8 Crucial Private Equity Interview Questions for 2025

Master the 8 most common private equity interview questions. Our guide provides expert answer frameworks and prep tips to help you land the offer.

The private equity interview process is notoriously demanding, combining rigorous technical scrutiny with high-stakes behavioral and strategic assessments. To land a coveted role, you need more than just a strong resume; you need a mastery of the core concepts that drive the industry. This guide is designed to prepare you for that challenge by breaking down the most essential private equity interview questions you are almost certain to face.

We will move beyond generic advice, providing you with actionable frameworks, real-world examples, and specific preparation tips for each question. Our goal is to help you articulate your value and demonstrate that you possess the critical mindset of a principal investor. This comprehensive listicle will cover everything from the mechanics of an LBO model and company valuation techniques to the strategic nuances of deal selection and value creation.

By working through these questions and their detailed answer structures, you will build the confidence needed to navigate every stage of the interview. We will equip you with the precise tools to dissect complex financial scenarios, discuss market trends intelligently, and ultimately prove you are the right fit for the role. Let's dive into the questions that will define your interview performance.

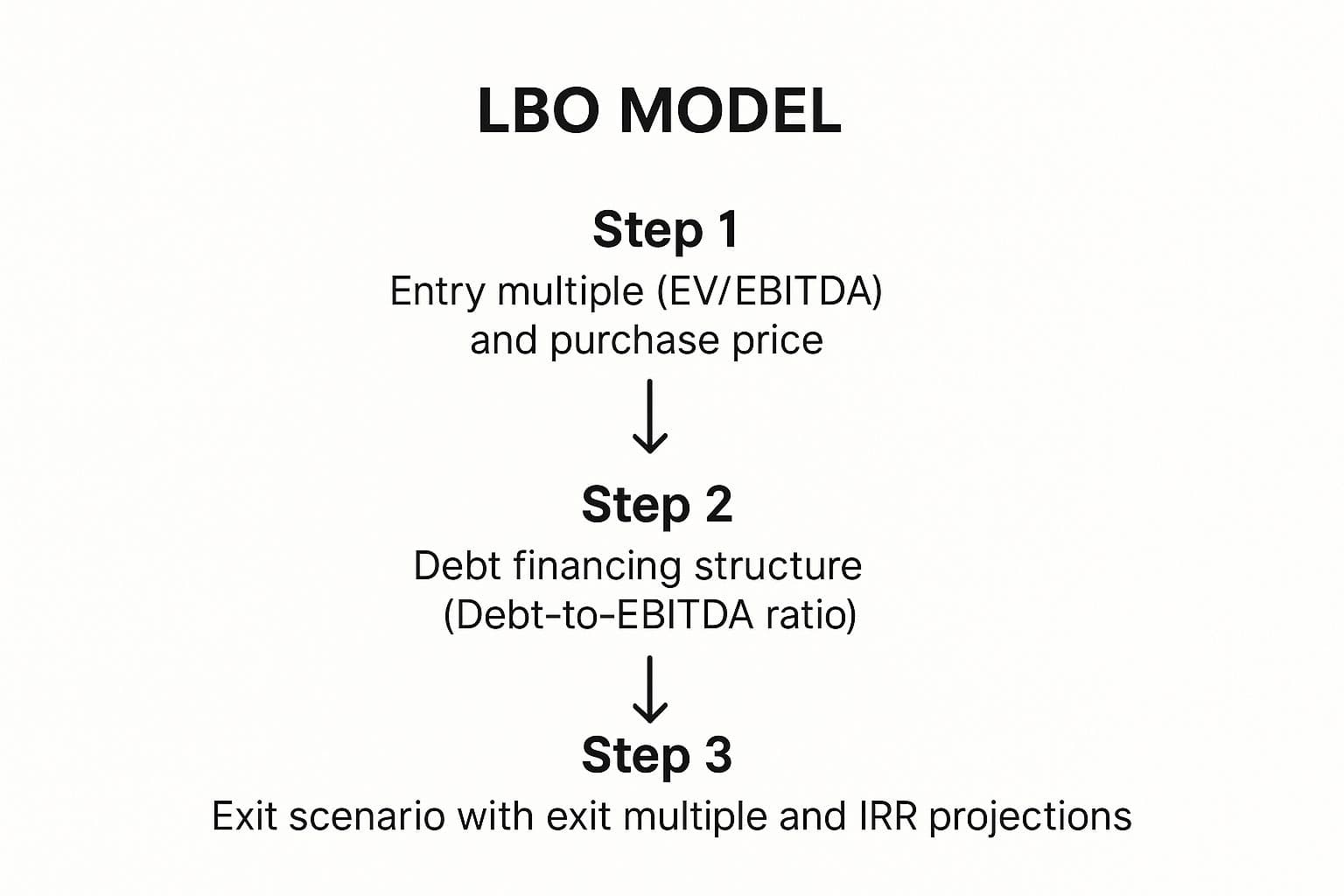

1. Walk me through an LBO model

This is arguably one of the most fundamental technical private equity interview questions. It directly assesses your understanding of the core private equity investment strategy: using leverage to acquire a company, improve it, and sell it for a profit. A strong answer demonstrates not just rote memorization of steps but a commercial understanding of how PE firms create value.

Your goal is to walk the interviewer through the entire process, from acquisition to exit, showing how financial assumptions translate into investor returns. This question tests your ability to structure a complex financial analysis and communicate it clearly and logically.

How to Structure Your Answer

A winning response follows a clear, step-by-step narrative. Start with the "why" before diving into the "how."

- Investment Thesis & Purchase Price: Begin by stating the assumptions for the acquisition. You'd calculate the purchase price based on an entry multiple (e.g., 10x LTM EBITDA) and determine the total funding required.

- Sources & Uses: Outline how the deal is financed. The "Uses" side includes the equity purchase price, transaction fees, and any debt repayment. The "Sources" side details the mix of debt (e.g., Term Loan B, Senior Notes) and sponsor equity used to fund the transaction.

