7 Investment Banking Technical Questions to Master in 2025

Ace your interview with our deep dive into 7 common investment banking technical questions. Includes model answers, key metrics, and pro tips to land the job.

The technical round of an investment banking interview is often the most daunting hurdle for aspiring analysts and associates. It’s where theoretical knowledge meets practical application under intense pressure. While countless resources list common questions, this guide goes deeper by providing a strategic blueprint for mastering the concepts behind the answers.

We will dissect seven of the most critical and frequently asked investment banking technical questions. For each one, you will find more than just a model answer. We provide a complete breakdown that includes:

- A structured, high-quality response.

- The underlying strategy behind the answer.

- Actionable preparation tips.

- Common pitfalls to avoid.

This isn’t just a list; it’s a framework designed to help you demonstrate the analytical rigor and clear communication that top-tier banks demand. Our goal is to equip you with the tools to transform a stressful interrogation into a confident showcase of your financial acumen. By understanding the "why" behind each question, you'll be prepared to handle any variation thrown your way, proving you have the skills to excel from day one. Let's dive into the core concepts you need to master.

1. Walk me through a Discounted Cash Flow (DCF) analysis

This is arguably one of the most fundamental investment banking technical questions. The Discounted Cash Flow (DCF) analysis is a valuation method that estimates a company's value based on its projected future cash flows. It's built on the principle that the value of a business is the sum of the cash it can generate in the future, discounted back to its present value.

How a DCF Works

A DCF analysis projects a company's unlevered free cash flow (UFCF) over a forecast period, typically 5-10 years. Each year's projected cash flow is then discounted to its present value using the company's Weighted Average Cost of Capital (WACC), which represents the blended cost of its debt and equity financing.

Finally, a Terminal Value is calculated to capture the company's value beyond the explicit forecast period. This is also discounted back to the present. The sum of the present values of the projected cash flows and the terminal value gives you the company’s Enterprise Value.

Strategic Approach

Your response should be structured and logical. Start with the "big picture" (the purpose of a DCF) and then walk through the steps methodically. The interviewer is testing your ability to communicate a complex process clearly and concisely.

- Step 1: Project Free Cash Flows: Start with revenue and work your way down. This involves forecasting revenues, subtracting operating costs to get to EBIT, adjusting for taxes, adding back non-cash charges like D&A, and accounting for changes in working capital and capital expenditures.

- Step 2: Calculate the Discount Rate (WACC): Clearly explain the components of WACC, including the cost of equity (often found using CAPM), the cost of debt, and the impact of the corporate tax shield on debt.

- Step 3: Determine Terminal Value: Explain the two primary methods: the Gordon Growth Model (Perpetuity Growth) and the Exit Multiple Method. Justify your choice of a long-term growth rate (e.g., in line with GDP growth) or a comparable company multiple.

- Step 4: Calculate Enterprise and Equity Value: Sum the present values of the cash flows and the terminal value to arrive at Enterprise Value. To get to Equity Value, subtract net debt and other non-equity claims.

