What is value chain analysis? A Practical Guide to Competitive Advantage

Discover what is value chain analysis and how this strategic framework reveals value along activities. Learn actionable steps for interviews.

Value chain analysis is a strategic tool, but it's not just another piece of business jargon. At its heart, it’s a way to see your business as a story—a sequence of activities that starts with an idea and ends with a happy customer. It’s about breaking down everything you do into individual steps to figure out where you’re creating real value and where you’re just spending money. The goal? Widen that gap between value and cost to boost your profit margin and sharpen your competitive edge.

Deconstructing A Business To Find Its Edge

Imagine you run a specialty coffee shop. Your business isn't just "selling coffee." It’s a whole chain of events: sourcing the perfect beans from a specific region (inbound logistics), roasting them to perfection (operations), designing a killer brand and cafe experience (marketing), and finally, serving that delicious cup with a smile (service).

This is the essence of value chain analysis, a framework brought to the forefront by business strategist Michael Porter. Each of these steps is a "link" in the chain. By dissecting this process, you can ask critical questions. Could we source beans more directly to cut costs? Can we roast in a unique way that customers will pay a premium for? Is our online ordering system seamless? Finding the answers is how you build a stronger, more profitable business.

The whole point is to identify which activities create the most bang for your buck and which ones are draining resources without adding much to the final product. By optimizing each link, you create something that customers believe is worth more than the total cost of producing it. That difference is your margin.

