Preparing for investment banking interviews: Your Roadmap to Offers

Master the essentials of preparing for investment banking interviews with concise drills, networking tips, and compelling behavioral stories to land offers.

Preparing for investment banking interviews is a marathon, not a sprint. Success demands a structured roadmap that marries deep technical knowledge with polished behavioral storytelling. It’s not about cramming; it's about a disciplined, multi-month strategy to master valuation, accounting, and financial modeling while relentlessly practicing your delivery through mock interviews.

Your Strategic Roadmap for Interview Success

Landing an investment banking offer takes a methodical, multi-faceted approach. Forget last-minute panic—this is about strategically blending deep conceptual understanding with polished delivery practiced over time. The best way to tackle it is by breaking the journey down into manageable phases, making sure you build a solid foundation before you start sparring.

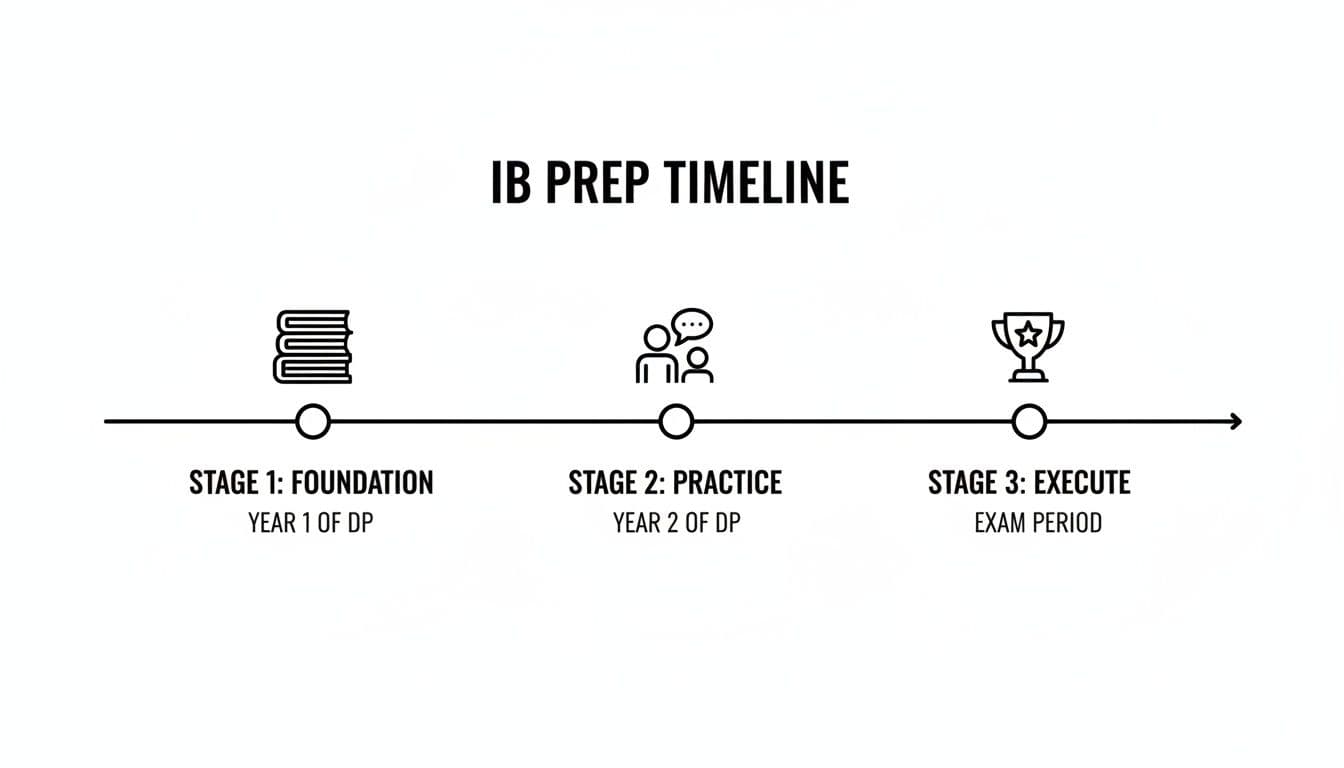

Think of this roadmap as your command center, laying out key milestones from building your technical base months out to executing flawlessly on Superday.

