Winning the Framework Case Interview

Dominate your framework case interview with this practical guide. Learn to build, adapt, and present winning frameworks with real examples and expert tips.

A framework case interview is simply an assessment where you're expected to use a logical structure to solve a business problem. But don't get hung up on the jargon. Think of it less like a rigid template and more like your personal roadmap for breaking down a messy, complex problem into bite-sized pieces. It's the first real signal you send the interviewer that you can think in a clear, organized, and thorough way.

Why Frameworks Are More Than Just Templates

Let's get one thing straight right away: interviewers can spot a memorized, off-the-shelf framework from a mile away. They don't want to hear you recite Porter's Five Forces like you're reading from a textbook. The case interview isn't a memory test; it's a test of your ability to think on your feet and apply structure to an ambiguous problem.

Think of it like an architect's blueprint. Before a single brick is laid, the architect draws up a detailed plan showing the foundation, the structure, the plumbing—every critical piece. That plan ensures nothing gets missed and the final building stands strong. Your framework does the same job. It tells the interviewer, "I've grasped the problem, and here’s the logical, step-by-step approach I'm going to take to solve it."

The Real Purpose of a Framework

The goal isn't to present a perfect, pre-baked model. The real point of laying out your framework is to showcase your core consulting toolkit before you even get into the weeds of the analysis. It’s your opening move.

A well-crafted framework immediately demonstrates a few key skills:

- Structured Problem-Solving: Can you take a massive, vague problem and break it down into smaller, logical components?

- Business Acumen: Do you understand how the different levers of a business—like revenues, costs, market forces, and operations—all fit together?

- Prioritization: Does your structure show that you have an instinct for what's likely most important to look into first?

- Hypothesis-Driven Approach: Your framework sets the stage for testing initial ideas and allows you to pivot cleanly as you get more data.

The single biggest trap candidates fall into is trying to jam a case into a framework they learned in a book. The best candidates listen intently to the prompt and build a custom structure that attacks the specific problem the client is facing.