Primary And Support Activities

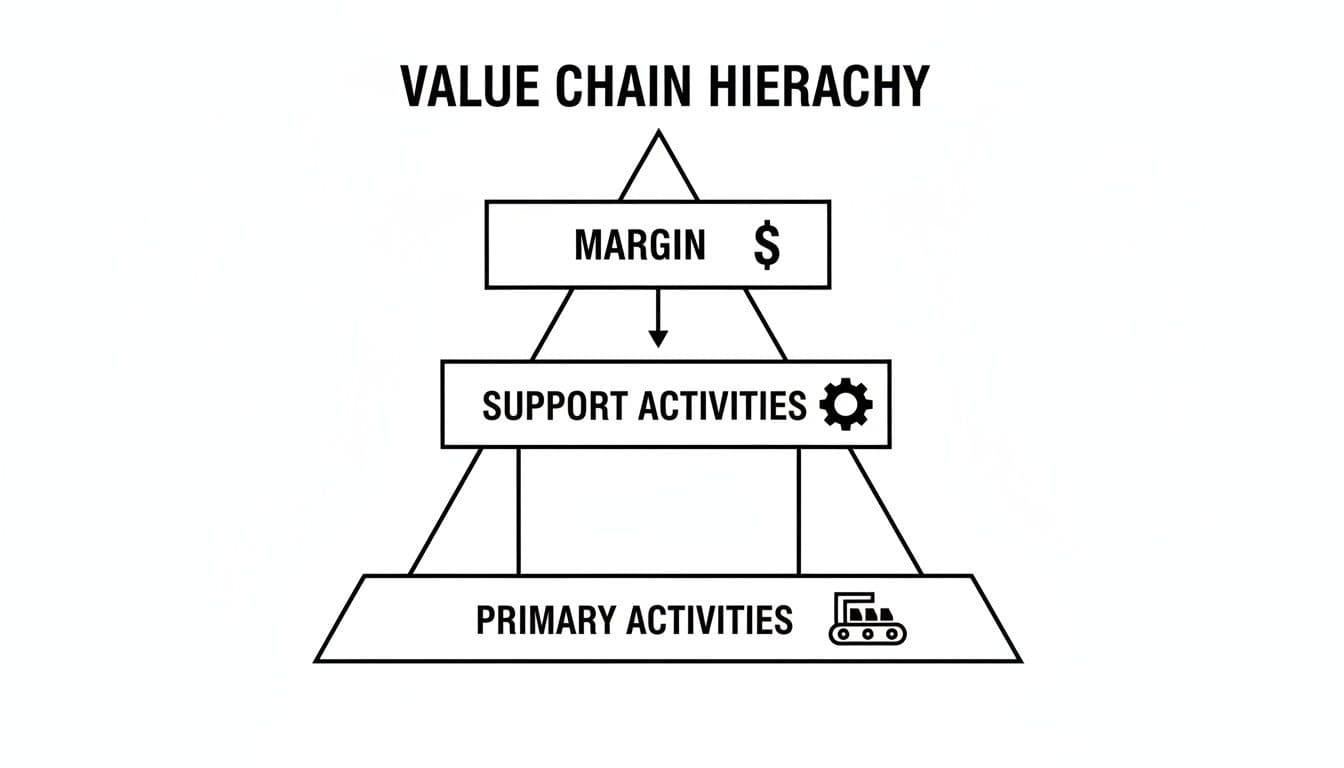

Porter’s framework neatly organizes a company’s functions into two buckets: Primary Activities and Support Activities. Think of it like a theater production: you have the actors on stage and the crucial crew working backstage.

- Primary Activities: These are the actors on stage—the core functions that directly create and deliver the product to the customer. They follow a logical sequence from start to finish.

- Support Activities: This is the backstage crew. They aren't in the spotlight, but the show can't go on without them. They provide the essential infrastructure that allows the primary activities to run smoothly.

To give you a quick overview before we dive deeper, here's a simple breakdown of how these activities are categorized.

Value Chain Activities At A Glance

| Activity Category | Core Function | Example Activities |

|---|---|---|

| Primary Activities | Directly involved in creating and delivering the product. | Inbound Logistics, Operations, Outbound Logistics, Marketing & Sales, Service |

| Support Activities | Enable and underpin the primary functions. | Procurement, Technology Development, Human Resources, Firm Infrastructure |

This model, which Porter laid out in his 1985 classic, Competitive Advantage, is more than just theory. Early case studies showed that by fine-tuning support activities—like investing in better technology for manufacturing—companies could boost their margins by as much as 20-30%. For anyone prepping for a consulting interview, getting comfortable with this framework is non-negotiable; it’s your key to showing you can think strategically about a business.

As the visual shows, functions like firm infrastructure and technology aren't just overhead—they are the foundation that allows operations, marketing, and sales to succeed.

By digging into each step, businesses can make targeted improvements that have a real impact on their what is operational efficiency. It's this methodical approach that helps uncover hidden sources of competitive advantage. A great analysis also looks ahead, considering how new technologies can be a game-changer. For example, some forward-thinking firms are exploring how XR as a Strategic Enabler for Competitive Advantage can completely redefine their operations or marketing efforts. That's the kind of thinking that moves an analysis from good to great.

Exploring Primary and Support Activities

To really get a handle on value chain analysis, you have to look past the textbook definitions and see a business for what it is: a system with two distinct but interconnected sets of functions. These are its primary activities and its support activities.

Think of it like a professional kitchen in a Michelin-starred restaurant. The primary activities are the chefs prepping ingredients, cooking the food, and plating the final dish. The support activities are everything else that makes that possible—the procurement team sourcing rare ingredients, the HR manager hiring top talent, and the accounting department keeping the lights on.

Both are absolutely essential for creating that final masterpiece and, ultimately, turning a profit. If one side falters, the other is sure to feel the impact. Let's break down each component, using a modern innovator like Tesla as our real-world example.

This diagram shows how everything fits together, with the foundational primary and support functions combining to create the company's overall margin.

As you can see, the support activities act as the essential infrastructure, making it possible for the primary, customer-facing activities to run smoothly and effectively.

The Five Primary Activities

Primary activities are the hands-on, sequential steps that get a product from raw materials into the customer's hands. They're the core functions that physically create and deliver value. If you want to make a direct impact on product quality and cost, this is often where you start.