As you can see, the timeline emphasizes getting the technical concepts down cold before you dive into intensive practice. The final phase is all about putting those honed skills to the test when it really counts.

The Core Pillars of Your Preparation

Your prep needs to be built on three non-negotiable pillars. If you neglect any one of them, you're creating a fatal weak point in your candidacy.

-

Technical Mastery: This is so much more than memorizing formulas. You need a rock-solid conceptual grasp of accounting, valuation methodologies (DCF, Comps, Precedents), and LBO modeling. Interviewers will push you with follow-up questions specifically designed to see if you really get it.

-

Behavioral Storytelling: Your "story" is your personal brand. This includes having a compelling answer for "Walk me through your resume," "Why investment banking?" and crafting STAR-method stories that show leadership, teamwork, and resilience. Every claim you make needs to be backed by a specific, quantifiable example.

-

Market and Deal Awareness: Banks want to hire people who are genuinely interested in what they do. You have to be able to talk intelligently about recent M&A deals, current market trends, and a company you've been following. This shows you have commercial awareness and a real intellectual curiosity for the industry.

Crafting a Realistic Timeline

A good rule of thumb for dedicated preparation is 2-4 months, putting in a consistent 10-15 hours per week. In the beginning, your focus should be almost entirely on building that technical base using guides and getting your hands dirty with financial modeling practice.

As you move into the middle phase, the focus shifts. This is when you start applying that knowledge in mock interviews and relentlessly refining your behavioral stories. The final month before interviews should be dedicated almost entirely to high-frequency practice—running through mock interviews (both technical and fit) several times a week to build muscle memory and perfect your delivery under pressure.

The goal isn't just to cram information; it's to internalize the material so it becomes second nature. Real confidence in an interview comes from knowing you've put in the reps and can handle whatever they throw at you.

Here's a table summarizing how you might structure this journey:

Investment Banking Interview Prep Timeline

This timeline provides a high-level overview of how to allocate your time and effort effectively.

| Phase (Timeline) | Core Focus | Key Activities | Success Metric |

|---|---|---|---|

| Foundation (Months 2-4) | Building Core Knowledge | Reading technical guides, learning accounting principles, building basic 3-statement and DCF models from scratch. | You can explain concepts like WACC, Enterprise Value, and Deferred Tax Liabilities clearly without notes. |

| Practice (Months 1-2) | Application & Refinement | Mock interviews (peer & alumni), crafting and memorizing behavioral stories, practicing paper LBOs, following market news. | You can complete a "walk me through a DCF" question smoothly and answer behavioral questions without sounding rehearsed. |

| Execution (Final 2-4 Weeks) | High-Frequency Reps | Multiple mock interviews per week, reviewing notes, staying current on recent deals, final story polishing. | You feel confident, your answers are sharp, and you can handle curveball questions calmly and logically. |

By structuring your prep this way, you systematically build the skills and confidence needed to turn your hard work into a coveted offer.

Beyond the content itself, your delivery matters immensely. For non-native English speakers, clear communication is paramount when explaining complex financial concepts. It's worth checking out resources for improving English pronunciation for job interviews to ensure your expertise comes across perfectly.

Getting Your Foot in the Door: Networking Your Way to an Interview

Before you ever get a chance to prove you can build a DCF model, you have to get the interview. And in investment banking, just dropping your resume into an online portal is the equivalent of sending it into a black hole. Strategic networking is what pulls your application out of that digital slush pile and puts it on a decision-maker's desk.

This isn't just about collecting contacts on LinkedIn. It's about building real relationships and gathering intel. The whole point is to turn a cold application into a warm introduction, which makes a world of difference in hyper-competitive markets like New York and London.

Don’t just take my word for it. In the cutthroat world of IB recruiting, a referral can literally skyrocket your chances. We're talking a 35% interview invite rate with a referral versus a dismal 8% for cold online applications. Networking is your golden ticket.

Who Should You Actually Talk To?

You have to be smart about this. Spraying and praying with generic emails is a waste of everyone's time. Instead, get methodical and build a targeted list of people at the firms you care about.

Focus your energy on these groups:

- Alumni from Your University: This is your easiest "in." People are hardwired to help those from their alma mater. Dig into your university's alumni database and get comfortable with LinkedIn's alumni search tool.

