Private Equity Interview Guide to Land the Offer

Our complete private equity interview guide covers technicals, LBOs, case studies, and behavioral questions to help you land your dream job in finance.

Landing a private equity offer can feel like an impossible climb, but with the right map, you can conquer it. This private equity interview guide is that map. We’ll break down the entire process, from that first call with HR to the final superday, so you know exactly what’s coming and can prepare to walk in with total confidence.

Decoding the Private Equity Interview Gauntlet

Think of the private equity interview process less like a standard interview and more like a tournament. Each round is a new challenge designed to test a different part of your skillset, and only the most well-rounded candidates make it to the end.

Firms aren’t just looking for someone who can build a flawless model. They're hunting for future partners—people who blend sharp analytical skills with sound business instincts and can hold their own in a boardroom.

It all starts with getting your resume past the initial screen, where they’re mostly looking for a background in investment banking or a similar high-finance role. Once you’re through that filter, the intensity kicks up—fast.

To give you a clearer picture of the journey ahead, let's break down the typical stages. While the exact order can shift depending on the firm, this table outlines the core components of the PE interview gauntlet.

The Private Equity Interview Stages

| Interview Stage | Primary Objective | Key Skills to Showcase |

|---|---|---|

| First Round Interviews | Screen for basic fit and technical competency. | Your story ("Why PE?"), resume walkthrough, and fundamental accounting and LBO knowledge. |

| Modeling Test | Assess your financial modeling speed and accuracy under pressure. | Building a clean, error-free 3- to 4-hour LBO model from scratch. |

| Case Study Presentation | Evaluate your investment judgment and communication skills. | Crafting a compelling investment thesis and confidently defending your assumptions. |

| Superday / Final Rounds | Make a final decision on cultural fit and investment acumen. | Deep market insights, commercial savvy, and connecting with senior partners. |

Each stage is a deliberate test designed to simulate a part of the job. Technical questions prove your financial fluency, behavioral questions probe your personality and drive, and the case study is your chance to show them how you think like an investor.

This structured process is designed to see if you have what it takes. Let’s look at what each part really entails.

The Core Interview Stages

While every firm has its own flavor, you can almost always count on these four core components.

-

First Round Interviews: These are your initial hurdles, usually with Associates or VPs. The focus is on your story—"Walk me through your resume" and the classic "Why PE?"—and confirming you have the technical basics down cold. Be ready for questions on accounting, valuation, and the core mechanics of an LBO.

-

Modeling Test: This is often the make-or-break stage. You'll typically get a timed LBO modeling test, anywhere from 2 to 4 hours, or a more involved take-home case study. They want to see if you can build a functional, well-structured financial model when the clock is ticking.

-

Case Study Presentation: It's not enough to just build the model; you have to sell the idea. Here, you'll present your model and investment recommendation to the team. This is where they test your ability to build a convincing investment thesis and stand your ground when they challenge your assumptions.

-

Superday or Final Rounds: If you make it this far, you're in the home stretch. This is a rapid-fire series of interviews with the firm's heavy hitters—Partners and Managing Directors. The conversation shifts from pure technicals to your broader market views, investment judgment, and whether you're someone they'd want to work with.

The entire process is a marathon, not a sprint. Success depends on building a solid foundation of technical expertise, practicing consistently, and articulating a compelling narrative that connects your past experiences to your future as a private equity investor.

This guide will give you the frameworks and strategies to excel at every turn, helping you understand the "why" behind every question and every test they throw at you.

Thinking Like a Private Equity Investor

Beyond nailing the formulas and modeling tests, the single most important skill you need to show in a private equity interview is genuine commercial awareness. It’s the difference between thinking like an analyst and thinking like an investor. You have to prove you understand the real-world forces that actually make or break a deal.

It’s about connecting the dots. When you read a headline about the Fed raising interest rates, you should immediately be thinking about how that tweaks the debt assumptions in an LBO model. You need to see how a volatile market can either slam the brakes on deal flow or, for the right fund, create some incredible buying opportunities. The PE world is a living ecosystem where everything from a kink in the global supply chain to a dip in consumer confidence can ripple through your portfolio.

Grasping the Macroeconomic Levers

Private equity doesn’t operate in a bubble. The big economic trends are the powerful currents that can either carry a deal to success or drag it underwater. A huge part of your prep is simply getting a handle on these dynamics.

