A Guide to prepare for case interview: Master the Process

Discover how to prepare for case interview with proven frameworks, practice questions, and a step-by-step plan to ace your interview.

Before you even think about memorizing a single framework, the real work of case interview prep begins. The goal is to build a solid foundation in structured thinking, sharp business sense, and quick mental math. This isn't about rote learning; it's about learning to think like a consultant.

Building Your Case Interview Foundation

So many candidates stumble because they jump right into complex frameworks like the 4Ps or Porter's Five Forces. Here's the truth from someone who's seen it time and again: those tools are useless if you haven't mastered the core principles behind them. You have to first learn how to take a big, messy, ambiguous problem and break it down into logical, bite-sized pieces.

The entire interview is a window into your mind. The interviewer doesn't really care if you get the "right" answer. What they're desperate to see is a clear, logical, and insightful problem-solving process. Can you handle uncertainty? Can you apply common-sense business logic? Can you stay cool under pressure?

This initial phase is all about building that mental muscle for rigorous analysis. It's where you truly internalize what it takes to perform well in a case.

Deconstructing the Case Interview

To solve a case, you first have to understand its anatomy. No matter the industry or problem, every case interview is designed to test the same core set of skills. Thinking like a consultant is all about being methodical.

- Problem Identification: Do you listen closely? Can you ask smart, clarifying questions to nail down the real problem you're supposed to be solving?

- Structuring the Problem: Can you create a logical roadmap—an issue tree—to break the problem down into distinct parts? This structure is everything.

- Quantitative Analysis: Are you comfortable doing quick math in your head? Can you look at a chart and pull out the key insights without getting bogged down?

- Business Insight: This is the big one. Can you go beyond the numbers to suggest practical, real-world business ideas? This is where your commercial awareness comes into play.

- Communication and Synthesis: Can you walk your interviewer through your thinking clearly and wrap it all up with a strong, persuasive final recommendation?

The goal isn't just to solve a puzzle in a vacuum. It's to have a structured, professional conversation about a business challenge. The way you guide that conversation shows your potential as a future consultant.