- Junior Bankers (Analysts and Associates): These are the people who were in your shoes just a year or two ago. They know the recruiting gauntlet inside and out and can give you the real scoop on their group's culture and what the interviews are actually like.

- People with a Shared Connection: Look for common ground. Did you grow up in the same town? Are you both members of a niche organization? Any shared link makes your outreach feel personal, not random.

How to Write an Email That Gets a Reply

Bankers are buried in emails. Your first message has to be sharp, respectful of their time, and crystal clear about what you're asking for. Generic, copy-pasted templates get deleted instantly.

A solid outreach email or LinkedIn message needs just three things:

- A Simple Subject Line: Something like "Student from [Your University] Seeking Advice" is perfect.

- The Connection Upfront: Lead with your connection. "I'm a sophomore finance major at [Your University] and saw your profile on the alumni network."

- A Low-Effort "Ask": You're aiming for a quick informational chat. End with something like, "Would you have 15 minutes in the coming weeks to share some insights on your experience at [Bank Name]?"

Pro Tip: Never, ever attach your resume to the first email. It screams "I just want a job from you" and kills any chance of building genuine rapport. The resume comes later, after you've actually had a conversation.

Making the Most of an Informational Interview

So you landed a call. Great. Now the real work begins. This is your chance to learn, make a good impression, and start building that relationship. Come prepared with a list of smart questions that you can't just find on Google.

Focus on their personal experience. Try questions like these:

- "What's been the most surprising part of your job as an analyst?"

- "Could you tell me a bit about the culture within your specific group, like TMT or Industrials?"

- "From your perspective, what skills are most crucial for a summer analyst to have on day one?"

Your main job here is to listen. You want this to feel like a real conversation. As you wrap up, thank them for their time and ask if there’s anyone else at the firm they’d recommend you speak with. This is how you get passed along internally. If you want to dive deeper, there are some excellent guides on how to network effectively and build connections that can help you master this.

The Follow-Up and the "Ask"

Within 24 hours of your chat, send a short, personalized thank-you email. Mention something specific you discussed—it shows you were actually listening and helps them remember you.

Once you've built that connection, the final piece is asking for the referral. As application deadlines get closer, circle back with a polite email. Something like, "I'm in the process of applying for the summer analyst role online, and I was wondering if you might be willing to pass my resume along to the recruiting team." It's direct but respectful, and it's often the step that turns a good conversation into a game-changing referral.

Nailing the Technical Gauntlet

This is where the rubber meets the road. The technical interview is designed to see if you truly understand the language of finance or if you’ve just memorized a few formulas. They want to see if you can think on your feet when the pressure is on.

Success here isn't about rote memorization. It’s about showing you have a deep, almost intuitive grasp of how the core concepts of finance actually work together. Interviewers will push you beyond simple definitions to see if you can apply these principles to messy, real-world situations.

The Three Pillars of Technical Knowledge

Your technical prep should be built around three core areas. It’s not enough to know them in isolation; the real skill is understanding how they all connect.

- Accounting is Your Foundation: Every single analysis, every model, starts with the three financial statements. You have to be able to explain exactly how the Income Statement, Balance Sheet, and Cash Flow Statement link up and flow into one another. No exceptions.

- Valuation is Your Toolkit: This is the bread and butter of the job. You need to be rock-solid on Discounted Cash Flow (DCF) analysis, Public Comparables (Comps), and Precedent Transactions. Know them inside and out.

- Transaction Concepts are Key: You must understand the mechanics of how mergers and acquisitions (M&A) and leveraged buyouts (LBOs) fundamentally work. Be ready to walk an interviewer through the high-level impacts of a deal on a company’s financials.

Don't underestimate this section. Technical questions remain the heart of investment banking interviews, and it's where most candidates get cut. Core concepts like enterprise value, DCF mechanics, and LBO modeling trip up an estimated 60% of unprepared candidates during intense Superday interviews.

From Memorization to True Understanding

Just knowing the formula for WACC is table stakes. A good interviewer will immediately ask a follow-up like, "Okay, so how would a significant increase in accounts receivable affect WACC?" That’s the kind of question that separates the top candidates from everyone else.

To get to that level, you have to constantly ask yourself why. Why does depreciation get added back on the cash flow statement? Why does a DCF analysis give you Enterprise Value instead of Equity Value?