-

Interest Rates: This is the big one. When rates are low, debt is cheap. That means PE firms can pile on leverage to fund buyouts, which often juices returns and pushes valuations higher. But when rates start climbing, the cost of that debt goes up, squeezing potential IRR and forcing firms to be much smarter—and stingier—about the price they’re willing to pay.

-

Market Volatility: A choppy market makes everyone nervous. Sellers get hesitant, buyers get cautious, and that gap between what someone wants and what someone will pay—the “bid-ask spread”—can get pretty wide, slowing everything down. But for firms that specialize in distressed assets or just have the guts to play the long game, that same volatility can be a goldmine, letting them scoop up great companies at a discount.

A sharp candidate sees macroeconomic headwinds as more than just risks; they're potential openings. If you can articulate how a firm might pivot its strategy to navigate—or even exploit—a changing economy, you’re demonstrating that you think like a partner, not an intern.

Differentiating Fund Strategies

Here’s a critical point: not all private equity is the same. The questions you get will be shaped entirely by the specific strategy of the fund you’re interviewing with. If you don't get this, you'll sound generic and unprepared.

Common PE Fund Strategies:

- Leveraged Buyouts (LBOs): This is the classic PE playbook. These funds buy mature, stable companies with predictable cash flow, using a ton of debt to do it. The game plan is to improve operations, pay down that debt, and sell the company for a healthy profit.

- Growth Equity: This is less about financial engineering and more about fueling growth. These firms take minority stakes in fast-growing companies that are already established but need capital to hit the next level.

- Venture Capital (VC): Think early-stage, high-potential—and often pre-revenue—companies. VC is the highest-risk, highest-reward corner of the market, betting on disruptive ideas that could become the next big thing.

- Distressed Debt: These funds are the turnaround artists. They buy the debt of companies that are struggling or near bankruptcy, often using that position to gain control and steer the company back to health.

Knowing whether you’re walking into a buyout shop or a growth equity firm changes everything. The LBO interview will be a deep dive into debt mechanics and operational turnarounds. The growth equity chat will be all about total addressable market, competitive moats, and scalability.

Staying Ahead of Industry Trends

Finally, a top-tier candidate can talk intelligently about what’s happening in the industry right now. It shows you’re genuinely passionate and not just cramming for a test. The key themes are always evolving, but a few have become central to how PE operates today.

For instance, you should have a viewpoint on the rise of private credit and increasing regulatory scrutiny. A huge number of PE firms are bracing for regulators to get more involved, which naturally affects how deals get done. At the same time, private credit has exploded as an alternative to traditional bank financing, giving firms more flexible options.

Even with headwinds like high interest rates and geopolitical uncertainty, the industry is adapting. Firms are getting creative with liquidity and finding new ways to generate returns. You can find more detailed insights on the current PE outlook in recent industry reports. Being able to discuss these trends thoughtfully is a massive differentiator.

Mastering the Technical Interview Questions

This is where the rubber meets the road. While your story gets you in the door, your technical chops prove you can actually do the job.

Interviewers aren’t looking for you to just spit back formulas. They want to see that you have a real-world, intuitive grasp of accounting, valuation, and LBO mechanics. It's one thing to memorize concepts; it's another thing entirely to apply them under pressure.

Think of it like learning a language. Anyone can memorize vocabulary, but fluency is about understanding the grammar and context to form coherent sentences. We're going to build that fluency.

The Famous $10 Depreciation Question

This question is a classic for a reason. It’s a simple, elegant way to test whether you truly understand how the three financial statements link together. If you can walk through this cleanly, it signals that your accounting foundation is rock-solid.

Let's trace how a $10 increase in depreciation flows through the books, assuming a 40% tax rate.

-

The Income Statement:

- Depreciation is an expense, so EBIT (Earnings Before Interest and Taxes) immediately drops by $10.

- With a 40% tax rate, your tax bill goes down by $4 ($10 x 0.40). You get a tax shield.

- This means Net Income ultimately declines by $6 (the initial $10 hit, minus the $4 tax savings).

-

The Cash Flow Statement:

- You always start with Net Income, which we know is down by $6.

- But depreciation isn't a cash expense—no money actually left the building. So, you have to add back the full $10.

- The net result? Your cash flow from operations actually increases by $4 (–$6 + $10).