- Financial Projections: Project the company’s financials (typically an integrated 3-statement model) over the holding period (usually 3-7 years). This involves making assumptions about revenue growth, margins, and capital expenditures.

- Debt Schedule & Free Cash Flow: Use the financial projections to build a debt schedule. Calculate Free Cash Flow (FCF) and show how it's used to pay down debt principal, reducing risk and building equity value over time.

- Exit & Returns: Finally, calculate the exit value, typically by applying an exit multiple to the projected exit-year EBITDA. From this, you subtract remaining net debt to find the final equity value. The key output is calculating the Internal Rate of Return (IRR) and Multiple on Invested Capital (MoIC) for the sponsor.

This structured process is visually represented in the following infographic, which outlines the key stages of an LBO model from entry to exit.

The flow demonstrates how the initial purchase price, financing structure, and exit assumptions are interconnected to ultimately determine the investment's projected IRR.

For a deeper dive into the mechanics and a live walkthrough, the video below provides an excellent, detailed explanation.

2. How do you value a company?

This is a cornerstone finance and private equity interview question designed to test your technical foundation and commercial judgment. Your ability to articulate different valuation methodologies shows you can determine a company's worth, a critical skill for assessing investment opportunities, negotiating purchase prices, and planning for a successful exit. A great answer demonstrates a nuanced understanding of each method's strengths and weaknesses.

This question probes your ability to think like an investor. It’s not just about listing formulas; it's about explaining how you would triangulate different data points to arrive at a defensible valuation range for a potential acquisition.

How to Structure Your Answer

A comprehensive answer should cover the three primary valuation methodologies, explaining the "what," "why," and "when" for each.

- Discounted Cash Flow (DCF) Analysis: This method values a company based on the present value of its projected future cash flows. It’s considered an intrinsic valuation because it relies on the company’s specific financial forecasts, capital structure, and risk profile (WACC). This is often viewed as the most academically rigorous approach.

- Comparable Company Analysis (CCA): Also known as "trading comps," this is a relative valuation method. It involves comparing the target company to a set of similar publicly traded companies, using metrics like EV/EBITDA or P/E multiples. The key is to find truly comparable peers in terms of industry, size, and growth profile.