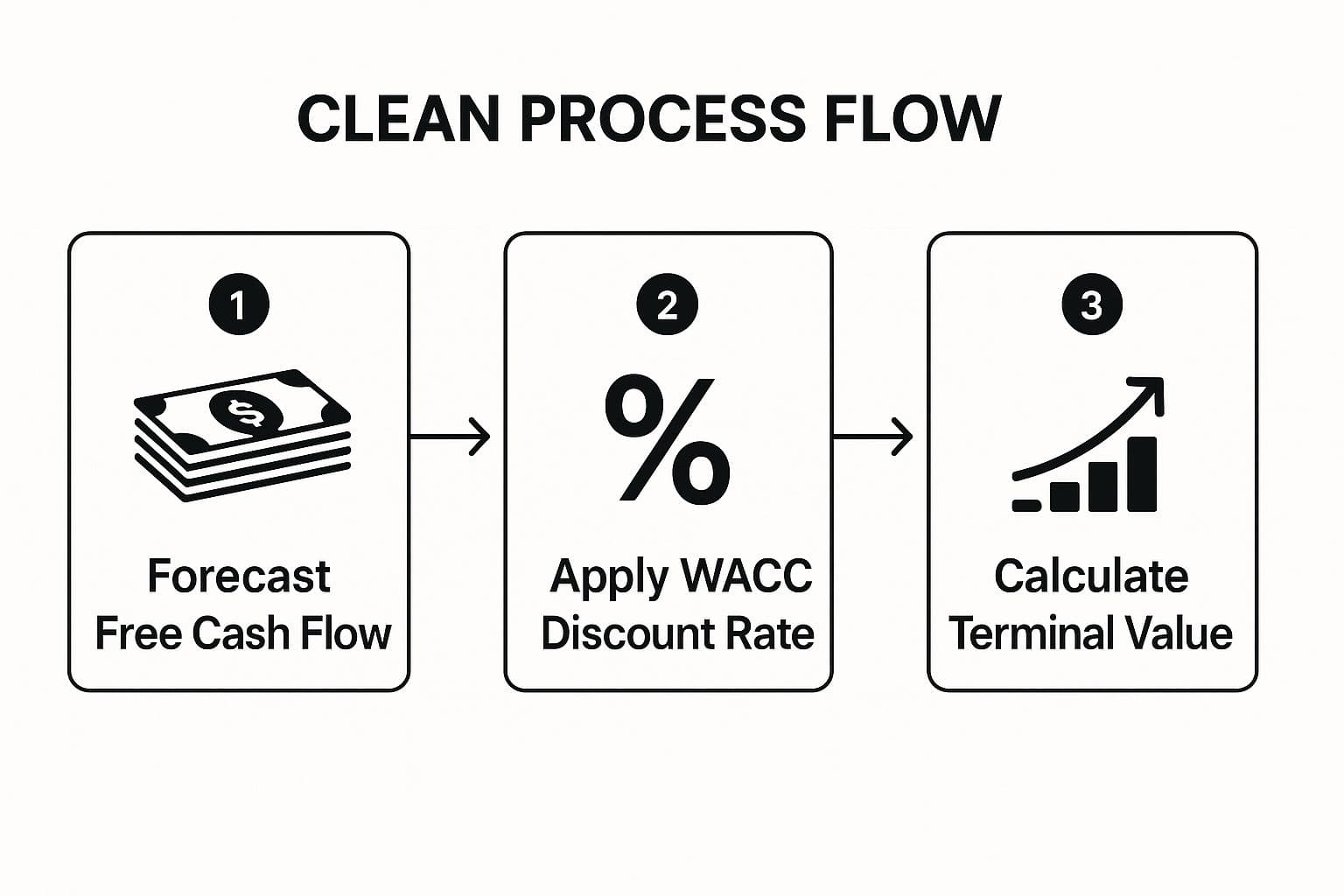

This infographic breaks down the core workflow of a DCF valuation.

The visualization highlights the sequential nature of the process, emphasizing that future cash flows must first be projected before they can be discounted and a terminal value can be added.

2. How would you value a company with three different methods?

This is a classic, multi-part question that tests your breadth of valuation knowledge. The interviewer wants to see if you can go beyond a single methodology and triangulate a company's value using different perspectives. The three most common methods are Discounted Cash Flow (DCF), Comparable Company Analysis (Comps), and Precedent Transactions.

How the Three Methods Work

This approach, often called "triangulation," uses different valuation techniques to arrive at a range of values, providing a more robust and defensible conclusion. Each method has its own set of assumptions, strengths, and weaknesses, making the combination powerful. For example, a DCF provides an intrinsic valuation based on a company's cash-generating ability, while Comps and Precedents provide relative valuations based on current market conditions and comparable deals.

A comprehensive valuation analysis is a core skill in finance, especially in deal-making environments. For further insights into how these techniques are applied in an investment context, you can explore common private equity interview questions which often revolve around valuation.

Strategic Approach

Your answer should be a high-level overview of each method, followed by a discussion of how you would use them together. The interviewer is assessing your ability to think critically about valuation and not just recite formulas.

- Step 1: Comparable Company Analysis (Comps): Explain that you would identify a group of publicly traded companies with similar business models, size, and growth profiles. You would then calculate valuation multiples like EV/EBITDA or P/E for this peer group and apply the median or mean multiple to the target company's relevant financial metric to derive its value.