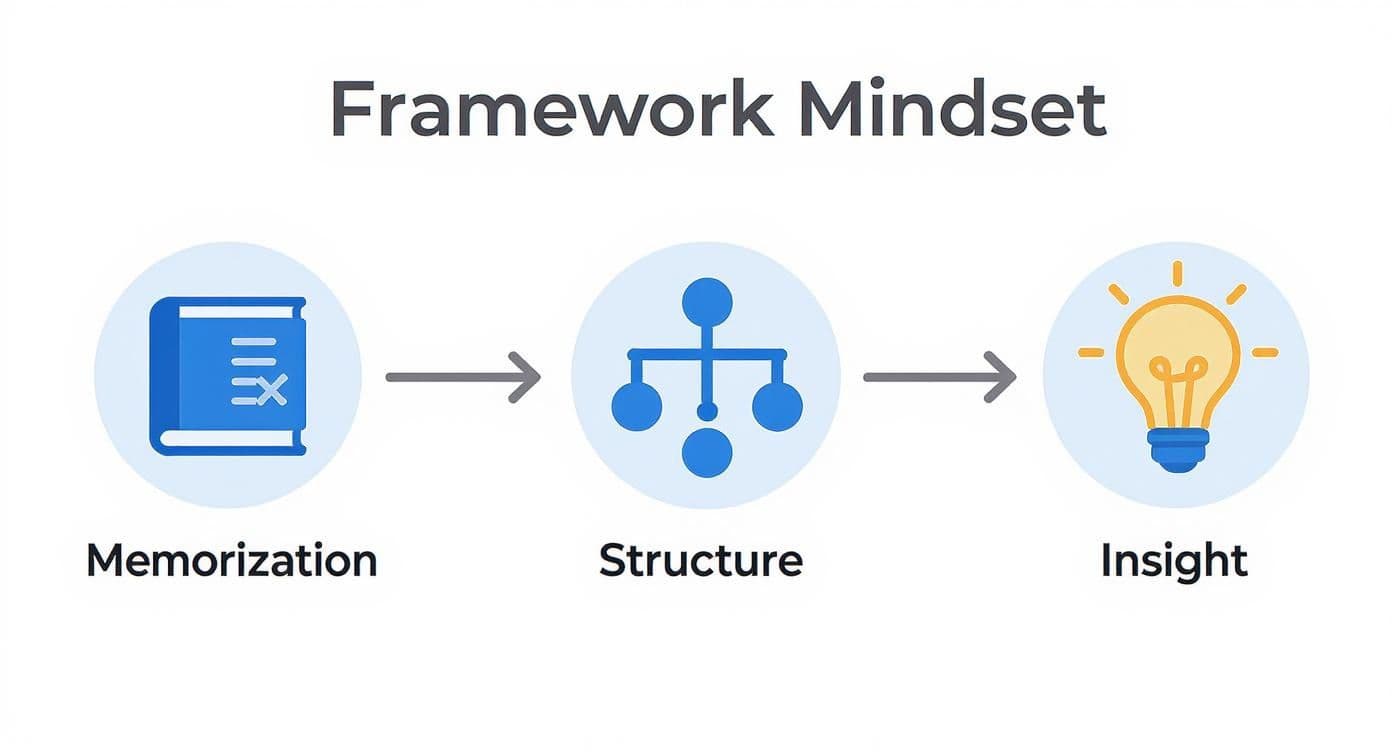

Shifting Your Mindset

You need to abandon the idea that there's one "right" framework for a specific type of case. The classic models you read about, like Profitability or Market Entry, are fantastic starting points. But they are just that—starting points. They're the building blocks you use to construct something custom-fit to the case at hand.

For example, a prompt about a retailer's declining profits is never just a Profit = Revenue - Costs problem. A much stronger, bespoke framework would immediately get more granular.

- Revenue Side: You might break this down into

Revenue per storeandNumber of stores. Then, you could go even deeper onRevenue per store, looking atFoot trafficandAverage basket size. - Cost Side: This could be split into

Fixed costs(like rent and staff salaries) andVariable costs(like the cost of the goods themselves).

This kind of detail shows you aren't just regurgitating a formula. It proves you're actively thinking about the client's business and its unique context. Making this shift—from being a memorizer to being an active problem-solver—is what will set you apart in any framework case interview.

Building Your Custom Framework with MECE

The real test in a case interview isn't whether you've memorized a dozen frameworks. It's whether you can build a logical, custom-fit structure for a problem you've never seen before. This is what separates a good candidate from a great one.

You don't need to invent a new consulting theory on the fly. The secret lies in a simple, powerful principle that underpins all great problem-solving: MECE.

At its heart, MECE stands for Mutually Exclusive, Collectively Exhaustive. It's the golden rule for breaking down any complex problem, made famous by McKinsey. In plain English, it means your framework's components shouldn't overlap, and together, they should cover all the bases.

- Mutually Exclusive: Each part of your analysis is distinct. If you're looking at revenue, you wouldn't have buckets for "Online Sales" and "Website Sales"—they're the same thing. You’d use clear dividers like "Online Sales" and "In-Store Sales."

- Collectively Exhaustive: You’ve covered all the possibilities. Analyzing a company’s costs? You can't just look at variable costs. You need to include fixed costs to see the whole picture.

This isn't about rote learning; it's a shift in mindset. You use the core principles you've learned to build a solid structure, which is the only way to uncover real, powerful insights.

Putting MECE to Work

Let's get practical. Say you're given a case: a U.S.-based SaaS company wants to expand internationally. A weak approach would be to just list random ideas like "marketing," "sales," and "culture." That's a brainstorm, not a structure.

A MECE framework provides a real roadmap. For market entry, you could create a structure that methodically assesses every critical angle.

Example MECE Breakdown for Market Entry:

- Market Opportunity (Is this market attractive?)

- Market Size & Growth Rate

- Total Addressable Market (TAM) for our specific product

- Typical Profit Margins in this region

- Competitive Landscape (Is this market winnable?)

- Key Local and International Competitors

- Competitor Market Share and Strengths

- Risk of Substitute Products or Services

- Entry Feasibility (Are we capable of entering?)

- Regulatory and Legal Hurdles

- Cultural Fit and Language Barriers

- Available Distribution Channels and Potential Partners

- Financials (Does the math work?)