- Precedent Transaction Analysis (PTA): Similar to CCA, this method uses relative valuation but looks at multiples paid for similar companies in past M&A deals. This approach is useful because it reflects the control premium an acquirer might pay. However, finding recent and relevant transactions can be challenging, and market conditions at the time of the deal are a major factor.

- Triangulation and Conclusion: A strong answer concludes by explaining that no single method is perfect. You would use all three to establish a valuation range, or a "football field," and then use your judgment to determine the most reasonable value based on the specific circumstances of the deal and current market sentiment.

3. What makes a good LBO candidate?

This is one of the most common private equity interview questions, moving from the “how” of an LBO to the “why.” It tests your commercial acumen and ability to think like an investor. Answering well shows you understand the fundamental characteristics that make a leveraged buyout successful, beyond just the financial mechanics. Your goal is to articulate the profile of a company that can support a significant amount of debt while also presenting clear opportunities for value creation.

This question assesses your understanding of what drives returns in private equity: stable cash flows to service debt, a strong market position to ensure predictability, and tangible levers for improvement. Successful answers blend financial theory with practical business sense, demonstrating a holistic investment perspective.

How to Structure Your Answer

A strong response is a checklist of ideal attributes, explaining why each is important for a PE sponsor. You should frame your answer as a systematic evaluation of a potential target, connecting each characteristic back to the core goals of an LBO: debt paydown and equity value growth.

- Stable & Predictable Cash Flows: This is the most crucial attribute. A company needs consistent cash generation to meet its interest and principal debt payments. Businesses with subscription models, long-term contracts, or those in non-cyclical industries (e.g., healthcare, consumer staples) are often ideal.

- Strong Market Position & Defensible Moat: A leading market share, strong brand recognition, or high barriers to entry provide a defensive "moat." This protects cash flows from competitive pressures, ensuring stability throughout the investment hold period.

- Operational Improvement Potential: PE firms don't just use leverage; they actively manage their portfolio companies. Look for opportunities like cost-cutting, professionalizing management, improving sales strategies, or executing accretive add-on acquisitions.

- Strong Management Team (or a plan to install one): A capable and motivated management team is essential for executing the value creation plan. If the current team isn't strong, the PE firm must have a clear plan to bring in new leadership.

- Clear Exit Strategy: A good LBO candidate has multiple viable exit paths. This could mean a sale to a strategic buyer, another financial sponsor (secondary buyout), or an IPO. The attractiveness to a wide range of future buyers de-risks the investment.

4. How do private equity firms create value?

This question moves beyond the numbers of an LBO model to test your commercial acumen and strategic thinking. Interviewers want to see that you understand that private equity is not just about financial engineering; it’s about actively improving businesses to generate returns. A great answer demonstrates a nuanced understanding of the operational and strategic levers that drive real-world performance improvements in portfolio companies.

This is one of the more strategic private equity interview questions, designed to gauge whether you can think like an investor and a business operator. It assesses your knowledge of the PE value creation playbook, which includes everything from top-line growth initiatives to bottom-line efficiencies and better governance.

How to Structure Your Answer

The best approach is to categorize value creation into distinct, logical pillars. This shows the interviewer you have a structured framework for thinking about business improvement.

- Financial Engineering (Leverage & Deleveraging): Start with the most traditional lever. Explain how using leverage magnifies returns. Crucially, emphasize that using the company's free cash flow to pay down debt over the holding period (deleveraging) directly increases the sponsor's equity value upon exit.

- Operational Improvements (Margin Expansion): This is the core of modern PE. Discuss how firms drive efficiency. Provide examples like optimizing the supply chain, implementing lean manufacturing, upgrading IT systems to reduce SG&A, or improving procurement to lower costs. This demonstrates an understanding of hands-on value creation.

- Strategic Growth (Multiple Expansion & Revenue Growth): Talk about top-line and strategic initiatives. This includes entering new markets (geographies or product lines), executing accretive M&A (buy-and-build strategy), or repositioning the business to command a higher exit multiple. For example, shifting a company towards a recurring revenue model can justify a higher valuation.

- Governance & Management: Acknowledge the importance of human capital. PE firms often professionalize the board, bring in industry experts, and align management incentives (e.g., through equity ownership) with the sponsor's goals to drive performance.