The real goal is to build financial intuition. When you truly understand the "why" behind a concept, you can reason your way through any question—even one you’ve never heard before. That's what interviewers are looking for: a future banker who can think, not a human calculator.

How to Structure Your Answers for Maximum Impact

The way you explain your answer is just as critical as the answer itself. A rambling, unstructured response—even if it's technically right—won't land well. Always use a clear, logical framework.

Take a classic question: "Walk me through a DCF." Here's how to structure it:

- Start with the big picture: "A DCF is a valuation method that estimates a company's value based on the present value of its projected future cash flows."

- Lay out the steps: Explain that you'd project the company's unlevered free cash flows for a period, calculate a terminal value, discount both back to today using the WACC, and then sum them up to arrive at the Enterprise Value.

- Define the key inputs: Briefly touch on what makes up unlevered free cash flow and mention the two common ways to calculate terminal value (the Gordon Growth method and the Exit Multiple method).

This kind of structured response shows you have an organized thought process and can communicate complex ideas clearly. To sharpen this skill, it’s worth reviewing guides that break down how to approach a variety of investment banking technical questions.

Handling Curveballs and Advanced Questions

Once you’ve mastered the fundamentals, get ready for some curveballs. Interviewers love to push the boundaries to see how you handle questions that aren’t straight out of a textbook.

A common one is, "How would you value a private company?" Your answer needs to show you recognize the limitations of standard valuation methods.

- Public Comps: You can still use them, but you have to mention applying a liquidity discount (usually in the 10-30% range) because private shares aren't easily traded.

- Precedent Transactions: This is often a great method for private companies, as you're looking at what similar businesses have actually sold for.

- DCF: This is still very relevant, but the challenge is calculating WACC. You'd need to find a beta from a group of public comps, unlever it, and then relever it based on the private company's specific capital structure.

Another tricky area is applying these concepts to unique situations, like valuing a pre-revenue startup. A standard DCF is almost useless here since cash flow projections are pure speculation. A great answer would acknowledge this and suggest alternatives, like looking at comps based on non-financial metrics (e.g., daily active users) or using a "venture capital method" that works backward from a potential future exit.

Showing you can think through these advanced scenarios proves you’re more than just a student who read a guide—you’re a candidate who can think like a real banker.

Crafting Your Story for Behavioral Questions

Look, the technical questions are just the price of admission. Everyone who gets a final round interview is smart. What really sets you apart—what gets you the offer—is how you handle the behavioral questions.

Bankers aren't just hiring a human calculator. They're looking for someone they can trust in the trenches at 2 AM, someone who won't crack under pressure. This is your chance to prove you’ve got the grit, teamwork skills, and genuine drive to not just survive, but thrive.

Your "story" is the key. It's how you connect the dots on your resume into a compelling narrative that screams, "I get this industry, and I'm built for it."

Building Your Core Narrative

Your story isn't just walking through your resume chronologically. It’s a targeted, 2-3 minute pitch that’s authentic, memorable, and answers the real questions behind the questions: "Why banking?" and "Why should we hire you over the ten other brilliant people we're seeing today?"

Start by brainstorming the defining moments from your life—internships, class projects, leadership roles, even that time your startup idea failed. Find experiences that showcase the traits bankers actually care about.

- Analytical Rigor: When did you use data to solve a genuinely tricky problem?

- Teamwork and Leadership: Think of a time you had to rally a dysfunctional group to hit a deadline.

- Resilience: How did you handle a major screw-up or setback? What did you do to bounce back?

Pick your best three to five "greatest hits" from this list. These will become the versatile pillars of your behavioral answers, ready to be adapted to almost any question they throw at you.

The Power of the STAR Method

The STAR method (Situation, Task, Action, Result) is your best friend for structuring these stories. It stops you from rambling and gives your answer a clean, powerful arc that interviewers can easily follow.

Here’s how to put it into practice:

- Situation: Briefly set the stage. What was the project? Who was on the team? Keep it short and sweet—just enough context.

- Task: What was your specific goal? What were you personally responsible for delivering? This defines your role.

- Action: This is the most important part. Detail the exact steps you took. Use "I" statements. Even if it was a team project, focus on your individual contribution. What did you build, analyze, or negotiate?