-

The Balance Sheet:

- Let's check if it balances. On the Assets side, Cash is up by $4 (from the cash flow statement).

- Property, Plant & Equipment (PP&E) is down by $10 from the added depreciation.

- This means the Total Assets side has decreased by $6 ($4 – $10).

- Now for the other side. Retained Earnings are linked to Net Income, so they're down by $6.

- Both sides are down by $6. It balances.

Being able to articulate this flow without hesitation is a baseline requirement. It demonstrates you understand how a company’s operational activities, cash position, and overall value are interconnected.

Core Valuation Methodologies

Private equity is fundamentally about buying businesses at a good price and selling them for a better one. That means valuation is at the heart of everything you'll do. You need to be completely fluent in the big three.

- Discounted Cash Flow (DCF): This is all about a company's intrinsic value. You're valuing it based on the present value of the cash it’s expected to generate in the future. It’s pure fundamentals, independent of market hype.

- Comparable Company Analysis (Comps): This is a relative valuation method. You're essentially asking, "What are similar public companies worth today?" You look at their trading multiples (like EV/EBITDA) and apply them to your target company to get a valuation ballpark.

- Precedent Transaction Analysis: This is also relative, but it looks at what acquirers have actually paid for similar companies in the past. These multiples are often higher than public comps because they include a "control premium"—the extra amount you pay to get full control of a business.

A great answer doesn't just define these. It explains why you'd use one over the other and what the major pros and cons are in a given situation. For a deeper dive, you can explore our comprehensive guide on private equity interview questions.

Understanding LBO Mechanics

The Leveraged Buyout (LBO) is the signature move for most PE firms. At its core, it's just buying a company using a whole lot of debt.

The strategy is to use the company's own cash flow to service and pay down that debt over the investment period. As the debt shrinks, the PE firm's equity stake becomes a larger and larger piece of the pie.

Think of it like buying a rental property: you put down a 20% deposit (equity) and get a mortgage for 80% (debt). As your tenants' rent payments pay down the mortgage, your ownership (equity) in the house grows. That's what magnifies your return when you eventually sell it.

An LBO model is built to answer one key question: what's the highest price we can pay for this business and still hit our target return (typically a 20-25% IRR)? That return is driven by three main levers:

- Debt Paydown: Using the company's cash to pay back the bank, increasing the equity value.

- EBITDA Growth: Actually improving the business and growing its earnings.

- Multiple Expansion: Selling the company for a higher valuation multiple than you paid for it.

How to Build a Flawless LBO Model Under Pressure

The LBO modeling test is a legendary gatekeeper in private equity interviews. It's more than just a math problem; it's a high-stakes, timed exam designed to see how you think and perform when the pressure is on.

Think of it like being a top chef during a frantic dinner service. You don't just have to cook a fantastic meal—you have to do it quickly, efficiently, and keep your station spotless. A messy model, even one that spits out the right IRR, signals sloppy thinking to an interviewer.

The only way to nail it is to have a repeatable, methodical process. Breaking this beast of a task into smaller, manageable steps will keep you calm and focused, preventing you from getting lost in the weeds when the clock is ticking.

Setting the Stage: Your Assumptions Tab

Every great LBO model starts with a clean, well-organized set of assumptions. This is your control panel. Before you even think about writing a formula, you need to lay out every single input in one dedicated place. This is non-negotiable for building a model that’s both flexible and easy for someone else to follow.

Group your assumptions logically to tell the story of the deal. Start with the transaction itself, then move to how the business will run, and finish with the financing.

- Transaction Assumptions: This includes the Purchase Price (usually an entry EV/EBITDA multiple), the sources of funding (all the different types of debt and equity), and any transaction fees.

- Operational Assumptions: Here, you'll map out your projections for revenue growth, EBITDA margins, capital expenditures (CapEx), and changes in net working capital.

- Financing & Exit Assumptions: This covers the interest rates for each debt tranche, any required amortization, and, crucially, the exit multiple you think you can sell the business for down the road.

When you centralize all these drivers, your model becomes dynamic. You can instantly see how tweaking one variable—like bumping up the entry multiple—flows through the entire model and impacts the final returns.

The Sources and Uses Blueprint

Once your assumptions are locked in, the first real output you’ll create is the Sources and Uses table. It’s a simple but absolutely critical schedule that shows where the money for the deal is coming from (Sources) and exactly where it’s all going (Uses). This table must balance to the penny.