5. Tell me about a recent private equity deal

This question tests more than just your memory of headlines; it assesses your genuine interest in the private equity industry and your ability to think like an investor. It’s a chance to show you’re actively following the market, can dissect a transaction, and can form a commercial opinion on a deal's merits. A strong answer proves you can go beyond the press release and analyze the strategic and financial rationale.

Your goal is to articulate the story of a recent transaction, from the initial thesis to the potential risks. This question is one of the more common private equity interview questions because it effectively combines technical knowledge with commercial acumen, revealing how you would analyze potential investments.

How to Structure Your Answer

A well-structured answer will walk the interviewer through your analysis of the deal, demonstrating a comprehensive understanding.

- Deal Overview: Start with a concise summary of the transaction. Name the private equity firm (acquirer), the target company, the industry, and the approximate deal size and valuation multiples (e.g., Enterprise Value / EBITDA).

- Investment Thesis: Explain why the PE firm likely made the investment. What was the rationale? This could include industry tailwinds, the company's strong market position, operational improvement opportunities, or a buy-and-build strategy.

- Company & Market Analysis: Briefly describe what the target company does, its business model, and its competitive landscape. Discuss the attractiveness of the market it operates in.

- Value Creation Levers: Detail how the sponsor will create value. Will they drive revenue growth through new market entry, improve margins by cutting costs, or pursue strategic M&A? Be specific.

- Risks & Mitigants: Conclude with a balanced view by identifying the key risks associated with the investment. This could be anything from competitive pressure and regulatory changes to integration challenges. Discuss how the PE firm might mitigate these risks.

Effectively breaking down a deal this way is similar to tackling a mini-investment committee memo. Your structured thinking here is closely related to the skills needed for real-world deal analysis, much like those tested in various case study interview questions. For additional practice on structuring complex business problems, you can learn more about how to approach case study interviews.

6. What's the difference between private equity and investment banking?

This is a classic fit and motivation question designed to understand your career goals and ensure you know what you’re getting into. Interviewers use this to gauge whether you have a genuine, well-researched interest in private equity or if you're simply following a generic finance career path. A strong answer proves you understand the fundamental differences between being an advisor and being a principal investor.

Your goal is to articulate not just the factual differences but also why the private equity model specifically appeals to you. This question is a prime opportunity to demonstrate your commercial acumen and align your personal ambitions with the long-term, value-creation mindset of a PE professional.

How to Structure Your Answer

A compelling response moves beyond a simple definition to show a nuanced understanding of both worlds and a clear preference for private equity.

- Principal vs. Advisor: Start by highlighting the core distinction. Investment banking is an advisory role, focused on executing transactions (M&A, IPOs, debt/equity raises) for clients on a deal-by-deal basis. Private equity is a principal investing role, where the firm acts as the owner, deploying its own capital to buy, operate, and grow companies over several years.

- Investment Horizon & Involvement: Discuss the time frame and depth of engagement. Bankers have a short-term, transactional focus, often moving to the next deal once one closes. In contrast, PE professionals have a long-term horizon (typically 3-7 years) and are deeply involved in the operational strategy and day-to-day value creation of their portfolio companies.

- Skill Set & Value Creation: Explain the different skills required. While both require strong financial modeling and analytical abilities, investment banking is more sales and relationship management-focused. Private equity demands a broader skill set that includes operational improvements, strategic planning, and long-term management of assets.

- Personal Motivation: Conclude by clearly stating why the PE model is a better fit for you. Emphasize your desire to be a long-term partner to businesses, drive tangible operational change, and see an investment thesis through from start to finish. This is much more convincing than simply mentioning compensation.

The structured nature of PE case studies often tests these very principles. Understanding the distinction between advising on a deal and owning the outcome is critical, as you might explore in a case study interview.

7. How has COVID-19 impacted private equity?

This is a key topical question among private equity interview questions, designed to test your commercial awareness and understanding of macro-economic impacts on the industry. It assesses your ability to think critically about how major dislocations affect investment theses, portfolio management, and deal execution. A strong answer shows you can connect global events to the day-to-day realities of a PE fund.