-

Inbound Logistics: This is all about getting the raw materials in the door. It covers receiving, storing, and managing all the inputs. For a company like Tesla, this means sourcing lithium and cobalt for its batteries, managing mountains of aluminum for car bodies, and handling a complex supply chain for thousands of tiny electronic parts. Get this right, and you minimize waste and keep the assembly line humming.

-

Operations: This is the transformation stage—where raw materials become a finished product. Tesla’s Gigafactories are the perfect example. Inside, advanced robotics and hyper-efficient assembly processes work in concert to build vehicles at a massive scale. Every ounce of efficiency gained here directly lowers the cost of each car that rolls off the line.

-

Outbound Logistics: Once the car is built, how does it get to the customer? That’s outbound logistics. It includes everything from storing finished vehicles and processing orders to the final delivery. Tesla flipped the script here by using a direct-to-consumer sales model, completely bypassing traditional dealerships and creating a major strategic advantage.

-

Marketing & Sales: These are the activities that convince a customer to actually buy the product. Again, Tesla’s approach is anything but traditional. It relies almost entirely on its powerful brand, the public profile of its CEO, and viral media events rather than paid advertising. A company's branding and sales channels are key parts of its go-to-market strategy framework, which we cover in another detailed guide.

-

Service: This is everything that happens after the sale to keep the customer happy and enhance the product’s value. Think customer support, repairs, and ongoing updates. Tesla’s over-the-air software updates and its network of Service Centers are absolutely critical for customer loyalty. In fact, studies show a strong service strategy can boost customer lifetime value by over 25%.

The Four Support Activities

Support activities don’t directly build the product, but without them, nothing would get built at all. They are the "backstage" crew and infrastructure that allow the main performance to happen.

Key Insight: It’s easy to dismiss support activities as simple overhead, but that's a mistake. They are incredibly powerful levers for creating a competitive advantage. A company with world-class technology or a hyper-efficient procurement process can easily outmaneuver competitors, even if their primary activities look nearly identical.

Let's dig into the four key support functions:

-

Procurement: This isn’t about the raw materials themselves, but the act of buying them. It involves finding vendors, negotiating contracts, and purchasing all the inputs for the value chain—from battery minerals to office paper. A sharp procurement team at Tesla can lock in favorable long-term contracts for critical minerals, creating a massive cost advantage down the road.

-

Technology Development: This covers all the R&D, process automation, and software that underpins the value chain. At Tesla, this is a core part of its identity. From its pioneering battery tech and self-driving AI to the sophisticated software that runs its factories, technology is what fuels innovation across the entire company.

-

Human Resource Management: This is all about the people. It includes every activity related to recruiting, hiring, training, and developing the workforce. For a tech-heavy company like Tesla, the ability to attract and retain the world's best engineering and manufacturing talent is a critical function that makes everything else possible.

-

Firm Infrastructure: Think of this as the company's central nervous system. It includes the support systems that keep the entire organization running, such as accounting, legal, finance, and general management. A solid infrastructure ensures the company is compliant, financially sound, and strategically aligned, providing the stable foundation that all other activities are built on.

Primary vs Support Activities Deep Dive

To crystallize the difference, let’s compare these two categories side-by-side. The following table breaks down their distinct roles and strategic importance in building a lasting competitive advantage.

| Activity | Category | Strategic Goal | Key Performance Indicators (KPIs) |

|---|---|---|---|

| Inbound Logistics | Primary | Minimize input costs and ensure timely supply. | Inventory turnover, cost of raw materials, supplier lead times. |

| Procurement | Support | Secure the best possible price and terms for all inputs. | Cost savings achieved, supplier performance ratings, contract compliance. |

| Operations | Primary | Maximize production efficiency and product quality. | Cost per unit, defect rate, production cycle time. |

| Technology Development | Support | Drive innovation and create process efficiencies across the firm. | R&D spending as % of revenue, number of new patents, time to market. |

| Marketing & Sales | Primary | Drive demand and convert leads into customers. | Customer acquisition cost (CAC), conversion rate, market share. |

| Human Resource Management | Support | Attract, develop, and retain top talent to enable all functions. | Employee turnover rate, time to fill open positions, employee satisfaction. |

| Service | Primary | Enhance customer satisfaction and increase lifetime value. | Net Promoter Score (NPS), customer retention rate, first-call resolution. |

| Firm Infrastructure | Support | Ensure operational stability, compliance, and strategic alignment. | Administrative costs as % of revenue, audit compliance, financial reporting accuracy. |

As the table shows, while primary activities are focused on the direct flow of value to the customer, support activities are geared toward optimizing the entire system. A truly effective value chain analysis recognizes that you can't have one without the other; they are two sides of the same coin.