- Upfront Investment Costs

- Projected Revenue and Breakeven Timeline

- Expected Return on Investment (ROI)

This structure ensures you miss nothing and don't waste time analyzing the same point twice. It’s no surprise that over 80% of case assessments at firms like McKinsey, Bain, and BCG are evaluated on the candidate’s ability to create MECE frameworks.

A MECE framework isn’t just a checklist; it's a hypothesis tree. Each branch is a core question that needs an answer. It directs your questions and helps you build a compelling, data-driven story for the interviewer.

Common MECE Traps and How to Avoid Them

Building a MECE framework in 30 seconds with an interviewer watching is tough. It takes practice. Here are a couple of the most common traps I see candidates fall into.

The biggest mistake is the "laundry list." Just rattling off the 4 P's—Price, Product, Promotion, Place—isn't a MECE structure. A better approach is to start with high-level, exclusive buckets first, like "Internal Levers" vs. "External Market Forces," and then drill down. To get better at this, check out our guide on structured problem-solving techniques.

Another trap is being too generic. Your framework for a nonprofit's declining funding is entirely different from one for a factory's production slowdown. Always mirror the language of the case. Instead of "Revenue," say "Donation Streams." Instead of "Costs," say "Program Expenses" and "Administrative Overhead." This subtle shift shows you're not just reciting a template; you're actively listening and tailoring your approach to the problem at hand.

Adapting Classic Frameworks for Modern Problems

https://www.youtube.com/embed/f30T69k2TSQ

Standard models like Profitability, the 3Cs, or Market Entry are foundational tools in your case interview kit. They give you a solid starting point for structured thinking, but here’s a rookie mistake I see all the time: treating them as a one-size-fits-all solution. The real business world is messy and complex, and your interviewer is testing your ability to adapt, not just recite a memorized template.

The real magic happens when you customize these classic frameworks to fit the specific, modern context of the case. Think of it like tailoring a suit. An off-the-rack suit gets you in the door, but it only looks sharp once it's been adjusted to fit you perfectly. It's the same with frameworks—they only become truly powerful once you modify them to address the unique contours of the business problem you're facing.

Moving Beyond the Textbook Formula

Relying on a textbook model without any tweaks can send you down a completely wrong path. A classic Market Entry framework might prompt you to analyze market size, competition, and company capabilities. But what if the client is a software-as-a-service (SaaS) company? A generic analysis would completely miss the core drivers of that business.

For a SaaS business, you've got to adapt your structure to include the metrics that actually matter:

- Customer Acquisition Cost (CAC): How much do they spend to get a new subscriber?

- Lifetime Value (LTV): How much revenue will one customer generate before they leave?

- Churn Rate: What percentage of customers are canceling their subscriptions each month or year?

- Integration Capabilities: Can the software plug and play with the other tools a customer is already using?

Suddenly, you’re not just having a high-level chat about the market. You're diving into a sophisticated analysis of whether a subscription model is actually viable. This shows the interviewer a much deeper level of business sense.

The goal isn't to prove you know the name of a framework; it's to show you understand the underlying business logic. Customizing a framework is proof you're actively solving the problem, not just pulling up a memorized file from your brain.

The way we use frameworks in interviews has changed because consulting itself has changed. It's all about strategic, tailored problem-solving now. A deep dive into modern case prep shows seven dominant models, including the Profitability Framework, Market Entry, and the 3Cs (Company, Customer, Competition). For example, Starbucks' successful entry into China was analyzed using a Market Entry framework that was heavily customized to include cultural fit and regulatory hurdles—factors a generic model would overlook.

In fact, data from applicants at top-tier firms shows that up to 70% of successful interviews use one of these core frameworks as a starting point. This really highlights their importance. You can explore a full breakdown of these core consulting frameworks to see how they form the basis for more advanced, custom analysis.

Real-World Adaptation Scenarios

Let's get practical and talk about how to modify frameworks for today's business challenges. Imagine you get a profitability case for a major airline. A simple Profit = Revenue - Costs structure is way too broad to be useful. It tells the interviewer nothing.