Your goal is to demonstrate a nuanced view, discussing not just the immediate challenges but also the lasting structural changes and new opportunities that emerged. It's a chance to show you follow the markets and can think strategically about both risk and opportunity.

How to Structure Your Answer

A winning response should be balanced, covering both the negative and positive impacts across the private equity lifecycle. Structure your answer to show a holistic understanding of the industry.

- Portfolio Management (The Triage Phase): Begin with the immediate impact. PE firms shifted focus from new deals to supporting their existing portfolio companies. This involved liquidity management, securing government support, and adapting business models to survive lockdowns. For example, helping a restaurant chain pivot to delivery-only.

- Investment Theses & Sector Divergence: Discuss how the pandemic accelerated certain trends. Sectors like technology, SaaS, healthcare, and logistics boomed, attracting significant PE interest due to their resilience. Conversely, sectors like travel, hospitality, and traditional retail faced immense pressure, leading to distressed opportunities.

- Deal Execution & Due Diligence: Explain the practical changes to the deal-making process. Due diligence became largely virtual, increasing the reliance on data and third-party reports. Valuations were also impacted; uncertainty led to valuation gaps between buyers and sellers and the increased use of structures like earn-outs.

- Long-Term Thematic Shifts: Conclude by highlighting lasting changes. The pandemic reinforced the importance of technology adoption, supply chain resilience, and ESG considerations. Firms now place a greater premium on businesses with flexible operating models and strong digital capabilities, fundamentally altering what makes an attractive LBO target.

8. Why do you want to work in private equity?

This is one of the most critical motivational and fit-based private equity interview questions. While technical skills are essential, interviewers use this question to gauge your genuine interest, long-term commitment, and cultural alignment. They need to know if you understand what the job truly entails and if your motivations go beyond just financial rewards.

A compelling answer will demonstrate a sophisticated understanding of the PE model and connect your personal career aspirations directly to the unique aspects of the role. It’s your chance to tell a story that links your past experiences to a future in principal investing, showing that this is a deliberate and well-researched career move.

How to Structure Your Answer

A strong response is authentic, specific, and demonstrates a clear understanding of the industry's day-to-day realities. Avoid generic answers and tailor your narrative to the firm you're interviewing with.

- Articulate Your "Why": Start with a clear, high-level thesis. Explain what specifically attracts you to private equity over other finance roles like investment banking, hedge funds, or venture capital. Focus on themes like long-term value creation, operational involvement, and the ownership mindset.

- Connect to Your Experience: Provide concrete examples from your background (banking, consulting, etc.) that sparked your interest. Maybe you worked on a sell-side M&A deal and wanted to be on the other side, making investment decisions and seeing the company grow post-acquisition.

- Show You Understand the Role: Acknowledge the realities of the job. Mention your desire to work closely with management teams, conduct deep due diligence, and drive strategic initiatives. This shows you have realistic expectations beyond just financial modeling.

- Align with the Firm: Demonstrate that you've done your homework. Connect your interest to the specific firm’s investment strategy, portfolio companies, or culture. For example, "I'm particularly drawn to [Firm's Name]'s hands-on approach with its portfolio companies in the software sector, which aligns with my background in tech M&A."

- Summarize Your Ambition: Conclude by reinforcing your long-term commitment. Frame private equity not just as the next step, but as the ideal platform for your professional growth and skills.

For those transitioning from different fields, understanding how to position your background is key. Your experience in a field like consulting, for instance, provides a strong foundation for the strategic and operational aspects of PE work. You can explore how to frame your career transition effectively to highlight these transferable skills.