A balanced Sources and Uses table is the bedrock of your entire model. It’s the sanity check that ensures you’ve accounted for every dollar needed to close the deal, from buying the company to paying the lawyers.

Think of it as the architectural blueprint for the transaction. The Uses side details the total cost of the acquisition—the equity purchase price, any debt you’re refinancing, and all related fees. The Sources side shows how you’ll pay for it all, breaking down the cash from each debt facility and, most importantly, the sponsor's equity check.

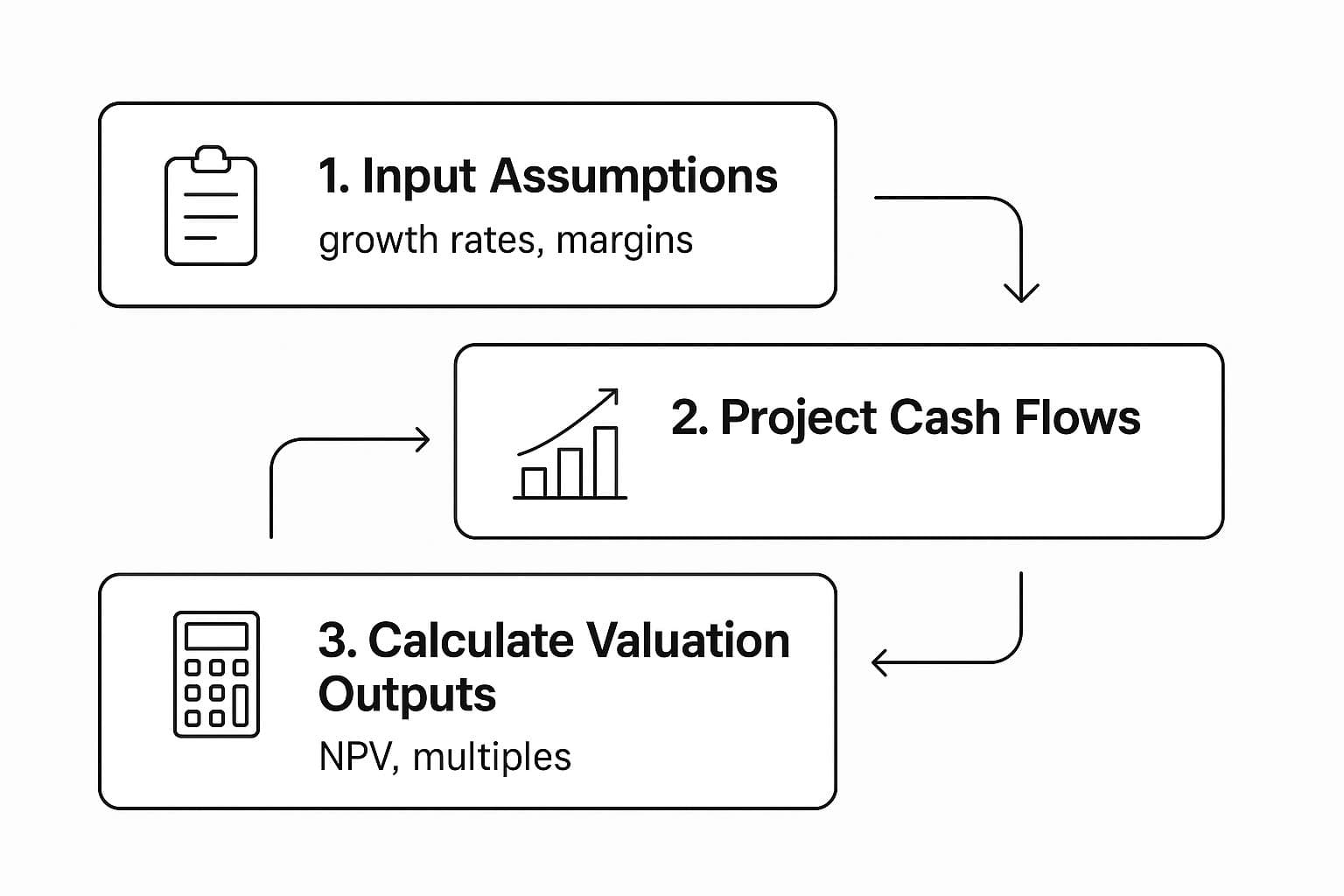

The infographic below gives a great high-level view of how these inputs flow through a model to generate the final outputs.