- Step 2: Precedent Transaction Analysis: Describe how you would find historical M&A transactions involving similar companies. You'd look at the multiples paid in those deals (e.g., the acquisition EV/EBITDA) and apply a similar multiple to the target company. This method often yields a higher valuation due to the inclusion of a "control premium."

- Step 3: Discounted Cash Flow (DCF) Analysis: Briefly walk through the DCF process as described previously. Emphasize that this is an intrinsic valuation method based on the company's projected future cash flows and is independent of current market sentiment.

- Step 4: Triangulate and Conclude: Explain that you would summarize the valuation ranges from all three methods on a "football field" chart. You would then discuss the pros and cons of each method in the context of the specific company and conclude with a reasonable valuation range, explaining which method you might weight more heavily and why.

3. Explain the difference between enterprise value and equity value

This is another core concept among investment banking technical questions, testing your understanding of a company's capital structure and its implications for valuation. Enterprise Value (EV) represents the total value of a company's core business operations, available to all capital providers: equity holders, debt holders, and preferred shareholders. In contrast, Equity Value represents the value attributable only to the common equity shareholders.

How Enterprise and Equity Value Relate

Think of Enterprise Value as the theoretical "takeover" price. If you were to acquire a business, you would need to buy out all its equity holders and also assume its debt. Equity Value, on the other hand, is simply the company's market capitalization (share price multiplied by the number of shares outstanding).

The bridge between these two values is crucial. To get from Equity Value to Enterprise Value, you add net debt (total debt minus cash), preferred stock, and minority interest. Conversely, to move from Enterprise Value to Equity Value, you subtract those same components. This calculation is fundamental for linking different valuation methodologies and understanding a company's true operational worth.

Strategic Approach

Your answer should be a clear, step-by-step explanation of the "bridge" between the two values, demonstrating you grasp the underlying logic rather than just memorizing a formula. The interviewer wants to see that you can think about value from the perspective of different stakeholders.

- Step 1: Define Each Term Clearly: Start by defining Enterprise Value as the value of the company's core operations to all investors. Then, define Equity Value as the value available only to equity holders.

- Step 2: Explain the Bridge: Walk through the calculation methodically. Start with Equity Value, add debt, and then explain why you add it (it's a claim on the company's assets). Then explain why you subtract cash (it's a non-operating asset that can be used to pay down debt). Add preferred stock and minority interest, explaining their status as other capital providers.

- Step 3: Provide Contextual Examples: Mention that in an M&A context, buyers focus on Enterprise Value because they are acquiring the entire capital structure. For a public markets investor, Equity Value (market cap) is often the more immediate metric.

- Step 4: Connect to Valuation Multiples: Link the concepts to common multiples. Explain that EV is paired with unlevered metrics like EBITDA and EBIT (since these flows are available to all capital providers), while Equity Value is paired with levered metrics like Net Income (which is the profit available to equity holders).

4. Walk me through an LBO model and explain how leverage affects returns

This question is a cornerstone of private equity and leveraged finance interviews, making it one of the most important investment banking technical questions you can master. A Leveraged Buyout (LBO) is the acquisition of a company using a significant amount of borrowed money (debt) to meet the cost of acquisition. The purpose of an LBO model is to determine the potential return on a private equity firm's equity investment.

How an LBO Works

An LBO model starts by making assumptions about the purchase price, debt and equity financing, and the target company's operational performance. The private equity firm uses the company's own cash flows to service and pay down the debt over the investment horizon, typically 3-7 years. The goal is to sell the company at a later date for a higher price, with the debt significantly reduced. This process amplifies the returns on the original equity investment.

The core of an LBO model is a "Sources and Uses" table, which outlines where the capital for the acquisition is coming from (sources) and what it's being spent on (uses). The model then projects the company's three financial statements, focusing on how debt paydown affects the balance sheet and cash flow statement. Finally, it calculates the return to the PE sponsor, usually as an Internal Rate of Return (IRR) and a Multiple on Invested Capital (MoIC).

Strategic Approach

Your answer should demonstrate a clear, step-by-step understanding of the mechanics and the strategic rationale behind using leverage. The interviewer wants to see if you can connect the modeling steps to the core goal: maximizing equity returns.