A much stronger, adapted framework would immediately break these down into the specific drivers of that industry:

- Revenue Streams: Instead of just "revenue," you’d get specific with

Passenger Ticket Sales,Cargo Revenue,Ancillary Fees(like baggage and seat selection), andLoyalty Program Partnerships. - Cost Buckets: A generic "costs" bucket becomes

Fuel Costs,Labor(pilots, cabin crew),Aircraft Maintenance,Airport Landing Fees, andMarketing/Distribution Costs.

That level of specificity instantly signals that you get the unique economics of the airline industry.

To show how you can adapt these frameworks for modern scenarios, here’s a quick guide on how to add a layer of nuance to the classics.

Classic Framework Adaptation Quick Guide

| Classic Framework | Common Scenario | Key Adaptation/Modification |

|---|---|---|

| Profitability | Declining profits for a CPG company | Add a "Product Mix" branch to revenue; add "Supply Chain Volatility" to costs. |

| Market Entry | A tech firm entering the healthcare space | Add "Regulatory Compliance & Data Privacy (HIPAA)" and "Physician/Hospital Adoption Hurdles." |

| 3Cs (Company, Customer, Competition) | A retail brand losing market share to DTC | Expand "Competition" to include "Digital-Native DTC Brands." Add "Digital Customer Journey" under "Customer." |

| Mergers & Acquisitions | A legacy company acquiring a startup | Add a "Cultural Integration" and "Talent Retention" workstream to assess post-merger risks. |

This table is just a starting point, but it illustrates the kind of thinking that separates a good candidate from a great one. You're not just following a script; you're actively shaping the analysis around the problem.

Here's another great example: weaving in Environmental, Social, and Governance (ESG) factors. If a manufacturing client wants to boost its bottom line, sustainability goals might be a major constraint—or a huge opportunity. You should proactively add a branch to your profitability framework to assess this.

This new branch might explore things like:

- Potential cost savings from lower energy consumption.

- New revenue opportunities from marketing products as "green."

- Regulatory risks tied to carbon taxes or emissions caps.

By adding these modern considerations, you're showing forward-thinking strategic insight. You’re not just solving today's problem; you’re helping the client get ready for tomorrow's challenges. And that, right there, is the heart of high-value consulting.

Executing Your Framework Under Pressure

A brilliant framework on paper is one thing, but making it work in a live case interview is a whole different ball game. This is where the rubber meets the road. How you present, probe, and pivot your framework under pressure is what separates a good candidate from a great one. It’s the moment your structured analysis needs to become a dynamic, persuasive conversation.

Your first chance to take control comes right after you present your framework. You’ve had your minute of silence, the interviewer is looking at you expectantly. Your job now is to lay out your roadmap with confidence and clarity, showing them you have a logical plan to crack the case.

Articulating Your Initial Roadmap

Don’t just list the branches of your framework like a robot. That's a classic rookie mistake. Instead, tell a story about how you plan to solve the client's problem. This narrative approach is far more engaging and immediately signals strong communication skills.

For example, a flat, robotic statement won't impress anyone. Try opening with something more collaborative:

"To get to the bottom of our client's declining profits, I'd like to investigate a few key areas. I’ll start with the revenue side of the equation—specifically, any changes in price or sales volume. Then, I'll move on to the cost structure, breaking it down into fixed and variable components. Finally, I’ll take a look at the broader market to see if any external factors are at play. How does that sound as a starting point?"

See the difference? This communicates your plan, reveals your logic, and—most importantly—invites the interviewer into the process with you. It turns a monologue into a dialogue. If this doesn't feel natural yet, working through an Interview Skills Practice Guide can really help build that muscle memory.

Driving the Case with Insightful Questions

Your framework isn't a static checklist; it’s a machine for generating insightful questions. Each branch should be a launchpad for you to ask targeted, hypothesis-driven questions. Vague questions like, "Can you tell me more about costs?" are dead ends.

You need to be more precise. Use your framework to ask questions that test a specific idea you have.

- Weak Question: "What about the competition?"

- Strong Question: "You mentioned our market share has dropped. To understand that competitive pressure, do we know if we're losing ground to one major competitor or to several smaller, new entrants?"

