Case study interviews: Master the Process and Ace Your Offer

Master case study interviews with concise frameworks, step-by-step tactics, and tips to land your dream offer.

A case study interview isn't a pop quiz. Think of it more like a business simulation where you're asked to solve a real-world problem. It’s a collaborative work session designed to show an interviewer how you think, not just what you know. For top companies, it’s the single best way to see how you’d actually perform on the job.

What Is a Case Study Interview and Why Do Companies Use Them?

Think about how pilots train. Before ever stepping into a real cockpit, they spend countless hours in a flight simulator. It’s a safe, controlled environment to test their decision-making, crisis management, and technical skills. A case study interview is the business world’s equivalent of that flight simulator, especially for roles in consulting, finance, and strategy.

A resume can tell an employer what you've done in the past, but it can't show them how you tackle a complex, ambiguous problem right now. Companies want to see your mind in action. Can you take a messy, high-stakes business challenge, break it down into logical pieces, and build a clear path to a recommendation? The case interview lets them see that firsthand.

A Window into Your Problem-Solving Abilities

At its heart, the case study is a test of your analytical toolkit. Here’s a secret: it’s rarely about finding the one "right" answer. In most cases, a single correct solution doesn't even exist. The real evaluation is in the journey—the structured, logical process you use to get to your conclusion.

Interviewers are watching for a few key things:

- Structured Thinking: Do you build a logical framework to analyze the problem, or do you just jump to the first idea that comes to mind?

- Quantitative Acumen: How comfortable are you with numbers? Can you perform quick calculations to test your ideas and pull insights from data?

- Business Insight: Do you apply practical, real-world business sense to the situation?

- Communication Skills: Can you walk the interviewer through your thought process clearly and persuasively?

This is precisely why firms like McKinsey, Bain, and BCG have relied on case study interviews for decades. It’s an incredibly reliable method for finding people with the analytical horsepower and poise required to advise clients on multi-million dollar decisions.

The goal is to showcase a structured, analytical thought process. It’s a live demonstration of your ability to think like a consultant, breaking down ambiguity into a clear, actionable plan.

Simulating the Day-to-Day Reality

Ultimately, a case interview is designed to mirror the challenges you’d face in any high-stakes business role. Clients don't walk in with a neatly packaged problem and all the data you need. You get fragmented information and a broad goal, like "we need to increase profitability" or "should we enter this new market?"

Your job, both in the case and on the job, is to ask the right questions, form smart hypotheses, figure out what data you need, and then weave it all into a compelling recommendation. This back-and-forth conversation gives the interviewer a genuine feel for what it would be like to have you on their team, working side-by-side on a real project. They’re not just looking for an applicant; they’re looking for a future colleague.