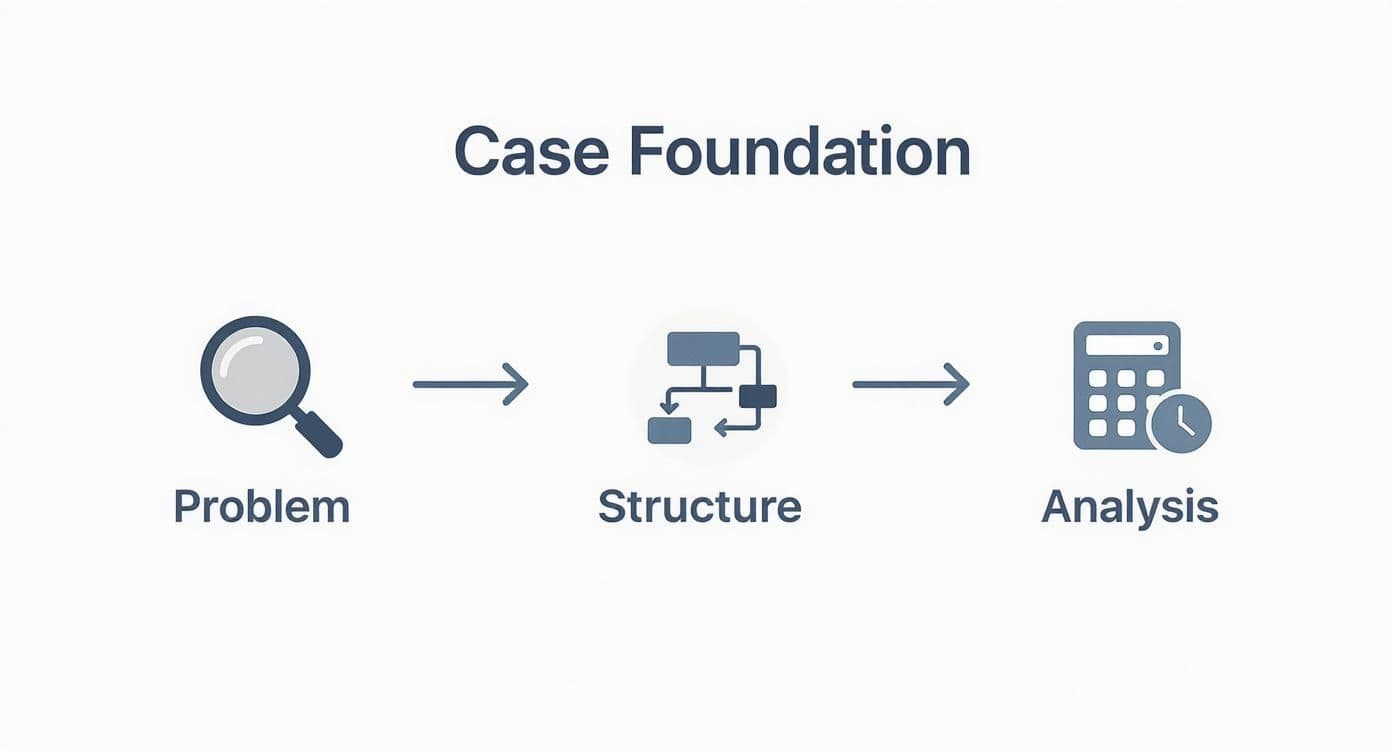

This visual really nails the flow. You start by understanding the problem, then you build a structure to guide your work, and only then do you dive into the analysis.

Trying to do the analysis without a solid structure is like trying to build a house without a blueprint. It just doesn't work.

To help you focus your practice, this table breaks down exactly what interviewers are looking for when they evaluate these core skills.

Core Competencies Assessed in Case Interviews

| Competency | What Interviewers Are Looking For | How to Demonstrate It |

|---|---|---|

| Structured Thinking | Your ability to break down a complex, ambiguous problem into smaller, logical, and manageable components. | Create a MECE (Mutually Exclusive, Collectively Exhaustive) framework at the start. Clearly state your approach and walk the interviewer through your logic. |

| Problem Solving | How you identify key issues, formulate hypotheses, and use data to drive toward a practical solution. | Ask insightful clarifying questions. Prioritize issues effectively. State your hypotheses and then explain how you'll test them. |

| Quantitative Skills | Your comfort and accuracy with mental math, data interpretation (charts, graphs), and making reasonable estimations. | Think out loud as you do calculations. Sense-check your numbers ("Does this answer make sense?"). Be quick and confident with percentages and large figures. |

| Business Acumen | Your understanding of general business concepts, market dynamics, and industry trends. | Apply real-world examples. Discuss risks, implementation challenges, and competitive reactions. Your recommendation should be practical, not just theoretical. |

| Communication | Your ability to articulate your thoughts clearly, concisely, and persuasively. This includes listening skills and professional presence. | Maintain eye contact and a conversational tone. Summarize your findings at key points. Structure your final recommendation with a clear "what" and "why." |

By keeping these competencies in mind, you can ensure every minute of your prep time is spent developing the skills that actually matter on interview day.

Sharpening Your Mental Math and Business Acumen

Quantitative fluency is a common stumbling block. You're going to be asked to do math without a calculator, often with big, intimidating numbers. The trick isn't to be a human spreadsheet; it's to get comfortable with estimations, percentages, and basic arithmetic while under pressure. Start doing daily drills with numbers like 7 million or $2.5 billion to get your speed and accuracy up.

At the same time, you need to be building your business acumen. You can't solve a business problem if you don't know how businesses actually run. Make it a daily habit to read publications like The Wall Street Journal or The Economist. This isn't optional. It's how you'll start to recognize market trends, common strategic challenges, and industry-specific language.

For a deeper dive into the broader skills consultants need, you can learn more about how to break into consulting. This background knowledge is what will empower you to make smarter assumptions and generate much more insightful hypotheses during your cases.

Mastering Flexible Case Interview Frameworks

One of the biggest mistakes candidates make is treating case interview frameworks like a rigid script. They hear a prompt and immediately try to force-fit it into a memorized Profitability or 4Cs model. That’s a surefire way to sound generic and completely miss the nuances of the problem at hand.

Frameworks aren't magic bullets. Think of them as starting points—scaffolding to organize your thoughts and make sure you don't miss anything obvious. The real goal when you prepare for a case interview is to show you can think in a structured, logical way that’s customized to the problem, not just recite something from a book.