As you can see, clearly defined inputs are the starting point. They directly feed the cash flow projections, which then drive the valuation and return metrics that ultimately determine if the deal is worth pursuing.

Projecting the Three Financial Statements

With the deal structure in place, it’s time to build the engine of your analysis: the integrated three-statement model. This means projecting the Income Statement, Balance Sheet, and Cash Flow Statement.

Always start with the Income Statement. Project revenue and expenses based on your operational assumptions to get down to Net Income. That bottom-line figure then becomes the starting point for your Cash Flow Statement.

Next, on the Cash Flow Statement, you’ll adjust Net Income for non-cash items (like D&A) and changes in working capital to calculate Cash Flow from Operations. This is where you really see if the company can generate enough cash to handle its new, heavy debt load.

Finally, the Balance Sheet ties it all together. Every single line item is linked to the other two statements. Cash, for instance, flows in from the bottom of the Cash Flow Statement, while Retained Earnings is driven by Net Income. A perfectly balanced Balance Sheet is the ultimate proof that your model is mechanically sound.

Building a financial model involves making a number of key assumptions that directly influence the investment returns. Understanding these drivers is crucial for both constructing the model and defending your conclusions.

The table below outlines the most important assumptions in an LBO model and explains how they affect the outcome.

Key LBO Model Assumptions and Their Impact

| Assumption or Driver | Description | Impact on Returns (IRR/MoIC) |

|---|---|---|

| Entry Multiple | The EV/EBITDA multiple used to determine the purchase price. | Higher multiple = Lower returns, as the initial investment is larger. |

| Exit Multiple | The EV/EBITDA multiple at which the business is sold at the end of the holding period. | Higher multiple = Higher returns. Multiple expansion is a key return driver. |

| Leverage Level (Debt/EBITDA) | The amount of debt used to finance the transaction. | Higher leverage amplifies returns (both positive and negative). More debt generally means higher potential IRR/MoIC, but also higher risk. |

| Revenue Growth Rate | The projected annual growth in the company's sales. | Higher growth = Higher EBITDA and cash flow, leading to higher returns. |

| EBITDA Margin Improvement | The ability to increase profitability through cost-cutting or operational efficiencies. | Margin expansion directly increases cash flow, allowing for faster debt paydown and higher returns. |

| Capital Expenditures (CapEx) | The cash spent on maintaining and acquiring fixed assets. | Lower CapEx frees up more cash for debt paydown, resulting in higher returns. |

| Interest Rates | The cost of the debt used in the LBO. | Higher interest rates mean more cash is spent on interest payments, reducing cash available for debt paydown and thus lowering returns. |

Mastering how these levers interact is what separates a good analyst from a great one. In an interview, you'll be expected to not only build the model but also to articulate how sensitive the returns are to each of these key inputs.

Mastering the Debt Schedule and Cash Flow Sweep

This is where the "L" in LBO really comes to life. The debt schedule tracks how the company pays down its debt over the investment period. A classic feature in these models is the cash flow sweep, where all excess cash flow generated by the business is used to aggressively pay down debt principal ahead of schedule.

This is a massive lever for generating returns. The faster you de-lever the company, the more equity value you create for the sponsor.

A proper debt schedule needs to track the following for each piece of debt:

- Beginning Balance

- Mandatory Repayments

- Optional Repayments (this is the cash sweep)

- Ending Balance

A notorious trap here is the circular reference. This happens because the interest expense on your Income Statement depends on the average debt balance, but the debt balance depends on how much cash you have to pay it down... which is affected by Net Income (after you've already calculated interest!). The standard fix is to enable iterative calculations in Excel, but you have to be careful it's working correctly and not hiding a bigger error.

The Payoff: Calculating Returns

The final step is getting to the bottom line—calculating the key metrics that decide if a deal is a "go" or "no-go": the Internal Rate of Return (IRR) and the Multiple on Invested Capital (MoIC).

- MoIC is the simpler of the two. It’s just the total cash you get back divided by the total cash you put in. A 3.0x MoIC means for every dollar you invested, you got three dollars back. Simple.