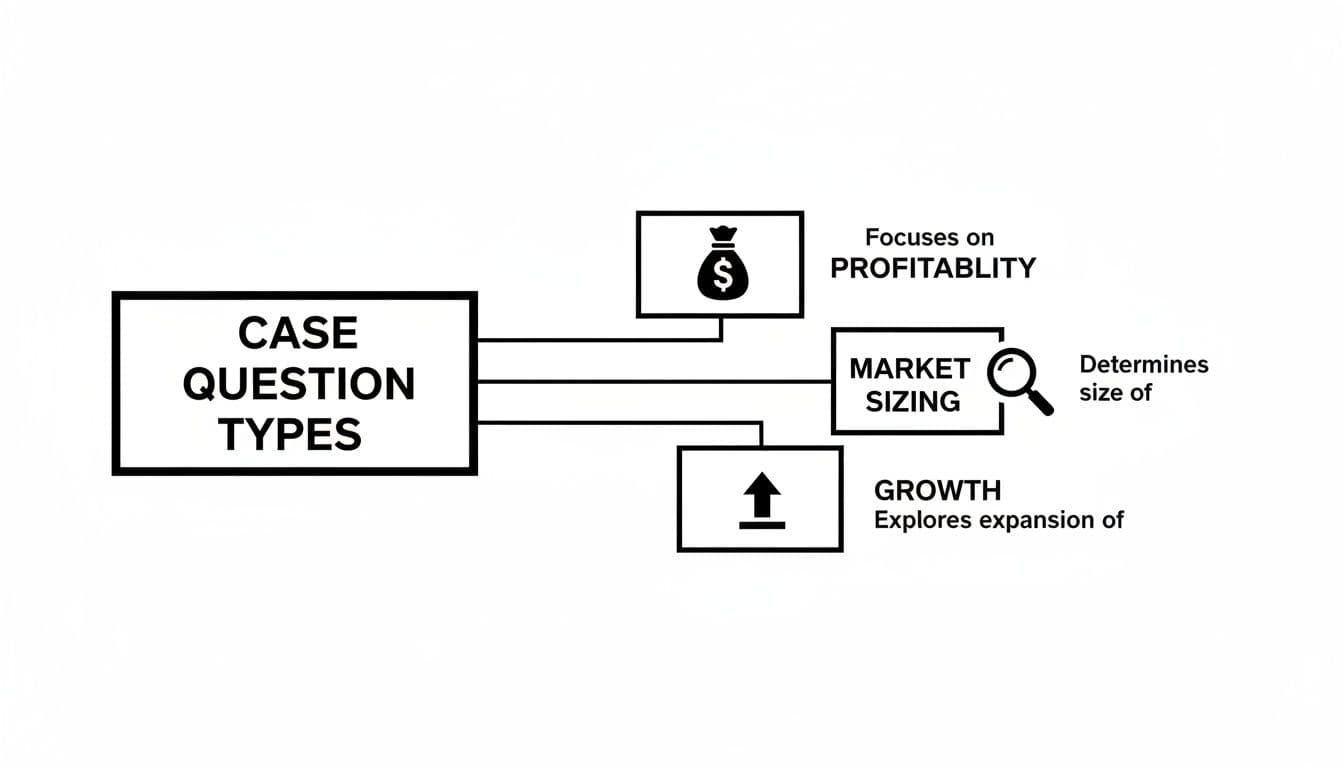

Decoding the Different Types of Case Questions

While every case interview feels unique, the questions themselves usually fall into a few predictable categories. Think of it like learning the basic plays in football; once you know the core formations, you can react intelligently to whatever the other team throws at you. Most of the time, you'll be dealing with one of three primary scenarios: profitability, market sizing, or growth strategy.

It's important not to see these as rigid boxes. A single case might start with a market sizing question that flows directly into a discussion about growth strategy. Your first job is to spot the dominant theme and pull out the right mental toolkit to get started.

Probing Profitability

Profitability cases are the bread and butter of consulting interviews. They’re direct, packed with numbers, and cut straight to the heart of a business’s health. The classic setup is simple: a company’s profits are tanking, and you’ve been brought in to figure out why and what to do about it.

The foundational formula here is Profit = Revenue - Costs. Your first move, always, is to break this down. Is revenue the problem (fewer sales, lower prices)? Or is it on the cost side (fixed or variable costs are spiraling)? This simple split immediately gives your analysis a clear, logical structure.

Imagine a regional retail chain tells you its profits have dropped by 15% over the past two years.

- Revenue Drill-Down: Are people buying fewer items? Have they been running more discounts, lowering the average price? Did a new competitor open up across the street?

- Cost Drill-Down: Are their suppliers charging more for inventory? Have the leases on their store locations gone up? Are they dumping money into marketing that isn’t bringing in more customers?

By dissecting each piece of the equation, you can pinpoint the root cause instead of just taking wild guesses.

Mastering Market Sizing

Market sizing questions are really a test of your logical thinking and how comfortable you are with ambiguity. The interviewer doesn't have a magic number in mind; they want to see you build a defensible estimate from the ground up, based on reasonable assumptions. You'll get a broad question like, “What's the annual market size for electric bikes in Amsterdam?”