- Step 1: Transaction Assumptions & Sources/Uses: Begin by outlining the purchase price assumption (often based on an EBITDA multiple) and how the deal will be financed. Explain the Sources and Uses table, which must balance, showing exactly how the acquisition and related fees are paid for with a combination of debt and equity.

- Step 2: Project Financials & Debt Paydown: Explain that you would build a pro-forma balance sheet and project the company's cash flows. Emphasize how cash flow is used to pay down mandatory debt amortization and optionally sweep excess cash to repay debt faster, thereby increasing the equity value.

- Step 3: Exit and Returns Calculation: Describe the exit assumptions, typically based on selling the company at a similar or higher EBITDA multiple after 5-7 years. Calculate the exit enterprise value, subtract the remaining net debt to find the equity proceeds, and then calculate the IRR and MoIC based on the initial equity investment.

- Step 4: Explain Leverage Impact: Clearly state that leverage amplifies returns. Using debt reduces the amount of equity the PE firm has to contribute, meaning any gains in the company's value disproportionately benefit the equity holders. However, also mention that this amplifies risk; if the company underperforms, the high debt burden can quickly erase equity value. Learn more about the intricacies of LBOs and PE interviews in this comprehensive private equity interview guide.

5. How do you analyze a merger and what are the key considerations?

This is a comprehensive question designed to test your understanding of M&A from both a strategic and financial perspective. Analyzing a merger involves evaluating its strategic rationale, quantifying its financial impact, and assessing the risks and potential for value creation. It's a core function of investment banking.

How Merger Analysis Works

Merger analysis begins by understanding the strategic reason for the deal, such as market entry, product expansion, or achieving economies of scale. Financially, the core is an accretion/dilution analysis, which determines whether the deal will increase or decrease the acquirer's earnings per share (EPS).

This involves valuing the target company, projecting the financial performance of the combined entity, and modeling the transaction's financing structure (cash, stock, or debt). Key considerations include quantifying potential synergies (cost and revenue), understanding the purchase price premium, and assessing social issues like management integration.

Strategic Approach

Your answer should be a multi-layered framework, moving from high-level strategy to detailed financial mechanics. This demonstrates a well-rounded understanding, a key trait interviewers seek when asking investment banking technical questions.

- Step 1: State the Strategic Rationale: Always begin here. Is the acquisition defensive or offensive? Is it to gain market share, acquire technology, or enter a new geography? Use examples like Disney's acquisition of Fox to gain a content library for its streaming service.

- Step 2: Discuss Valuation and Purchase Price: Explain how you would value the target company (using DCF, Comparable Companies, etc.) and determine an appropriate purchase price premium. Mention the financing mix (cash, stock, debt) and how that decision impacts the analysis.

- Step 3: Explain Accretion/Dilution Analysis: Walk through the mechanics. This involves projecting the combined company's net income, including synergies and additional costs (foregone interest on cash, interest on new debt), and calculating the new shares outstanding if stock is used. The goal is to determine the impact on the acquirer's EPS.

- Step 4: Address Key Risks and Synergies: Conclude by discussing the qualitative factors. Quantify potential cost and revenue synergies, but be realistic about the timeline and execution risk. Mention other critical risks like regulatory hurdles and cultural integration challenges. For a deeper dive into evaluating investment opportunities, explore this private equity case study.

6. What are the key financial statements and how are they connected?

This is a cornerstone accounting question in any finance interview, designed to test your foundational knowledge. How you answer this reveals your understanding of how a company's operations, financing, and investing activities are recorded and interact. It’s one of the most common investment banking technical questions because all financial modeling is built upon these principles.

How the Statements Work Together

The three core financial statements are the Income Statement, the Balance Sheet, and the Cash Flow Statement. The Income Statement shows a company's profitability over a period (e.g., a quarter or year). The Balance Sheet provides a snapshot of its assets, liabilities, and equity at a single point in time. The Cash Flow Statement bridges the gap, showing how cash changed between the beginning and ending balance sheet periods. They are intrinsically linked, with items from one statement flowing into the others.

Strategic Approach

Your answer must be clear, structured, and demonstrate a step-by-step understanding of the connections. Avoid just listing the statements; focus on explaining the "flow" of data between them. The interviewer wants to see that you can mentally trace the impact of a single financial event across all three statements.

