves you did a balanced analysis and didn't just look for flaws.

- Zero in on the "Killer Risks": Pinpoint the 2-3 critical deal-breakers. Is the valuation simply too high to make sense? Are there competitive threats that could erode margins? Is the industry in a structural decline?

- Quantify the Impact: Use your model to show exactly why these risks are so damaging. For instance, "Even in our most optimistic case, the severe pricing pressure means the deal fails to clear our fund's 25% IRR hurdle."

A confident "no" demonstrates maturity and a sharp understanding of risk management—a non-negotiable trait for any successful investor.

What Are Firms Looking for Besides the Right Answer?

At the end of the day, remember there’s rarely a single “right” answer. The case study is a test of your thought process and, just as importantly, a preview of what you’d be like to work with.

Beyond the numbers, they’re sizing you up on:

- Coachability: How do you react when your analysis is challenged? If an interviewer pokes holes in your assumptions, do you get defensive or do you engage in a thoughtful, constructive conversation?

- Intellectual Curiosity: Are you asking smart questions? Do you seem genuinely interested in the business and the industry, or are you just trying to get through the prompt?

- Poise Under Pressure: Can you stay calm, structured, and articulate when the clock is ticking and you're on the spot?

Your ultimate goal is to show them you think like an investor—someone who can balance opportunity with risk, data with good judgment, and rigorous analysis with clear, compelling communication.

Ready to master the private equity case study and land your dream job? Soreno provides an AI-powered platform with hundreds of cases and guided drills to sharpen your analytical skills. Practice with an MBB-trained AI interviewer, get instant, detailed feedback, and track your progress—all on your own schedule. Start your free trial today at https://soreno.ai.