There are two classic ways to tackle this:

- Top-Down Approach: Start with a huge, known number (like the population of Amsterdam) and systematically slice it down with logical filters.

- Bottom-Up Approach: Start with a small, individual unit (like a single bike shop or a specific type of customer) and build your way up to the total market.

Let’s try a top-down approach for our e-bike example. You’d start with Amsterdam’s population (around 870,000 people), then estimate the percentage of folks who are of cycling age, the fraction of those people likely to own a bike, the portion who would opt for an electric model, and finally, the average price of an e-bike. The key is to state every assumption you make out loud, turning a vague riddle into a structured math problem.

Navigating Growth Strategy

Growth strategy cases are the most open-ended of the bunch, demanding a mix of structured thinking and genuine creativity. The core question is always about how a company can expand. This could mean launching a new product, breaking into a new country, or buying another company.

The heart of any growth strategy case is a structured evaluation of opportunity versus risk. You have to analyze how attractive the move is and whether the company actually has what it takes to win.

For instance, say a traditional snack food company is thinking about launching a new line of organic, gluten-free chips. To advise them, you'd need to explore a few key territories:

- The Market: How big is the organic snack market, anyway? Is it growing? Who are the big players already there?

- The Company: Does an organic line even fit with their brand? Do they have the right manufacturing and distribution channels to pull it off?

- The Financials: What are the projected sales and costs? How long would it take for this new venture to actually make money?

By weighing these factors, you can deliver a thoughtful recommendation that’s much more powerful than a simple "yes" or "no." You're showing you can think like a CEO, charting a course for the future of the business.

Now that we've broken down the main types, let's pull them together into a quick reference table. This can help you quickly identify the kind of problem you're facing mid-interview.

Common Case Interview Question Types at a Glance

| Question Type | Core Objective | Key Skills Tested |

|---|---|---|

| Profitability | Diagnose the root cause of declining profits and recommend solutions. | Quantitative analysis, structured problem-solving, logical deduction. |

| Market Sizing | Estimate the size of a market (in revenue or units) with limited data. | Logical estimation, numerical fluency, comfort with ambiguity, assumption-based reasoning. |

| Growth Strategy | Evaluate opportunities for a company to expand and recommend a course of action. | Strategic thinking, business acumen, qualitative analysis, risk assessment. |

Knowing these patterns isn't about memorizing answers; it's about recognizing the type of challenge so you can confidently apply the right framework and thought process.

Mastering the Essential Case Interview Frameworks

Think of case interview frameworks as a trusty toolkit, not a rigid instruction manual. You wouldn't use a sledgehammer to hang a picture frame, right? In the same way, you need to know which framework to pull out for the right problem. They give you a starting point, a way to cut through the noise of a complex business scenario.

Frameworks are all about bringing structure to chaos. They help you break down a big, messy problem into smaller, manageable pieces. This shows your interviewer you can think logically and methodically, even when you're on the spot. Your goal isn't just to recite a framework; it's to adapt it to the unique details of the case in front of you.

The Profitability Framework

This is your bread and butter. Anytime you hear words like "declining profits" or "improving financial performance," this framework should immediately come to mind. It all starts with a simple but powerful equation: Profit = Revenue – Costs. The real analysis begins when you start peeling back the layers on both sides of that equation.

- Revenue Side: This breaks down into

Price per unitandNumber of units sold. Is the company struggling because its prices are too low, or is it simply not selling enough? Digging into this branch helps you find out. - Cost Side: Here, you'll look at

Fixed Costs(like rent and salaries) andVariable Costs(like raw materials). Is the issue high overhead, or is it costing too much to produce each item?

By systematically working through these components, you can quickly diagnose where the financial trouble is coming from instead of just guessing.

The visual below shows how different case types often point you toward a specific framework.