How to Perform a Value Chain Analysis

Okay, let's move from theory to action. This is where the rubber meets the road. Performing a value chain analysis isn't just some stuffy academic exercise; it's a practical, structured way to get under the hood of a business and find out what makes it tick—and what's holding it back. Mastering this process gives you a clear playbook for any strategy discussion or high-stakes case interview.

We're going to break it down into four straightforward, actionable steps. To make it real, we'll walk through the process with a hypothetical direct-to-consumer (DTC) shoe brand we'll call "SoleCraft." This will help you see how to go from simply listing activities to delivering the kind of sharp, strategic insights that get you noticed.

Step 1: Identify All Key Activities

First things first, you need to map out the entire sequence of a company's activities. The trick is to separate them into primary and support buckets. It’s absolutely critical to be specific here and tailor the list to the actual business model—don't just rattle off a generic template. Think through every single step it takes to get the product into a customer's hands.

For our DTC shoe brand, SoleCraft, the activity map would look something like this:

-

Primary Activities:

- Inbound Logistics: Sourcing sustainable leather and recycled rubber; managing supplier relationships in Portugal and Vietnam.

- Operations: Assembling the shoes at a partner factory; running quality control checks.

- Outbound Logistics: Warehousing finished shoes in a central U.S. location; managing partnerships with carriers like FedEx for direct shipping.

- Marketing & Sales: Running targeted social media campaigns; managing the e-commerce website; email marketing to past customers.

- Service: Handling customer returns and exchanges; managing online reviews and customer feedback.

-

Support Activities:

- Procurement: Negotiating contracts for raw materials and shipping services.

- Technology Development: Developing and maintaining the Shopify-based e-commerce platform; using data analytics to track sales trends.

- Human Resources: Hiring designers, marketers, and customer service representatives.

- Firm Infrastructure: Managing finance, legal, and overall company leadership.

Step 2: Analyze Costs and Value Drivers

With your activity map complete, it's time to dig into the numbers. The goal here is to attach a cost to each activity and figure out how it actually adds value for the customer. This is where you connect the day-to-day operations to the bottom line.

For SoleCraft, you'd start asking pointed questions:

- What’s the real cost of our sustainable leather per shoe compared to standard stuff?

- What is our customer acquisition cost (CAC) coming from Instagram ads?

- Our "free returns" policy feels great for customers, but what is its actual cost in reverse logistics? Does the goodwill it creates outweigh the expense?

When you’re doing this, you have to quantify the financial impact. Understanding key metrics is essential, and one of the most direct is calculating profit margin, which bridges the gap between operational costs and overall profitability.

Step 3: Pinpoint Competitive Advantages and Weaknesses

Now the fun begins. You take what you've found and stack it up against the competition. This side-by-side comparison is what reveals where the business truly excels and where it’s vulnerable. You’re hunting for sources of cost advantage (doing things cheaper) or differentiation advantage (doing things better or in a unique way customers will pay more for).

Interview Tip: This is the make-or-break moment in a case interview. The jump from "listing activities" to "identifying a strategic advantage" is what separates a good answer from a great one. Don't just present the facts; tell them what the facts mean.

Applying this to SoleCraft, our analysis might uncover:

- Weakness: Its inbound logistics costs are 15% higher than rivals' because it insists on premium sustainable materials.