The second question is worlds better. It shows you’re not just casting about for random information. You have a hypothesis (that the type of competitive threat matters), and you're actively seeking data to prove or disprove it. Asking sharp questions is a skill you can learn; it's all about learning how to think on your feet when the pressure is on.

Knowing When to Gracefully Pivot

Here's a truth about case interviews: no framework survives first contact with the data. You will, without a doubt, receive a piece of information that torpedoes your initial assumptions or sends you down a rabbit hole you didn't expect. The worst thing you can do is stubbornly stick to your original plan.

The ability to pivot gracefully is a hallmark of intellectual flexibility. When new data emerges, acknowledge it out loud and explain why it’s changing your approach.

You could say something like this:

"That's an interesting data point. My initial hypothesis was that revenue was the primary issue, but this new information about a 30% spike in raw material costs is a game-changer. It suggests the cost side is far more critical than I first thought. With that in mind, I’d like to shift my focus and dig deeper into the supply chain."

This kind of response is incredibly powerful. It proves you're listening, you can synthesize new information on the fly, and you aren’t afraid to change course when the facts change. You aren’t abandoning your structure; you’re adapting it. That’s what real consultants do every single day.

Weaving Quantitative Analysis into Your Structure

A beautifully structured framework is a great start, but it's only half the story. To really nail the case, you need to power that logical roadmap with a quantitative engine. It’s the numbers that turn a theoretical exercise into a compelling, data-driven recommendation. The real skill is making this analysis feel like a natural extension of your problem-solving logic, not a separate, bolted-on step.

From the moment you sketch out your framework, you should be thinking about where the numbers will go. Which branches of your logic tree are just educated guesses, and which can be proven (or disproven) with hard data? This foresight is what separates the good candidates from the great ones. You're not just creating buckets; you're building a diagnostic tool to zero in on the most critical quantitative questions.

Identifying Data-Driven Branches

Take a hard look at your initial structure and ask yourself, "Where am I assuming something that a number could confirm?" Your framework should be your guide, leading you straight to the calculations that matter most.

- Profitability Case: This is basically a math problem in disguise. Every single branch—price, volume, fixed costs, variable costs—demands a number. Your job is to sniff out which part of that equation has gone sideways.

- Market Entry Case: You can't talk about entering a market without sizing it up first. This is where a market sizing calculation becomes non-negotiable. The "Market Opportunity" branch of your framework is where you'll build your top-down or bottom-up estimate to quantify the potential prize. If you want to dive deeper, you can find more guidance here: https://soreno.ai/articles/what-is-market-sizing.

- M&A Case: It all comes down to the deal's value. Your "Financials" or "Synergies" branch is the perfect spot for a quick valuation to see if the acquisition makes financial sense.

The Art of Rapid Mental Math

Look, nobody expects you to be a human calculator. What they are testing is your comfort with numbers under pressure. The goal is "good enough" math, not perfect precision. The trick is to use round numbers and, most importantly, to talk through your calculations out loud.

Let's say you need to calculate 18% of $210 million. Don't freeze up.

Here's what you say: "Okay, to get a quick estimate, I'll approximate that as 20% of $200 million. I know that 10% of $200M is $20M, so 20% would be $40 million. My actual number will be slightly different, but this gives us a solid directional figure to work with."

This approach does two things brilliantly: it shows you can think on your feet, and it turns a potential roadblock into a moment to demonstrate your composure and clear thinking.

A Valuation Case in Action

Valuation cases are a prime example of weaving numbers into a framework case interview. These make up roughly 15-20% of all case interviews at top firms, so it's a skill you need to have. They test your ability to connect financial metrics to strategic logic. While we're talking numbers, don't underestimate the power of mastering qualitative data analysis techniques; they provide the context that makes the numbers meaningful.

Imagine you're asked to value a startup. A common approach is a Discounted Cash Flow (DCF) model. You might project 25% annual growth on $1 million in net income and apply a 15% discount rate, landing on a valuation around $8.2 million. As a cross-check, you could run a quick comparable company analysis that suggests $7.5 million, giving you a confident valuation range to present.

Extracting the "So What" from Your Numbers

Getting the math right is just the price of admission. The real magic happens when you interpret what those numbers actually mean for the client. The "so what" is the bridge connecting your calculation to your final recommendation. After every calculation, you must deliver a strategic insight.