As you can see, the core business challenges you'll face—profitability, market sizing, and growth—naturally map to specific analytical approaches.

The 3 Cs Framework for Market Analysis

If the case is about entering a new market, launching a product, or sizing up the competition, the 3 Cs framework is a fantastic place to start. It gives you a 360-degree view of the business environment by focusing on three crucial areas.

- Company: This is the internal look. What are our core strengths and weaknesses? Do we have the cash, talent, and brand recognition to make this work?

- Customers: Who are we trying to sell to? What do they actually want or need? Is the market segment big enough to be worthwhile?

- Competitors: Who else is out there? What are their strategies, and how much market share do they control? More importantly, how will they react when we make our move?

Using the 3 Cs ensures you don’t develop a strategy in a bubble. It forces you to ground your ideas in the reality of your company's capabilities and the external market forces at play.

Porter's Five Forces for Industry Assessment

When you need to zoom out and analyze an entire industry's health, this is your go-to tool. Developed by Harvard professor Michael Porter, it’s perfect for M&A cases where you're deciding if a company is a good acquisition target or for any big strategic question about entering a new industry.

Porter's Five Forces helps you answer the ultimate strategic question: "Is this a good industry to be in?" It forces you to look beyond just one company and evaluate the fundamental pressures that shape competition for everyone in that market.

You'll examine five key pressures:

- Threat of New Entrants: How high are the barriers to entry? Is it easy for a new player to show up and steal market share?

- Bargaining Power of Buyers: How much leverage do customers have to push prices down?

- Bargaining Power of Suppliers: On the flip side, how much power do suppliers have to raise their prices?

- Threat of Substitute Products: Can customers easily find another way to solve their problem?

- Rivalry Among Existing Competitors: How cutthroat is the competition between the current players in the market?

Getting comfortable with these core frameworks will prepare you to tackle almost any case that comes your way. If you want to take your skills to the next level, you can explore more advanced frameworks for your case interview and learn how to bend and blend them for any situation. That adaptability is what truly separates a good candidate from a great one.

Solving a Profitability Case Step by Step

Alright, let's put the theory into practice. We're going to walk through a classic profitability problem, which is the bread and butter of case study interviews. You can expect these to make up a solid 30-40% of the cases you'll see at top consulting firms.

A favorite scenario is the legacy business getting hammered by a disruptor. Think of a regional newspaper trying to survive against a flood of free online news—a scenario that mirrors the real-world crisis of the 2000s. Between 2000 and 2018, U.S. print ad revenues plummeted a staggering 70%, from $60 billion to just $18 billion.

The data shows that about 65% of these cases involve some serious number-crunching. If you can get comfortable with the math, your odds of landing an offer can jump by as much as 50%.

Here’s the prompt you might get:

Interviewer: "Our client is a regional newspaper in the United States. For the past three years, their profits have been declining. They've hired us to figure out why and recommend what to do about it."

This is your classic, open-ended profitability case. Your mission is to take this fuzzy problem and give it a sharp, logical structure. Let's break down exactly how to do that, step by step.

Step 1: Clarify the Objective

First things first: never assume you have the full picture. Your initial move should always be to confirm the client’s actual goal and ask smart, clarifying questions to fence in the problem.

You (Candidate): "Thank you. Just to make sure I'm on the right track, our main objective is to pinpoint the root causes of the profit decline over the past three years and then propose some concrete solutions to turn things around. Do they have a specific profit target in mind?"

Interviewer: "That's correct. They want to get back to their profit levels from three years ago. Let’s call that Year 0."

You (Candidate): "Got it. And just to be clear, are any potential solutions off-limits? For instance, are they open to new pricing structures, changing their content, or even overhauling their business model?"

Interviewer: "Assume everything is on the table for now."

This quick back-and-forth isn't just about gathering information. It frames the problem and immediately shows the interviewer that you’re a proactive, methodical thinker.