Top candidates use frameworks like a flexible toolkit. They adapt them on the fly, combine pieces from different models, or even build a new structure from scratch when the situation demands it. This shows the interviewer you’re truly wrestling with the client's problem, not just going through the motions.

Moving Beyond Rote Memorization

Instead of memorizing the "Profitability Framework," truly understand its DNA. At its core, it’s just Profit = Revenue - Costs. Revenue then breaks down into Price x Volume, and Costs split into Fixed + Variable. Once you grasp this simple logic tree, you can apply it to almost anything.

What if the case is about a nonprofit struggling with funding? The "profit" motive is gone, but the structure holds. "Revenue" becomes "Funding Sources" (grants, donations, etc.), while "Costs" are still just the organization's expenses. This is exactly the kind of agile thinking that interviewers are looking for.

"The interviewer is testing your ability to think, not your ability to memorize. A custom-built framework that directly addresses the client's problem is always more impressive than a perfectly recited but ill-fitting standard one."

Building a bespoke approach on the spot proves you have a higher level of analytical maturity. It’s a clear signal that you can handle the messy, unique challenges that real-world consulting projects throw at you every day.

How to Select and Adapt the Right Framework

When you first hear the case prompt, don't immediately lock onto a single framework. Your mind should be scanning for clues that point toward the core issue.

Here’s a quick way to think about matching problems to foundational structures:

- "Profits are down" is a classic signal for a Profitability deep-dive. Start with the core equation, but get ready to dig into the reasons why revenue or costs have shifted.

- "Should we enter a new market?" naturally points to a Market Entry framework. This usually means looking at the market size, competitors, your company's capabilities, and the financial logic.

- "How should we respond to a new competitor?" is a great time to pull out a Competitive Response or 4Cs (Company, Customers, Competitors, Collaborators) analysis.

But the key is this: state your chosen starting point, briefly explain why you chose it, and then be ready to pivot.

For example, a market entry case might quickly reveal that the main hurdle isn't market size but a tangled mess of government regulations. A sharp candidate would immediately adjust their structure to focus more heavily on regulatory risks and mitigation strategies, moving far beyond the standard template. That kind of adaptability is what separates the "maybes" from the "hires."

Building a Custom Framework from Scratch

Sometimes, a case simply won't fit a standard model. A prompt like, "How can a city increase public library usage?" doesn't map neatly onto profitability or M&A. This is your moment to shine.

Start by brainstorming the major "buckets" or categories of issues. For the library problem, a good first-pass structure might look something like this:

-

Understand the User (The "Customer")

- Who are our current library patrons (demographics, visit frequency)?

- Who are the potential users we aren't reaching?

- What do they need or what problems can we solve for them?

-

Analyze the "Product" (Library Services)

- What are we currently offering (books, digital media, community classes)?

- How accessible are these services (hours, locations, online portal)?

- How do we stack up against alternatives (bookstores, cafes, online resources)?

-

Explore "Marketing and Awareness"

- How does the community learn about the library now?

- What new channels could we use to reach non-users?

This custom framework is logical, covers the key areas, and is perfectly tailored to the prompt. It shows you can create clarity from ambiguity—which is the very essence of a consultant's job.

Getting comfortable with this takes practice. Start by taking standard business frameworks and applying them to weird, non-business problems (e.g., "How would you increase a YouTuber's subscriber count?"). This forces your brain to focus on the underlying logic, freeing you up to deliver the kind of sharp, creative analysis that lands offers.

How to Tackle Market Sizing Questions

Few phrases strike more fear into a candidate's heart than, "So, how many golf balls are sold in the U.S. each year?" Market sizing questions can feel like they come out of left field, designed purely to see if you can pull a number out of thin air.

But there’s a clear method to the madness. These questions are a direct test of your structured thinking, your comfort with ambiguity, and how well you apply logic under pressure.

The good news? They aren't about getting the exact right answer. It’s all about showing a credible, step-by-step process to reach a reasonable estimate. Whether you’re asked about the market for pet insurance in Canada or the number of windows in New York City, your approach is what’s on trial.

Top-Down vs. Bottom-Up Approaches

Your primary toolkit for any market sizing problem comes down to two distinct but complementary approaches. Choosing the right one—or even blending them—is your first strategic decision.