Private Equity Interview Questions Comparison

| Item | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Walk me through an LBO model | High – requires technical modeling skills and financial engineering knowledge | Moderate – needs financial data and modeling tools | Clear understanding of debt usage, value creation, and returns | PE interviews testing core technical skills | Demonstrates technical competency and risk-return understanding |

| How do you value a company? | Moderate – involves multiple valuation methods and market analysis | Moderate – requires financial data and market info | Accurate estimation of company worth using various techniques | Valuation tasks across PE and finance functions | Shows analytical rigor and market awareness |

| What makes a good LBO candidate? | Moderate – requires screening criteria and industry knowledge | Low to Moderate – requires company data and market insight | Identification of strong, predictable investments | Deal sourcing and investment screening | Demonstrates investment judgment and understanding of PE model |

| How do private equity firms create value? | Moderate to High – involves strategic and operational insights | Moderate – needs knowledge of operational levers and governance | Understanding of value creation beyond financing | Strategic planning and portfolio management | Highlights comprehensive PE value proposition and strategic thinking |

| Tell me about a recent private equity deal | Low to Moderate – focused on market research and deal analysis | Low – requires up-to-date information and deal databases | Assessment of deal rationale, risks, and opportunities | Interview questions assessing market awareness | Demonstrates industry knowledge and critical thinking |

| What's the difference between private equity and investment banking? | Low – conceptual comparison requiring industry knowledge | Low – mostly theoretical understanding | Clear distinction of career paths, roles, and business models | Career choice discussions and interviews | Clarifies motivations and shows industry understanding |

| How has COVID-19 impacted private equity? | Moderate – requires macroeconomic and sector analysis | Low to Moderate – needs recent market data and trends | Insight into adapting PE strategies amid disruption | Current events discussions and strategy adjustments | Shows adaptability and market awareness |

| Why do you want to work in private equity? | Low – personal motivation and understanding of PE work | Low – relies on self-reflection and career research | Demonstrates cultural fit and career alignment | Motivational interview questions | Highlights passion, self-awareness, and career planning |

Beyond the Questions: Your Path to Interview Success

Navigating the landscape of private equity interview questions requires more than just memorizing answers; it demands a fundamental shift in how you think. As we've explored, the questions you'll face are designed to test not only your technical acumen but also your commercial judgment, your communication skills, and your ability to think like an investor. From dissecting an LBO model to articulating the value creation levers of a PE firm, each question is a window into your potential as a principal investor.

The frameworks and examples provided throughout this guide are your foundational tools. They offer structured approaches to deconstruct complex problems, whether you're valuing a company or analyzing a recent deal. However, simply knowing the theory is not enough to secure an offer in this hyper-competitive field. The true differentiator is your ability to apply these concepts fluidly and convincingly under pressure.

From Knowledge to Mastery: The Importance of Practice

The journey from understanding a concept to mastering its application is paved with deliberate, repetitive practice. Your goal is to move beyond a robotic recitation of steps to a natural, conversational delivery that showcases genuine insight. This is where many candidates fall short; they possess the knowledge but lack the polish and confidence that only comes from real-world simulation.

Consider the most critical takeaways from our discussion:

- Technical Fluency: You must be able to walk through an LBO model or a valuation analysis with precision and clarity. The mechanics should be second nature, freeing up your mental bandwidth to focus on the strategic implications.

- Commercial Acumen: Identifying a good LBO candidate or explaining how a firm creates value requires you to think beyond the numbers. You need to demonstrate a deep understanding of business models, industry dynamics, and competitive advantages.

- Narrative Cohesion: Answering behavioral questions like "Why private equity?" or discussing a recent deal requires a compelling narrative. You must connect your experiences, motivations, and insights into a story that resonates with your interviewers.

Your Actionable Next Steps

Mastering these areas requires a dedicated preparation strategy. You must internalize the frameworks until they become an intuitive part of your problem-solving toolkit. The key is to simulate the interview environment as closely as possible, forcing yourself to articulate your thoughts clearly and concisely, just as you would on the day. This type of practice helps you identify your blind spots, refine your communication, and build the confidence needed to perform at your peak.

The path to a career in private equity is challenging, but it is also incredibly rewarding. By treating your preparation not as a checklist to complete but as a skill to be honed, you transform yourself from a candidate who knows the answers into one who embodies the investor mindset. The dedication you invest now will be the foundation of your success in the interview room and beyond.

Ready to turn theory into interview-winning performance? Sharpen your skills and get instant, detailed feedback on your answers to these private equity interview questions with Soreno’s AI-powered mock interview platform. Practice unlimited, on-demand interviews in a realistic, judgment-free environment by visiting Soreno today.