Step 2: Structure the Problem

Now it's time to lay out your roadmap. This is where you introduce a framework to guide your analysis. For any profitability case, the Profitability Tree is your best friend.

You (Candidate): "To dig into the declining profits, I'd like to break the problem down using the classic formula: Profit = Revenue – Costs. I'll start on the revenue side, which I'll split into subscription revenue and advertising revenue. After that, I’ll tackle the cost side, breaking it into fixed and variable costs. Does that sound like a reasonable way to approach this?"

Interviewer: "That sounds perfect. Where would you like to start?"

Notice how you ask for their buy-in? This simple question turns the interview from an interrogation into a collaboration. A solid grasp of business fundamentals is non-negotiable here. It helps to know how to read company financial statements so you can quickly diagnose a business's health.

Step 3: Ask Insightful Questions and Analyze

With your structure in place, it’s time to start drilling down. You’ll lead the investigation by asking for data to test your hypotheses, starting with revenue.

You (Candidate): "Let’s start with revenue. Can you tell me if the decline has been driven more by subscriptions, advertising, or a mix of both? And do you have any data on how those revenue streams have changed over the last three years?"

Interviewer: "Good question. Subscription revenue has been flat, but advertising revenue has dropped by 20%."

Bingo. That’s your first major clue. Now you have to figure out why ad revenue is tanking.

You (Candidate): "A 20% drop is definitely significant. Advertising revenue is essentially a function of the number of ads sold and the average price per ad. Do we know which of those two factors is the main culprit here?"

Interviewer: "The number of ads sold has decreased, especially from local businesses."

This answer opens up a new branch of inquiry focused on customers (the advertisers) and competitors. This process of peeling back the onion, layer by layer, is the real engine of a case interview. At this stage, you might even do some quick back-of-the-envelope math, maybe something like you'd see in a break-even analysis example, to understand the financial pressure points.

Step 4: Synthesize and Recommend

Once you've explored both the revenue and cost sides, you'll be sitting on a pile of insights. The final, crucial step is to weave them all together into a clear, compelling recommendation.

You (Candidate): "Based on our analysis, the core problem is the 20% drop in advertising revenue, which seems to be driven by local businesses shifting their ad spend to online platforms. My recommendation would be a three-part strategy. First, create a bundled digital and print advertising package designed specifically for those local businesses we’re losing. Second, launch a new digital-only subscription model to grow our online audience, which will make our platform more valuable to all advertisers. And third, look into cost savings by optimizing our printing and distribution logistics."

This kind of summary is powerful because it ties your entire analysis directly to an actionable plan. You've successfully turned messy data into a clear business story.

How to Tackle Market Sizing and Growth Cases

Beyond pure profitability problems, you'll almost certainly run into cases centered on market sizing and growth strategy. They might seem different on the surface, but both are designed to test your ability to think logically under pressure and communicate your assumptions.

Let's break down how to approach each one with a practical example.

Example Walkthrough: A Market Sizing Case

Market sizing questions are a consulting interview classic. They're a fantastic way for the interviewer to see how you handle ambiguity and build a logical estimate from the ground up. The final number is less important than the journey you take to get there.

So, imagine your interviewer leans back and asks, "How big is the U.S. market for yogurt each year, in dollars?"

The trick is to start broad and systematically narrow down your focus. This is often called a top-down approach.

- Start with a Big, Known Number: The U.S. population is your anchor. A good, round number like 330 million people is all you need.

- Break It Down: Obviously, not everyone is a yogurt eater. The next step is to slice the population into meaningful groups. Age is a great way to do this: Children (0-18), Adults (19-65), and Seniors (65+).

- Estimate How Often People Buy: For each group, you need to make an educated guess about their yogurt habits. Maybe health-conscious adults have it a few times a week, while kids and seniors eat it less often.

- Do the Math for Total Units: Now you just multiply the number of consumers in each segment by how much yogurt they eat per year. This gives you a total number of yogurt cups sold.