- Step 1: Start with the Income Statement: Begin with Net Income, the "bottom line" of the Income Statement. This is the starting point for both the Cash Flow Statement and the Balance Sheet.

- Step 2: Link to the Cash Flow Statement: Explain that Net Income is the first line item in the Cash Flow from Operations section. Then, detail how you adjust for non-cash expenses (like Depreciation & Amortization) and changes in working capital (Accounts Receivable, Inventory, Accounts Payable) to get to true cash flow.

- Step 3: Link to the Balance Sheet: Describe how Net Income flows into the Retained Earnings account under Shareholders' Equity on the Balance Sheet. Also, mention how items from the Cash Flow Statement, such as Capital Expenditures (affecting PP&E) and debt/equity issuance, update their corresponding accounts on the Balance Sheet.

- Step 4: Close the Loop: Conclude by explaining that the final ending cash balance on the Cash Flow Statement becomes the cash balance on the current period's Balance Sheet, making it balance (Assets = Liabilities + Equity). Highlighting this final check demonstrates a complete understanding.

7. How would you evaluate a company's creditworthiness for a debt issuance?

This is a core investment banking technical question, particularly for roles in Leveraged Finance or Debt Capital Markets (DCM). It assesses your understanding of how lenders and bond investors analyze a company's ability to service and repay its debt obligations. The goal is to determine the company's risk profile and its capacity to take on new leverage.

How Credit Analysis Works

Evaluating creditworthiness involves a comprehensive analysis of both quantitative metrics and qualitative factors. The analysis aims to answer one central question: Can the company consistently generate enough cash to cover its interest payments and principal repayments, even in a downturn? This involves looking at a company's leverage (how much debt it has) and its coverage (its ability to pay for that debt).

The process involves calculating key credit ratios, comparing them to industry peers and historical levels, and stress-testing financial projections. This dual quantitative and qualitative approach provides a holistic view of the company's financial health and operational stability, which is crucial for pricing a debt issuance and determining appropriate covenants.

Strategic Approach

Your answer should be a structured walkthrough of the "Three C's" of credit: Capacity, Collateral, and Covenants, with a primary focus on Capacity. The interviewer wants to see if you can think like a lender, prioritizing downside protection over upside potential.

- Step 1: Analyze Leverage Ratios: Begin with quantitative metrics that measure the company's total debt burden. Key ratios include Total Debt/EBITDA and Net Debt/EBITDA, which indicate how many years of cash flow it would take to repay debt. Also, mention Debt/Total Capitalization to understand the capital structure mix.

- Step 2: Examine Coverage Ratios: This is about the company's ability to service its debt. Discuss EBITDA/Interest Expense (the Interest Coverage Ratio) and (EBITDA - CapEx)/Interest Expense. A higher ratio indicates a stronger ability to meet interest payments from its operations.

- Step 3: Assess Qualitative Factors: Move beyond the numbers. Discuss the company's business model stability, competitive advantages (moat), industry trends, and management team quality. For example, a subscription-based business like Netflix has more predictable revenue than a cyclical industrial company.

- Step 4: Conduct Sensitivity Analysis: A crucial step is to stress-test the financial model. Discuss how you would analyze downside scenarios, such as a recession or a major operational issue, to see if the company can still meet its debt obligations. This demonstrates a sophisticated, risk-focused mindset essential for credit analysis.

7 Key Investment Banking Technical Questions Compared

| Topic | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Walk me through a Discounted Cash Flow (DCF) analysis | High – requires detailed financial modeling | Moderate – financial data, forecasting | Intrinsic company value based on fundamentals | Valuing companies with predictable cash flows | Comprehensive and widely accepted valuation method |

| How would you value a company with three different methods? | Very High – combining multiple methods | High – extensive research and modeling | Valuation range with cross-method validation | Complex valuations needing triangulation of value | Multiple perspectives reduce reliance on one approach |

| Explain the difference between enterprise value and equity value | Low – conceptual understanding required | Low – basic financial metrics | Clear distinction of valuation metrics and capital structure | Capital structure analysis and basic valuation discussions | Enables comparison across capital structures |