Here’s how to translate your numbers into a powerful narrative:

| Calculation Result | Weak Interpretation | Strong Interpretation (The "So What") |

|---|---|---|

| Market size is $500M. | "The market size is $500 million." | "The market is a healthy $500M. However, with three major players already controlling 80% of it, this will be a tough fight. We'll need a unique angle or a disruptive advantage to even stand a chance." |

| Project A has an ROI of 15%. | "The ROI for this project is 15%." | "While a 15% ROI clears our client's minimum threshold, it's a lot lower than the 25% they get from their core business. To justify this, we need to be certain this investment opens up new, high-growth areas for them down the road." |

This final step—turning data into insight—is what interviewers are really listening for. It proves you're not just a number cruncher. You're a strategic thinker who uses quantitative analysis to drive real business decisions. Your framework gives you the map, but the numbers tell you which road to take.

Common Questions on Case Interview Frameworks

Even after you've done the prep work, some nagging questions about case frameworks always seem to pop up. These are the "what if" scenarios that can throw you off balance right when you need to be sharpest. Let's tackle them head-on so you can walk into your interview with total confidence.

Think of this as moving beyond theory and into the real, messy application. The goal is to feel prepared not just for the case, but for the pressure that comes with it.

What Is the Biggest Mistake Candidates Make?

By far, the most common mistake is slapping a pre-memorized framework onto a case without thinking. It's painfully obvious to an interviewer when a candidate hears "tech company" and immediately defaults to a generic 4Ps model, even if it doesn't fit.

That kind of thinking completely misses the point. The interviewer isn't testing whether you can name a framework; they're testing if you can think from first principles. You have to listen carefully to the prompt and build a custom structure that actually solves the client's specific problem.

How Many Frameworks Should I Actually Know?

Stop trying to memorize a specific number. That's a trap. Instead of collecting a long list of frameworks, you're far better off deeply understanding the business logic behind 3-4 core concepts.

- Profitability: It always comes down to Revenue – Costs.

- Market Entry: This is about weighing the opportunity against your company's ability to capture it.

- Business Situation: A flexible structure looking at the company, its customers, and the competition.

The most powerful tool you have isn't a list of memorized frameworks—it's a deep understanding of the MECE principle. If you truly master MECE, you can build a custom framework for any problem thrown your way. That's what really impresses interviewers.

Knowing how to think in a structured way is infinitely more valuable than knowing a dozen framework names. That’s the real test.

What If My Initial Framework Is Wrong?

It’s not just okay to adjust your framework—it’s expected. Real consulting work is never a straight line. You get new information, a hypothesis breaks, and you have to pivot. Showing you can do this under pressure is a huge plus.

If you realize you’ve hit a dead end or a more important issue has surfaced, just say so. Don't panic or try to hide it. Take a breath, explain your new line of thinking, and recalibrate.

For example, you could say: "My initial structure focused heavily on market expansion, but based on the customer retention data you just shared, it seems the core product itself might be the real problem. I think we'd be better off shifting our focus there. Does that sound right to you?" This shows you're flexible, transparent, and collaborative.

How Do I Present My Framework to the Interviewer?

Once you get the prompt and take a minute to structure your thoughts, you need to drive the conversation. Don't wait to be asked. Lay out your plan of attack as a concise, high-level roadmap.

Start by sharing the main "buckets" or areas you plan to investigate. This gives the interviewer a clear preview of your logic before you dive into the nitty-gritty.

A great kickoff sounds something like this: "To figure out if our client should launch this new product, I'd like to structure my analysis around three key questions. First, what's the market opportunity—specifically, its size and profit pools? Second, what's the competitive landscape like, and how are we positioned to win? And third, do we have the internal capabilities to actually pull this off? Does that feel like a good place to start?"

This approach immediately establishes you as a confident, logical partner in solving the problem.

Ready to stop memorizing and start mastering the art of the case interview? Soreno gives you unlimited practice with an AI-powered, MBB-trained interviewer that provides instant, rubric-based feedback on your structure, MECE logic, and communication. Build the skills and confidence you need to land the offer. Start your free trial.