-

Top-Down Analysis: Think of this as starting big and whittling down. You begin with a massive, known number (like the U.S. population) and apply a series of logical filters (percentage of adults, of those, the percentage who play golf, their purchase frequency, etc.) to slice your way to a final figure.

-

Bottom-Up Analysis: This is the reverse. You start small, with a single unit, and build your way up. You might estimate the sales of one golf course and then multiply that across all the golf courses in the country to get your total.

Honestly, the most impressive candidates often use one method to build their main estimate and the other as a quick "sense check" to see if their answer is in the right ballpark.

Building Your Estimation Logic

Let's make this tangible. Imagine you’re asked to estimate the annual market size for coffee shops in your city.

A bottom-up approach is a great place to start.

First, think about a single coffee shop. How much money does it make in a day? You can break this down: (Avg. price per customer) x (Customers per hour) x (Operating hours).

You won't know the exact figures, so you have to state your assumptions clearly. Something like, "Okay, let's assume the average customer spends about $5. During the morning rush from 7-10 AM, they probably serve 50 customers an hour. For the rest of the day, let's say it drops to 20 customers an hour."

From there, you just do the math for one shop's daily revenue, multiply it out for the year, and then estimate the total number of coffee shops in your city. That gives you your total market size. The key is to voice every single assumption you're making. This gives your interviewer a chance to jump in and say, "That seems a bit high, let's try 30 customers an hour," which turns it into the collaborative conversation it's meant to be.

The most critical part of a market sizing question isn't the final number. It’s the clarity and logic of your structure and assumptions. State them confidently and explain your reasoning for each one.

As you get deeper into prep, you'll realize that having a few key statistics memorized can be a huge help in grounding your assumptions.

Knowing figures like the U.S. population or median household income lets you anchor your estimates in something real, which makes your entire analysis more credible.

The Crucial Final Step: Sense-Checking

You’ve done the math and landed on a number. The biggest mistake you can make is to stop there.

The final—and most important—step is to quickly sense-check your answer. Does it feel right?

Going back to our coffee shop example, if your final market size is $50 billion for a single city, that should set off alarm bells. A quick sanity check using a top-down approach could prove why. "If the city's population is 5 million, that would mean every single person—babies included—spends $10,000 a year on coffee. That seems way too high."

This simple act of reflection shows immense commercial acumen. It proves you're not just a calculator; you're a business thinker who can put numbers into a real-world context. For more detailed walkthroughs, check out our guide on common market sizing interview questions.

Market sizing is a fundamental part of consulting interviews. It’s a direct test of your numerical fluency and logical reasoning. A solid method always involves asking clarifying questions, outlining your plan, rounding numbers to keep the math simple, and validating your final answer. Mastering this skill is non-negotiable for success.

Using Drills and Mocks to Sharpen Your Skills

Knowing your frameworks is one thing. Performing flawlessly when the pressure is on? That's a whole different ball game. This is precisely where deliberate practice comes in, transforming what you’ve learned into a real, high-performance skill.

You can't just read about cases and expect to succeed. You have to get your hands dirty with focused drills and realistic mock interviews. This is the most critical phase of prep—where you move from just knowing the material to actually doing it. It’s how you build the muscle memory to structure problems on the fly, crunch numbers quickly, and communicate your thoughts like a seasoned consultant.

From Solo Drills to Live Practice

Before you jump into a full, 30-minute case with a partner, start by isolating individual skills. Think of it like a musician practicing scales before tackling a complex symphony. Mastering the fundamentals makes the final performance infinitely smoother.

Here are a couple of drills to get you started:

- Brainstorming Drills: Give yourself five minutes on a timer. The goal? Generate a completely MECE (Mutually Exclusive, Collectively Exhaustive) list of ideas for a prompt. For instance, "What are all the possible ways the Louvre Museum could generate revenue?" This hones your creative and structural thinking.

- Quantitative Drills: Practice your mental math. Run through market sizing questions or chart interpretation exercises until it feels second nature. Getting comfortable with large numbers and percentages is non-negotiable for any aspiring consultant.

Having a few key stats in your back pocket is invaluable here, especially for market sizing. For example, knowing the world's population is roughly 8 billion gives you a solid anchor for any top-down estimation. When you can pull figures like these from memory, your assumptions become far more credible and your calculations get faster. It's worth learning the essential statistics for case interviews to ground your analysis.