| Walk me through an LBO model and explain how leverage affects returns | High – complex modeling and scenario analysis | High – detailed debt & cash flow data | Understanding leverage impact on returns and risk | Private equity buyouts and leveraged transactions | Amplifies returns and incentivizes operational improvements |

| How do you analyze a merger and what are the key considerations? | High – multifaceted financial and strategic analysis | High – synergy quantification, deal modeling | Evaluation of synergy, accretion/dilution, and risks | M&A transactions with strategic and financial complexity | Can create significant value through synergies and scale |

| What are the key financial statements and how are they connected? | Low to Moderate – basic accounting knowledge | Low – access to financial statements | Understanding of financial statement interconnections | Foundational financial analysis and valuation | Provides comprehensive view of company financial health |

| How would you evaluate a company's creditworthiness for a debt issuance? | Moderate – quantitative and qualitative analysis | Moderate – financial ratios and industry data | Credit risk assessment and debt capacity evaluation | Debt issuance, lending, and credit risk decisions | Systematic approach combining metrics with judgment |

From Theory to Practice: How to Prepare for Success

Navigating the landscape of investment banking technical questions can seem like a monumental task. As we've explored, the questions range from foundational concepts like the three financial statements to complex, multi-step processes like building a Discounted Cash Flow (DCF) or Leveraged Buyout (LBO) model. The core lesson is clear: interviewers are not just testing your ability to recall formulas, they are evaluating your ability to think like a banker.

Merely memorizing the steps to value a company or the formula for Enterprise Value is insufficient. The true goal is to achieve a deep, intuitive understanding of the underlying financial principles. Why does an LBO generate returns? What assumptions drive a valuation, and how sensitive is the output to those changes? This deeper comprehension is what allows you to adapt your answers to unexpected follow-up questions and demonstrate genuine intellectual curiosity.

Key Takeaways and Actionable Next Steps

Recapping our journey through the most common technical questions, several themes emerge. Mastery requires a blend of conceptual knowledge and practical application.

- Connect the Dots: Never treat a concept in isolation. The connection between the income statement, balance sheet, and cash flow statement is a microcosm of how all financial concepts are intertwined. Your ability to explain how a change in depreciation flows through all three statements shows a holistic understanding that interviewers value highly.

- Context is King: The "correct" valuation method always depends on the company's industry, life cycle stage, and financial profile. Your answers should reflect this nuance. Instead of just listing DCF, Comps, and Precedent Transactions, explain why you might favor one over the other in a specific scenario.

- Storytelling with Numbers: The most effective answers transform complex financial analysis into a clear, compelling narrative. When walking through a merger model, you are not just listing accretion/dilution mechanics; you are telling the story of how two companies can create value by combining. This narrative skill is the hallmark of a great analyst.

To transform this knowledge into a powerful interview performance, you must move beyond passive reading and into active, structured practice.

Building Your Technical Interview Muscle

The path from knowing the answers to delivering them flawlessly under pressure is paved with deliberate practice. Rote memorization is a fragile strategy that shatters with the first unexpected question. A robust, adaptable understanding is built through repetition and real-world simulation.

Your preparation should follow a structured progression:

- Verbalize the Concepts: Start by talking through your answers out loud, alone. Can you explain how leverage impacts LBO returns to a non-finance person? This forces you to simplify and clarify your thinking.

- Whiteboard Your Models: Move to a whiteboard (or a piece of paper) and draw out the structures. Sketch the high-level components of a DCF, an LBO, or the connections between financial statements. This visual practice solidifies the mental frameworks.

- Simulate the Pressure: The final, most critical step is to practice in an environment that mimics the real interview. This is where you test your ability to articulate complex ideas clearly, concisely, and with confidence when the pressure is on.

Remember, the goal of mastering these investment banking technical questions is not just to get the answer right, but to prove you have the analytical rigor, intellectual horsepower, and communication skills to excel as a banker from day one. It’s about showing you can be a trusted member of a deal team.

Ready to bridge the gap between theory and a polished interview delivery? Soreno offers an AI-powered mock interview platform that provides a realistic, on-demand practice environment. Get instant, detailed feedback on your answers to a vast library of investment banking technical questions, helping you refine your structure, clarity, and confidence before you ever step into the real room. Start your preparation with Soreno today.