- Advantage: Its "Marketing & Sales" activity is a powerhouse. By using customer data effectively, SoleCraft’s CAC is 30% lower than the industry average. Plus, its brand story around sustainability lets it command a premium price.

- Conclusion: SoleCraft's real competitive edge isn't in making shoes—it's in its brand and its incredibly efficient, data-driven marketing engine.

Step 4: Develop Strategic Recommendations

The final step is to turn your analysis into a concrete plan. Based on the strengths and weaknesses you just uncovered, what should the company do? The best recommendations are specific, measurable, and tie directly back to the insights from your analysis.

For SoleCraft, solid recommendations would look like this:

- Double Down on Strengths: Invest more in the data analytics team to further sharpen marketing spend and personalize customer outreach. The goal? Increase customer lifetime value by 20%.

- Mitigate Weaknesses: Explore long-term contracts with material suppliers to lock in better prices, aiming for a 5-7% reduction in inbound logistics costs without compromising on quality.

- Explore New Opportunities: Launch a shoe recycling program (a "Service" activity). This turns a potential cost center into a powerful marketing tool, reinforcing the brand's sustainability pledge. This kind of initiative pulls from various business process improvement techniques by creating new value from existing operations.

Real-World Value Chain Analysis Examples

Theory gives you the map, but real-world examples show you the actual terrain. The best way to go from knowing the definition of value chain analysis to truly understanding it is to see how it works in practice.

Let's look at how this powerful framework is applied, first by a global retail giant and then in a classic consulting case interview.

IKEA's Cost Leadership Strategy

IKEA is a masterclass in using the value chain to build an unshakeable cost advantage. The company’s entire model is built around systematically cutting costs and adding value in places competitors don't even think to look.

Two of its primary activities, in particular, reveal this genius:

- Operations: Instead of shipping bulky, pre-assembled furniture, IKEA redesigned its products for flat-pack delivery. This single move dramatically slashes manufacturing, storage, and shipping costs. In effect, the assembly work is outsourced to the customer, turning what would be a huge operational expense into a core part of the IKEA brand experience.

- Outbound Logistics: Forget home delivery. IKEA customers typically drive to massive, out-of-town warehouses, pick the items themselves from the shelves, and handle their own transport. This completely sidesteps last-mile delivery costs, which are often the most expensive link in the entire logistics chain.

By rethinking these two key activities, IKEA engineered a cost structure that its rivals find nearly impossible to copy. This isn't just about being cheap; it's a deliberate, strategic dismantling of how traditional furniture retail works.

This kind of strategic thinking is even more critical with the rise of global value chains (GVCs). Since the 1990s, companies have been disaggregating their operations worldwide. By 2015, the trade of intermediate goods in electronics GVCs hit 52%, dwarfing the 28% seen in traditional goods. This global integration lets companies optimize every single step. For finance professionals, this is gold; upgrading a supplier's role in a value chain can boost its enterprise value by 15-25%. For more on this, check out the latest global value chain research and its economic impacts.

Consulting Interview Case: The Grocery Chain

Now, let's put you in the hot seat. Imagine you're in a high-stakes consulting interview and get this prompt: "Your client, a regional grocery chain, is losing market share. How would you use value chain analysis to figure out why?"

A solid candidate won't just list Porter's five activities. They'll use the framework to form sharp, testable hypotheses and guide their investigation.

Candidate Response: "Great, thanks for the prompt. To figure out why the client is losing market share, I’d use a value chain analysis to break down their operations and see where they're falling behind competitors. I'd start by focusing my investigation on three specific areas: Procurement, Inbound Logistics, and Firm Infrastructure."

This kind of structured opening immediately tells the interviewer you're thinking logically. From here, a great candidate would start digging deeper with pointed questions.

1. Probing Procurement and Inbound Logistics

- "First, let's look at Procurement. How do our supplier deals and purchase volumes stack up against the competition? Are we getting the same discounts on key products? Even a 2% cost difference here could explain the entire margin gap."