Finding and Vetting Case Partners

Once you're feeling good about the component parts, it’s time for live mock interviews. And let me tell you, your choice of practice partner is crucial. You need someone who is just as invested in this as you are and who isn't afraid to give honest, constructive feedback.

Check out MBA programs, university consulting clubs, or online case communities to find people. But don't just partner with the first person who says yes—a bad partner can actually reinforce bad habits.

The quality of your practice is far more important than the quantity. Five mock interviews with a great partner who gives detailed, actionable feedback are more valuable than twenty with someone who just says, "Good job."

When you find a potential partner, run a single "chemistry check" case with them. See if they’re engaged, if their feedback is specific, and if you’re at a similar skill level. Investing that little bit of time upfront will pay off big time down the road.

Maximizing Your Mock Interviews

To get the most out of your practice, you have to treat every mock like it's the real deal. Dress the part, find a quiet space, and stick to the time limit. The closer your practice environment is to the actual interview, the better you'll handle the pressure when it really counts.

The real learning, however, happens in the debrief after the mock. Don't just gloss over it. Instead of asking a generic "How did I do?", use a more structured approach:

- Self-Assessment: Kick things off by explaining what you thought went well and where you felt you struggled. This demonstrates self-awareness.

- Partner Feedback: Now, ask your partner for their specific thoughts. Dig into your structure, your analysis, your communication style, and your final recommendation.

- Actionable Takeaways: Wrap up by identifying one or two concrete things you will focus on improving in your very next session.

Consider recording your mocks (with your partner's permission, of course). Watching yourself back is a powerful way to catch things you might have missed in the moment, like filler words or moments where your explanation wasn't quite clear. This cycle—practice, feedback, refine—is what drives real improvement.

When you're ready for new challenges, you can pick a case from our extensive library to ensure you're always tackling fresh problems.

Polishing Your Performance for Interview Day

The last stretch of case prep isn't about cramming more frameworks. It's about sharpening your delivery and building the kind of mental stamina that will see you through a tough interview. This is where you shift from just doing the analysis to performing the case with confidence.

Think of it like this: a talented musician knows all the right notes, but a true performer captivates an audience. They have poise and control the narrative. Your goal is to move beyond just solving the problem and truly own the room, leaving a lasting, positive impression.

Creating a Feedback Loop That Actually Works

You can't improve what you don't measure. Without a structured way to get feedback, you're just practicing your mistakes and cementing bad habits. To really dial in your skills, you need a system to track your progress and act on what you learn from every single mock interview.

This doesn't have to be complicated. Just open up a simple spreadsheet and use it as your performance tracker. After each mock, be brutally honest and rate yourself on a 1-5 scale across the core skills:

- Structuring: Was your framework logical and customized? Did you avoid just regurgitating a generic one?

- Analysis: How was your quant? Were you fast and accurate? Did you pull real insights from the data, or just state the obvious?

- Communication: How clearly did you articulate your thought process? Did you guide the interviewer or just ramble?

- Recommendation: Was your final answer sharp, data-driven, and truly actionable?

This simple act forces you to confront your weak spots. If you see your "Analysis" score is consistently a 2 out of 5, you know exactly what to focus on during your next practice session. This data-driven approach takes the guesswork out of getting better.

Nailing the Final Recommendation

Your recommendation is the grand finale. It's the last thing the interviewer hears, and a weak, meandering conclusion can sour 25 minutes of otherwise great work.

The key is to synthesize, not summarize. Lead with your definitive answer—the "so what"—right away. Then, back it up with the 2-3 most critical arguments from your analysis.

For example, don't walk them through your entire process again. Hit them with a punchy, top-down recommendation like this:

"My recommendation is that our client, the beverage company, should not enter the German energy drink market. This is based on three crucial findings. First, the market is an effective duopoly, with two players controlling 70% of the share, making customer acquisition incredibly expensive. Second, intense price competition means our projected margins fall short of the company’s 15% hurdle rate. And finally, we're facing significant regulatory hurdles that could stall our entry and inflate costs."

This structure is confident and easy to digest. Finish by mentioning a couple of next steps to show you're already thinking about implementation.