- Result: End with the outcome. Quantify it whenever possible. Did you increase efficiency by 15%? Did your analysis lead to a specific recommendation? What did you learn from the experience?

A classic rookie mistake is spending 80% of the time on the Situation. Interviewers don’t care about the backstory; they care about what you did and what happened because of it. Make the Action and Result the stars of the show.

The game has changed. Behavioral questions now take up a massive 35% of interview time, a huge jump from a decade ago. It's no longer about memorizing technicals; it's about proving you have leadership potential and can think on your feet. For more on this shift, The Interview Guys have some great insights into how bankers' expectations have evolved.

Polishing and Practicing Your Delivery

Once you've got your core stories mapped out in the STAR framework, the real work begins: practice. You need to know these stories so well that they sound completely natural, not like you're reading a script.

Record yourself answering common questions like, "Tell me about a time you failed," or "Describe a team conflict you handled." Listen to the playback. Are you using filler words? Is your tone confident? This kind of self-critique is invaluable.

How you tell your story is just as important as the story itself. To sharpen your delivery, take a look at our guide on essential communication skills for interviews.

Ultimately, your goal is to paint a picture of a candidate who is not only sharp and technically capable but also has the maturity, self-awareness, and collaborative spirit to be a great future colleague.

Using Mock Interviews to Polish Your Performance

Your technical knowledge and polished story are just the raw materials. The real magic happens in mock interviews—that's the forge where you shape everything into an offer-winning performance.

There is simply no substitute for practicing under pressure. The whole point is to build muscle memory, learn to manage your nerves, and turn abstract concepts into confident, articulate answers when it really counts.

Structuring Your Mock Interview Schedule

The biggest mistake I see candidates make is jumping into mocks with industry professionals way too early. If you haven't nailed down your foundation, you're just wasting a golden opportunity to get high-level, nuanced feedback.

Think of it as a progression. You want to build up deliberately, increasing the pressure and the quality of feedback at each stage. This way, you walk into the real thing with unshakeable confidence, knowing you’ve already faced the toughest questions out there.

The Three Stages of Mock Interview Prep

A smart practice schedule has a clear flow, from low-stakes reps to high-stakes dress rehearsals.

-

Stage 1: Practice on Your Own. Start by simply talking through your answers out loud. Record yourself explaining your resume or walking through a DCF. When you play it back, you'll be amazed at the filler words, awkward phrases, and rambling you catch. This is your baseline.

-

Stage 2: Practice with Your Peers. Once your core stories and technical explanations feel solid, grab classmates or friends who are also going through the wringer. They'll spot mistakes you’ve become blind to and give you a fresh perspective. You’ll also learn a ton just by hearing how they frame their own answers.

-

Stage 3: Practice with an Industry Pro. In the final weeks before your interviews, it's time to call in the experts. Schedule mocks with alumni or mentors working in finance. Their feedback is as real as it gets, focusing on the subtle industry cues and unspoken expectations that separate a good candidate from a great one.

Don’t Sleep on AI-Powered Practice Tools

Beyond practicing with people, AI-powered interview platforms are an incredible supplement for high-frequency drills. The best part? They're available 24/7. No scheduling needed. You can bang out reps whenever you have a spare 15 minutes, which is a huge advantage for building fluency.

These tools provide instant, data-driven feedback on your delivery—analyzing your pacing, filler words, and even your vocal tone. While an AI can't replicate the strategic insights of a seasoned banker, it's phenomenal for polishing your presentation. It gives you the kind of objective critique a friend might be too polite to share.

This principle of structured practice isn't unique to banking. For example, many aspiring consultants use similar tools to practice cases for McKinsey, where the focus on clear, structured communication is just as intense.

How to Actually Use the Feedback You Get

A mock interview is pointless if you don't do anything with the feedback. You have to be strategic about collecting it and turning it into real improvement. Don't just nod and say thanks.

At the end of every single mock, ask this question: "What is the #1 biggest thing I can do to improve before my next interview?" This forces your partner to give you one prioritized, actionable piece of advice instead of a generic "you did great."

Keep a running log of all the feedback you receive. After each session, jot down the key takeaways—maybe you fumbled a technical concept, or a behavioral story didn't quite land. Before your next mock, review those notes and actively work on fixing those specific things. This creates a powerful feedback loop that will accelerate your progress.