- "Next, for Inbound Logistics, I’d want to know about freshness and spoilage. Do our competitors have a faster 'farm-to-shelf' time? I’d ask: what is our spoilage rate as a percentage of COGS, and how does that compare to the industry average of 5-7%?"

2. Analyzing Firm Infrastructure

- "Finally, I'd examine Firm Infrastructure, which includes the in-store experience. How is the store layout? Is our checkout process slower than rivals? A clunky in-store experience is a direct hit to customer loyalty and how often they come back."

3. Synthesizing for a Killer Recommendation

After gathering the data, the candidate pulls it all together for a clear, actionable recommendation.

"Based on my initial questions, it looks like the core issue isn't our pricing—it's our fresh produce supply chain. Our spoilage rate is 9%, which is well above the industry benchmark. This not only kills our margins but also hurts how customers see our quality. I would recommend we pilot a new sourcing model with local farms for our fastest-selling produce. This could cut inbound time by 48 hours and drastically reduce spoilage."

This is what a mastery of value chain analysis looks like. It’s not an academic checklist; it’s a diagnostic tool used to dissect a business, find the weakest link, and propose a focused, data-backed solution.

Common Mistakes to Avoid in Interviews

Knowing the theory of value chain analysis is one thing. Applying it cleanly under the pressure of a case interview is what separates the top candidates from the rest of the pack. So many smart applicants stumble, not because they don't know the framework, but because they fall into a few predictable traps.

Think of this section as your field guide to sidestepping those common pitfalls. We'll walk through the critical mistakes that can downgrade a great answer to a mediocre one, so you can deliver your analysis with the kind of impact that gets you the offer.

Moving Beyond Generic Frameworks

The most common mistake? Just reciting the list of primary and support activities without anchoring them to the specific company or industry in the case. An interviewer has heard the textbook definition a thousand times. They want to see you use the framework as a real-world diagnostic tool.

Simply saying, "we need to analyze their operations," is far too vague—it doesn't add any real value. You have to get specific. A weak analysis sounds like it could apply to any company, while a strong one is grounded in the operational realities of the business at hand.

Before (Weak): "The company should improve its operations to cut costs."

After (Strong): "For this fast-fashion retailer, 'Operations' is all about the speed of their design-to-production cycle. We need to find out if they can slash their lead time from six weeks to three, which would put them on par with an industry leader like Zara. That single change would cut inventory risk and make them much more responsive to new trends."

See the difference? We moved from a generic statement to a specific, measurable recommendation that shows true business sense.

Failing to Connect Analysis to Financials

Here's another classic error: performing a great operational analysis but failing to connect it to the client's bottom line. Every single insight you pull from the value chain has to eventually tie back to either boosting revenue or cutting costs. If you can't quantify the potential financial impact, your analysis is only half-done.

It's not enough to spot a bottleneck in inbound logistics. You have to take the next step and estimate what that bottleneck is costing the company and what the financial prize would be for fixing it.

Key Takeaway: Always ask yourself, "So what?" What does this operational weakness or marketing strength actually mean for the company's P&L? If you can't answer that question, you haven't finished the job.

For example, understanding a company's place in global value chains (GVCs) can reveal huge financial levers. The World Bank's Global Value Chain Development Report found that from 1995-2015, developing nations participating in GVCs grew exports by 4.2% annually, blowing past the 2.8% for non-participants. You could use a similar insight in a case, like analyzing a pharma GVC where shifting final assembly to India could unlock 15% in cost savings—a direct hit to the bottom line. You can learn more from the World Bank's findings on global value chains.

Overlooking Interdependencies Between Activities

Candidates often treat each activity like a separate silo, completely forgetting that the value chain is an interconnected system. The real insights—the "aha!" moments—often live in the connections between activities, where a change in one area creates powerful ripple effects across the entire business.

For instance, a company's HR strategy (a support activity) has a direct and profound impact on its customer service team (a primary activity).

- Before (Weak): "The company has high employee turnover in its call centers."