Mastering the "Soft Stuff" on Game Day

Your math skills can be flawless, but if you can't connect with your interviewer, you're sunk. They aren't just wondering if you can do the work; they're asking themselves, "Would I be comfortable putting this person in a room with a CEO?"

Build Rapport Like a Human

Your interviewer isn't a case-giving robot. Make some small talk. Ask them how their week is going or what kind of projects they're on. You’re not trying to become best friends, just trying to shift the dynamic from an interrogation to a collaborative session. When you're both more relaxed, the case flows better.

Think Aloud, Don't Ramble

This one is a balancing act. You have to show your work, but you can’t narrate every single thought that pops into your head. The trick is to pause for a second to organize your thoughts before you speak. Use signposts to guide your interviewer, like, "Okay, to break down the revenue side, I want to look at two drivers: price per unit and total volume."

How to Recover Gracefully When You Mess Up

Spoiler alert: you will make a mistake in a case interview. You’ll flub a calculation or go down a rabbit hole that leads nowhere. How you handle that moment is far more revealing than the mistake itself.

Whatever you do, don't panic or try to cover it up. They will notice.

The best move is to own it calmly, correct it, and move on. A simple, "My apologies, let me re-run that number. I see I made a multiplication error. The correct figure should be..." demonstrates incredible composure. Handling a mistake with grace can actually make you look more confident, as it proves you can perform under pressure when things aren't going perfectly.

Common Case Interview Questions and Answers

As you dive into case prep, it’s completely normal for a few nagging questions to pop up. Getting clear, straightforward answers to these is crucial so you can stop second-guessing your approach and start making real progress. Let's tackle some of the most common hurdles I see candidates face.

How Many Cases Should I Actually Do?

This is probably the number one question I get. While there's no magic number, the sweet spot for most people is 20-30 high-quality mock interviews. And the key word there is quality.

Simply churning through cases isn't the goal. Each one needs to be a learning experience with detailed, constructive feedback. If you do fewer than 20, you might not see enough different case types to spot the patterns. If you do much more than 30, you risk burning out or, even worse, practicing the wrong way and cementing bad habits.

The real aim is to move from that awkward "I know I'm doing this wrong" stage to a place where you're deliberately applying the right techniques. Eventually, it becomes second nature—that’s when you know you're ready.

What’s a Realistic Prep Timeline?

Another big one is figuring out how long this whole process will take. For most candidates juggling other commitments, a focused 4 to 8-week sprint is a solid, realistic timeframe. This gives you enough runway to learn the theory, drill the fundamentals, and get plenty of mock interview reps without resorting to last-minute cramming.

Here’s one way to break that down:

- Weeks 1-2: Dive into the fundamentals. This is your time to really nail the core frameworks, sharpen your mental math, and practice brainstorming on your own.

- Weeks 3-6: This is prime time for mock interviews. You should be aiming for 3-5 mocks a week with a variety of partners. Hearing different perspectives on your performance is invaluable.

- Weeks 7-8: Start tapering off. Shift your focus to reviewing your notes, identifying weak spots, and polishing your "story." A few final warm-up cases right before the big day will keep you sharp.

A quick reality check: Your ideal timeline really depends on where you're starting from. An MBA with a finance background might need less time on the basics than an engineering Ph.D. making a career pivot. Be honest with yourself about your gaps and plan accordingly.

What if I Get an Industry I Know Nothing About?

It’s the classic fear: the interviewer kicks off with a case about the German chemical manufacturing industry or Paraguayan mining operations, and your mind goes blank.

Relax. They don't expect you to be an industry encyclopedia. The case is a test of your thinking process, not your trivia knowledge.

When you're thrown a curveball like this, lean into your structure. This is your chance to show how you create clarity from chaos. Use the first few minutes to ask intelligent, foundational questions. Something like, "This is a new industry for me, which is exciting. To make sure I'm on the right track, could you briefly walk me through the major revenue streams and key costs for a company in this space?"

This isn't a sign of weakness—it shows you're curious, coachable, and methodical. Nailing an unfamiliar case is one of the best ways to prove you can do the actual job of a consultant.

Stop wondering if your prep is on the right track. With Soreno, you get instant, rubric-based feedback from an MBB-trained AI on every case you run. Build real confidence with unlimited, on-demand practice at https://soreno.ai.