- IRR is the annualized rate of return on the investment. It answers the question, "What was my effective annual growth rate on this money?" PE funds typically target an IRR of 20-25% or more.

These two numbers are the ultimate scorecard for your model. They are the direct result of everything you've built—the purchase price, the leverage, the operational plan, and the exit assumptions. A clean, well-built model gives you the confidence to stand behind those numbers and defend the story they tell.

Telling Your Story and Proving Your Fit

Getting the technical questions right gets you in the door. It's your story, however, that actually lands you the offer. After you've survived the intense modeling tests and the technical grilling, the interview inevitably shifts to a far more important question: Are you the right fit for this team?

Getting the technical questions right gets you in the door. It's your story, however, that actually lands you the offer. After you've survived the intense modeling tests and the technical grilling, the interview inevitably shifts to a far more important question: Are you the right fit for this team?

Private equity firms are small, intense, high-stakes environments. The partners aren't just looking for a human calculator; they're looking for future partners. They want to see genuine intellectual curiosity, sound commercial judgment, and a collaborative spirit.

This is your chance to connect the dots of your past experience into a compelling vision for your future. The goal is simple: tell a story that proves you have the drive, personality, and interpersonal skills to thrive here.

Answering the All-Important "Why Private Equity?"

This question seems straightforward, but it’s a minefield of generic, forgettable answers. If you say you want to "be an investor" or "work on exciting deals," you'll sound exactly like everyone else. A powerful answer has to be specific, personal, and authentic, tying your unique background directly to how private equity actually works.

Think of your answer as a three-part narrative:

- The Spark: Pinpoint the moment you realized you wanted to be an investor, not just an advisor. Was there a specific deal in your banking experience where you found yourself truly identifying with the buy-side's perspective? Talk about that.

- The Intellectual Appeal: Get specific about what fascinates you. Is it the long-term strategy of growing a business? The operational deep-dives? The creative process of building an investment thesis from the ground up?

- The Firm-Specific Connection: Why this firm? Connect your interests to their investment strategy, a recent deal you admired, or their particular approach to working with portfolio companies.

A great response to "Why PE?" isn't just about what you want to gain; it's about the value you believe you can add. It shows you’ve moved beyond the theory and understand the practical, hands-on nature of the job.

Building this kind of narrative is a skill that translates far beyond PE. Many professionals find that learning to tell their story this way is a crucial step as they prepare for consulting interviews and other strategic roles.

Walking Through a Deal You Worked On

When an interviewer asks you to "walk me through a deal," they are not looking for a bland project summary. This is a direct test of your commercial instincts. Can you think like a principal investor? Can you cut through the noise and identify the core drivers that made a deal tick... or fail?

You should structure your response like you're presenting it to an investment committee, zeroing in on the questions an investor would actually ask.

- Company Overview: Quickly paint a picture of the business model, its competitive moat, and the industry landscape.

- Investment Thesis: In a nutshell, why was this a good (or bad) deal? What were the key growth levers, potential operational improvements, or market tailwinds that drove the transaction?

- Risks and Mitigants: What were the biggest red flags? What kept you up at night, and how were those risks managed or addressed?

- Your Role and Opinion: What analysis did you personally own? And, most importantly, what was your take? If it were your own money, would you have done the deal?

Your ability to articulate a clear investment thesis and defend it with data is everything here. This conversation is also a great opportunity to show you're thinking about the bigger picture. For example, the exit market is a massive part of any deal's success. As noted in Vanguard's 2025 private equity market outlook, the recent rebound has been huge, with U.S. exits reaching $413 billion—a 49% jump from the year prior.

A surge like that frees up a ton of capital for new investments and really highlights why having a clear exit strategy from day one is so critical. By weaving in trends like this, you show a holistic understanding of the entire investment lifecycle. It proves you're not just a deal executor, but a thoughtful investor in the making.

How to Deconstruct the Case Study

Think of the case study as the final boss of the private equity interview process. This is where everything comes together—your analytical skills, your financial modeling chops, and your commercial judgment are all put to the test at once. The goal isn’t to find some single, magical “right answer.” It’s to show them how you think like an investor.

You might get a few hours for a live case or a whole weekend for a take-home assignment, but the objective is always the same. You need to get up to speed on a business, build a solid financial model, and then put together a compelling investment thesis you can stand behind and defend. Nailing this proves you can think and act like a real member of the deal team.