- After (Strong): "The high turnover driven by HR's current compensation plan is leading to poorly trained service agents. That's increased average call resolution times by 40%, which is directly damaging customer loyalty and lifetime value—a critical component of our 'Service' activity."

When you start connecting these dots, you elevate your analysis from a simple framework recitation to a powerful, data-driven strategic recommendation. This is how you show the top firms you have the analytical horsepower they're looking for.

Frequently Asked Questions About Value Chain Analysis

As you start working with the value chain framework, you’ll naturally run into a few common questions. Nailing down the answers to these is what separates a textbook definition from the kind of practical understanding that gets you hired.

This section tackles the most common queries I hear, helping you move from simply knowing the framework to truly understanding it.

What Is the Difference Between a Value Chain and a Supply Chain?

This is probably the single most common point of confusion, but the distinction is actually quite simple: it all comes down to scope.

A supply chain is just one piece of the puzzle. It’s all about the physical journey of a product—the logistics of moving raw materials into a factory and getting finished goods out to the customer. It's the "how it gets from A to B" part of the business.

A value chain, on the other hand, is the entire story. It includes the full supply chain, but it also covers every other activity that adds value along the way. Think R&D that makes the product innovative, marketing that creates a desirable brand, and customer service that builds loyalty.

- Supply Chain: Answers how a product moves. It's a logistical sequence.

- Value Chain: Answers why a customer will pay for it. It’s a strategic sequence.

A supply chain is tactical. A value chain is strategic. Getting them mixed up in an interview is a classic mistake.

The easiest way to remember it: a supply chain is about moving things efficiently. A value chain is about creating a competitive advantage at every single step.

Can Value Chain Analysis Be Used for Service or Tech Companies?

Yes, absolutely. While Porter’s original language sounds like it was written for a car factory, the core principles apply to any business. You just need to translate the concepts.

For a service or technology firm, the "activities" just look a little different. Take a modern SaaS (Software-as-a-Service) company, for example:

- Inbound Logistics: Instead of truckloads of steel, this might be acquiring data feeds, integrating third-party APIs, or licensing essential software.

- Operations: This is the heart of the business—the software development lifecycle. It's all about writing code, running quality assurance tests, and managing the cloud infrastructure.

- Outbound Logistics: How do you "ship" software? This becomes the customer onboarding process, provisioning new accounts, and ensuring rock-solid server uptime.

- Marketing & Sales: Think content marketing, SEO, digital ad campaigns, and the sales team that turns free trials into paying customers.

- Service: This is your customer success team, the helpdesk, technical support, and the knowledge base that helps users help themselves.

The support activities are just as crucial. HR finds the coding talent, procurement negotiates software contracts, and technology development (R&D) builds the next big feature. The framework is incredibly flexible once you learn to see past the manufacturing-era labels.

What Are the Biggest Limitations of This Framework?

Value chain analysis is a powerful tool, but it's not a magic wand. Its biggest weakness is its internal focus. The entire framework is designed to help a company look inward and optimize its own operations.

By itself, it tells you nothing about what’s happening outside your company walls—like what competitors are doing, how customer tastes are changing, or new government regulations.

That’s why you almost never use it in isolation. It’s most powerful when paired with other tools that provide that crucial external perspective.

- Porter's Five Forces: This gives you the industry-level view, analyzing competitive rivalry, the threat of new players, and the power of your suppliers and buyers.

- SWOT Analysis: This helps you directly connect your internal strengths and weaknesses (which you just found with your value chain analysis!) to the external opportunities and threats in the market.

Relying only on value chain analysis is a recipe for creating a perfectly efficient business that's making a product for a market that no longer exists. Its real strength is as a diagnostic tool, not as a complete, standalone strategy.

Ready to stop memorizing frameworks and start mastering them? Soreno is the AI-powered interview coach that helps you apply concepts like value chain analysis in realistic, challenging case interviews. Get instant, rubric-based feedback on your structure, numeracy, and business insight to pinpoint weaknesses and accelerate your prep. Stop practicing in theory and start performing under pressure.