To help you build a well-rounded plan, here's a look at how each practice method fits into your overall strategy.

Effective Mock Interview Strategy

| Method | Pros | Cons | Best For |

|---|---|---|---|

| Self-Practice | Convenient, zero pressure, great for getting the basics down. | No external feedback, can reinforce bad habits if you're not careful. | Early-stage prep; memorizing story outlines and core technical definitions. |

| Peer Mocks | Collaborative learning, mutual accountability, simulates some interview pressure. | Feedback quality can be inconsistent; peers might miss subtle flaws. | Mid-stage prep; refining your delivery and checking for clarity and impact. |

| AI Platforms | On-demand practice, objective data on communication style and delivery. | Lacks nuanced, industry-specific strategic feedback on your content. | Polishing delivery, eliminating filler words, and high-frequency technical drills. |

| Professionals | Highly realistic feedback, deep industry insights, invaluable networking. | Limited availability, can be high-pressure if you're not ready. | Final-stage prep; stress-testing your performance and getting expert-level advice. |

By layering these methods, you cover all your bases. You use AI and self-practice for volume and delivery polish, peer mocks for collaborative refinement, and sessions with professionals for that final, expert sign-off.

When you approach it this way, your real interview starts to feel like just another practice round—and that’s exactly where you want to be.

Common Questions About Investment Banking Interview Prep

As you get deep into the grind of IB interview prep, you're bound to have some questions. It’s a tough road, and knowing where to focus your energy is half the battle. Let's break down some of the most common things aspiring bankers ask.

How Long Should I Spend Preparing for IB Interviews?

There's no one-size-fits-all answer, but a focused 2-4 month window is a realistic and effective timeline for most people. What matters more than the total duration, though, is your consistency.

You should be aiming for 10-15 hours per week of disciplined practice. Break that time up. Think daily technical drills for 30-60 minutes, a dedicated 1-2 hours each week to refine your story, and weaving in more mock interviews as the real thing approaches. The goal isn’t cramming; it’s building muscle memory so the material becomes second nature.

What Is the Biggest Mistake Candidates Make in Technical Interviews?

Hands down, the biggest trap is memorizing answers without actually understanding the why behind them. Interviewers are trained to sniff this out instantly. They'll hit you with a follow-up or a practical application that a memorized definition just can't handle.

For example, anyone can recite the formula for WACC. But a sharp interviewer will ask how a company’s decision to issue more debt impacts its WACC and why that happens. That’s the real test.

Pro Tip: To sidestep this pitfall, constantly ask yourself "why" a concept works. Try explaining a DCF to a friend who knows nothing about finance. If you can make it simple for them, you truly understand the core logic.

How Can I Stand Out if I Don’t Attend a Target School?

Breaking in from a non-target school is absolutely doable, but it demands a different level of precision. Honestly, you just have less room for error.

Here’s how you can even the odds:

- Network Relentlessly: Your outreach has to be strategic and persistent. Use LinkedIn and your university's alumni network to forge real connections. The goal is to secure those crucial referrals that get your resume past the first screen.

- Be Over-Prepared: Your technical knowledge and behavioral answers can't just be good—they have to be flawless. You need to out-prepare the average candidate from a target school to prove you’ve earned your spot.

- Tell a Killer Story: Your "why banking" story needs to be powerful. It should highlight your unique drive, resilience, and a passion for finance that you can back up with real examples. A hungry, well-practiced candidate with a great story beats a complacent one every single time, regardless of their school.

Are AI Interview Prep Tools Worth Using?

AI tools can be a fantastic supplement, but they shouldn't be your only prep method. Their biggest strengths are convenience and data-driven feedback.

You can run drills whenever you have a spare moment, which is perfect for high-frequency practice. Plus, an AI platform can give you objective feedback on things like your speaking pace or use of filler words—details a friend might be too polite to point out.

That said, you still need to do mocks with real people. Combine the AI drills with sessions from experienced professionals who can give you the nuanced, industry-specific feedback that a machine can't replicate just yet.

Ready to put this into action? Soreno provides an AI-powered platform that simulates the investment banking interview experience. You get instant, detailed feedback on your technical answers and behavioral stories, helping you build the confidence you need to land the offer. Start your free trial at https://soreno.ai.