Identifying the Core Investment Pillars

Every solid private equity deal rests on a few clear, defensible pillars. Your first task is to comb through the case materials, which is usually a Confidential Information Memorandum (CIM), and start pulling out these key themes. These pillars will become the foundation for your entire analysis and recommendation.

- Industry and Market Dynamics: First, get a feel for the landscape. Is this a growing industry with the wind at its back, or is it facing major headwinds and disruption? You need to form a quick, educated opinion.

- Competitive Position: Does the company have a real competitive advantage—a "moat"? Look for clues like pricing power, high barriers to entry for competitors, or a product that’s genuinely better than the rest.

- Growth Levers: How are you going to grow this business? You need to pinpoint specific, actionable ideas. Think about entering new markets, launching new products, or making bolt-on acquisitions.

- Operational Improvements: Is there any low-hanging fruit? Look for places to trim costs or improve efficiencies that will flow directly to the bottom line and boost EBITDA margins.

- Exit Pathways: Always begin with the end in mind. How will the fund get its money back in 3-5 years? Figure out who the likely buyers will be—strategics or other sponsors—and what a realistic exit multiple looks like.

The case study is a direct simulation of the job. They want to see if you can cut through a mountain of information and zero in on the handful of factors that truly matter. That's the core skill on display here.

Building a Defensible Recommendation

After you’ve done your analysis, you have to bring it all together into a clear "Invest" or "Do Not Invest" recommendation. This isn't just a simple thumbs-up or thumbs-down. It's a fully fleshed-out investment thesis, supported by the numbers from your model and a thoughtful view on the risks and opportunities.

It helps to have a sense of what's happening in the market. For instance, the PE world is always evolving, with huge funds often targeting very specific sectors. In a recent quarter, U.S. private equity funds pulled in a massive $66.8 billion across 80 deals, which tells you there's a ton of capital looking for a home. You can find more PE fundraising trends on kpmg.com. A great thesis will show you're thinking about how the target company fits into these bigger industry trends.

Your final presentation needs to be balanced. Of course, you’ll highlight the key merits that make the deal attractive. But you also have to be upfront about the major risks. The key is that for every risk you point out, you should also propose a way to mitigate it or a key diligence item to get comfortable with it. This shows the kind of mature investment judgment they’re looking for. If you want to go deeper on this, check out our guide on what to expect in a case study interview.

Private Equity Interview FAQs

It's natural to have questions as you get into the weeds of private equity interview prep. Getting them answered helps you focus your energy on what actually moves the needle. Let's tackle a few of the most common ones that come up.

How Much Accounting Do I Really Need to Know?

Honestly, a ton. You need to know accounting so well that it's second nature. Think of it as the language of finance—if you're not fluent, you can't have a meaningful conversation.

You have to be able to explain, without hesitation, how the three financial statements connect. Be ready for a partner to ask you to walk them through how something like a $100 million asset sale, with a book value of $50 million, would flow through the income statement, cash flow statement, and balance sheet. You don't need a CPA, but you do need absolute command of the fundamentals.

What Is the Biggest Mistake in an LBO Modeling Test?

The classic, most frequent technical mistake is a balance sheet that doesn't balance. This almost always comes down to a busted link from the cash flow statement, especially around the cash sweep or debt schedule.

But here’s a mistake that’s just as fatal: a messy, disorganized model. If an associate can't follow your logic, they'll assume it's wrong. Clarity and structure are just as important as the correct final numbers. A clean, well-formatted model shows you think clearly under pressure.

How Do I Answer "Why Our Firm"?

This is where you show you’ve gone beyond a quick glance at their homepage. Your answer needs real substance, and that comes from deep research.

- Find two or three recent deals the firm has done that you genuinely find interesting.

- Be ready to explain why you think they were compelling investments. What was the investment thesis? How does it align with the firm's stated strategy?

- Mentioning specific partners and their work or commentary also shows you’ve put in the effort to understand who they are, not just what they own.

Ready to stop practicing and start performing in your interviews? Soreno offers an AI-powered platform with hundreds of finance and consulting cases, instant feedback, and guided drills to sharpen your skills. Get unlimited, on-demand mock interviews and pinpointed analysis to turn weaknesses into strengths. Start your free trial at https://soreno.ai.