- Put a Price on It: Finally, what's a reasonable average price? Let's say a single-serving cup costs $1.50. Multiply your total units by that price, and you have your market size in dollars.

The single most important thing you can do here is talk through every single assumption. It shows the interviewer exactly how your mind works and turns a fuzzy question into a structured math problem.

Getting comfortable with this kind of structured estimation is a core consulting skill. If you want to go deeper, check out our guide on how to calculate the size of a market.

Example Walkthrough: A Growth Strategy Case

Growth strategy cases feel a bit more like being a CEO for a day. They blend hard numbers with a sharp sense of business intuition, asking you to weigh big opportunities against potential pitfalls.

Picture this prompt: "A huge, old-school food company is thinking about buying a trendy organic snack brand. Should they pull the trigger?"

Your job is to deliver a clear, well-supported recommendation. A great way to structure your thinking is to look at four key areas: Market Attractiveness, Company Strengths, Synergies, and Risks.

This kind of M&A (Mergers & Acquisitions) problem is incredibly relevant today. As consumer tastes change, big brands often buy smaller ones to stay in the game. In fact, established food giants lost 12-15% of their market share between 2015 and 2020 because of the rise of smaller, organic products. A big driver of this was the 30% of U.S. consumers with bachelor's degrees who were increasingly reaching for premium options. You can discover insights about M&A case statistics on Management Consulted for more context.

Here's how you'd break down the problem:

- Market Attractiveness: First, is the organic snack market a good place to be? Is it growing fast? Who are the major players, and what are the profit margins like?

- Company Strengths: Does our client actually have what it takes to make this work? Think about their brand power and their massive distribution networks. Can they handle this new product line?

- Potential Synergies: This is where 1 + 1 = 3. Where can the two companies create more value together than they could apart? Maybe they can cross-sell products, cut costs by combining operations, or use the bigger company's supply chain to lower expenses. A good synergy plan can often lead to a 10-20% bump in revenue.

- Critical Risks: What could go horribly wrong? You've got financial risk (paying too much), operational risk (a messy, complicated integration), and even brand risk if the two company cultures clash.

By walking the interviewer through these four areas, you’re not just giving an answer. You’re building a powerful, logical argument that proves you can handle the kind of complex strategic decisions consultants face every day.

Common Mistakes to Avoid in Your Case Interview

Knowing what not to do in a case study interview is just as important as knowing what you should do. I’ve seen countless brilliant candidates get tripped up by the same few hurdles. If you can sidestep these common errors, you’ll let your analytical skills do the talking and walk in with a lot more confidence.

Think of yourself as a detective arriving at a crime scene. A great detective doesn't immediately chase the most obvious suspect. They rope off the area, gather evidence, question assumptions, and build their case methodically. Rushing the process or ignoring a key clue is a sure way to end up with the wrong person.

Failing to Clarify the Objective

The most common mistake? Diving headfirst into the problem without truly understanding the goal. A candidate hears “declining profits” and immediately starts brainstorming ways to slash costs. But what if the client’s real priority is maintaining their premium brand image, and aggressive cost-cutting would destroy it?

- What It Looks Like: You start building a framework the second the interviewer stops talking.

- How to Fix It: Pause. Seriously, just take a breath. Then, paraphrase the objective back to the interviewer. Ask clarifying questions like, "So, if I understand correctly, our main goal is to figure out why profits are down and recommend a path back to growth? And are there any other constraints, like a budget or timeline, I should keep in mind?"

This simple step ensures you and the interviewer are on the same page from the get-go.

Never assume the initial prompt is the whole story. Those first few minutes of clarifying questions aren't a waste of time—they're the foundation for your entire analysis.

Jumping to a Conclusion Too Early

This is the classic "solution-first" trap. The interviewer describes a struggling retail chain, and the candidate immediately blurts out, "They should launch an e-commerce site!" It feels like a quick win, but it’s an answer completely detached from any real analysis. What if their customer base is elderly? What if their logistics are a mess?

This misstep signals a lack of structured thinking. It shows you’re more interested in finding a fast answer than you are in doing the hard work of diagnosing the problem. Remember, the interviewer is evaluating your process, not just your final answer.

Making Sloppy Math Errors

Nothing tanks your credibility faster than a simple calculation mistake. The math in case study interviews is almost never about complex calculus; it's basic arithmetic, just with big numbers. The real test is whether you can stay accurate and composed under pressure.

A small error in a market sizing estimate or a profitability formula can completely derail your final recommendation. It tells the interviewer that you might not have the attention to detail needed for the job.

- What It Looks Like: You try to do all the math in your head and announce a number without showing your work.

- How to Fix It: Talk through your calculations out loud, step-by-step. Write everything down neatly. For instance, say, "Okay, to get the annual revenue, I need to multiply 1.5 million units by the $20 average price. I'll do 1.5 million times 10, which is $15 million, then double that to get $30 million." This lets the interviewer follow your logic and even offer a gentle correction if you make a small slip.

Ignoring Interviewer Hints

Finally, don't forget the interview is a conversation, not a presentation. Interviewers will often drop subtle hints to steer you in the right direction. If they say, "That's an interesting point on fixed costs, but what about recent shifts in their supply chain?"—that’s not a random comment. It’s a giant, flashing sign pointing you where to go next.

Ignoring these nudges makes you seem like a poor listener or too rigid in your thinking. The best candidates treat the interviewer like a partner, listening to their input and adjusting their strategy on the fly. This shows you're coachable and can work well with a team—two traits every firm is looking for.

Answering Your Lingering Case Interview Questions

Even with the best prep plan, a few nagging questions can stick around. Let's clear up some of the most common things candidates worry about so you can walk into your interview feeling ready for anything.

How Much Math Will I Actually Have to Do?

You'll definitely need to be comfortable with business math, but don't worry, they're not going to ask you to do advanced calculus on the fly. The real test is whether you can think with numbers, not just crunch them.

You should be ready to work with percentages, figure out break-even points, estimate market sizes, and run profitability scenarios—all while under a bit of pressure. Getting the right number is only half the battle; the interviewer really wants to see how you interpret what that number means for the business. Brushing up on your mental math, especially with big numbers, is a huge help here.

What if I Know Nothing About the Industry in the Case?

Relax, nobody expects you to be an expert on everything from agricultural tech to Swiss watchmaking. The case interview is designed to test your problem-solving process and how you structure your thoughts, not your knowledge of some obscure market.

In fact, it's totally fine—and even a good idea—to admit what you don't know and state your assumptions.

Here's what that sounds like in practice: "I'm not too familiar with the commercial shipping industry, but I'd assume its biggest costs are fuel and labor. Is that a reasonable place for me to start?" This shows the interviewer you can think logically and aren't afraid to be collaborative.

What Should I Do if I Get Completely Stuck?

First off, know that it happens to the best of us. The absolute worst thing you can do is panic. Taking a second to pause, take a breath, and just think is a sign of composure, not weakness.

Start by quickly summarizing what you've figured out so far. Saying something like, "Okay, let me just quickly recap my thoughts..." gives you a moment to reset. Look back at your framework and the notes you've taken. If you're still stuck, it's time to bring your interviewer into the conversation.

You could try, "I've explored the revenue side, and things seem solid there. I want to dig into costs now, but I'm not sure which area would be most impactful. Would you have any guidance on the company's biggest cost categories?" This approach shows you can handle pressure and know how to work as part of a team.

Ready to move from theory to landing the offer? Soreno gives you an AI platform with an MBB-trained interviewer for unlimited, on-demand practice. You'll get instant, specific feedback to build the muscle memory and confidence you need. Kick off your free trial and start practicing at https://soreno.ai.