Top Venture Capital Interview Questions to Prepare in 2025

Discover essential venture capital interview questions to help you succeed. Master key tips and stand out in your next venture capital interview.

Landing a role in venture capital is notoriously competitive. It's a field where sharp analytical skills, deep market intuition, and compelling storytelling converge. Your interviews are the ultimate test of this unique blend, demanding more than just reciting financial formulas or industry buzzwords. Success hinges on demonstrating a genuine investor's mindset: the ability to identify disruptive trends, evaluate founding teams with conviction, and articulate a clear investment thesis under pressure.

While many articles list common questions, this guide goes deeper. We are breaking down the eight most pivotal venture capital interview questions that truly separate top candidates from the rest. Think of this not just as a list, but as a strategic playbook designed to help you navigate the high-stakes conversations that lead to an offer. We will dissect the 'why' behind each prompt, moving beyond surface-level advice to provide structured frameworks for crafting compelling, memorable answers.

For each core question, you will find:

- The Interviewer's Goal: What the firm is really trying to assess.

- A Strategic Framework: A step-by-step approach to structure your response.

- Sample Answer Snippets: Concrete examples to illustrate strong delivery.

- Common Pitfalls: Critical mistakes to avoid that often disqualify candidates.

Whether you are transitioning from finance, consulting, or an operator role, mastering these questions will equip you with the confidence and substance needed to impress any investment committee. Let’s dive into the questions that will define your candidacy and help you secure your place in VC.

1. Walk Me Through Your Investment Process

This is one of the most fundamental venture capital interview questions because it directly evaluates your structured thinking and investment philosophy. Interviewers aren't just looking for a good answer; they want to see a systematic, repeatable framework that demonstrates you can handle the core function of a VC role: evaluating and selecting high-potential startups.

Your response should prove you have a clear, logical methodology for moving a company from an initial introduction to a signed term sheet and beyond. A weak answer is unstructured and focuses only on one aspect, like the product. A strong answer is a chronological narrative covering sourcing, diligence, decision-making, and post-investment support.

Deconstructing the Investment Process

A comprehensive answer breaks the process down into distinct, logical phases. You need to show how you filter the vast universe of potential deals down to a few exceptional opportunities.

- Sourcing & Screening: Where do you find deals? This could be through your network, inbound leads, thematic research, or demo days. Explain how you perform an initial screen based on the firm’s thesis, checking for fit in terms of sector, stage, and geography. At this stage, you're quickly assessing the team, market size (TAM/SAM/SOM), and initial product-market fit signals.

- Due Diligence: Once a company passes the initial screen, what's next? Detail your diligence process. This includes financial modeling (unit economics, cohort analysis), market analysis (competitive landscape, defensibility), customer calls, and deep dives into the technology. Mention both quantitative metrics and qualitative factors, like founder resilience and team dynamics.

- Decision & Execution: How is the final "yes" or "no" reached? Describe the investment committee (IC) process, how you prepare an investment memo, and how you articulate your recommendation. This demonstrates you understand the internal mechanics of a VC fund.

Pro Tip: Don't just list the steps. Weave in a brief, anonymized example of a deal you analyzed. For instance, "When I looked at a B2B SaaS company last year, our initial screen focused on ARR and net revenue retention. During diligence, we conducted 15 customer calls which revealed a key risk in their sales cycle, leading us to pass on the deal."

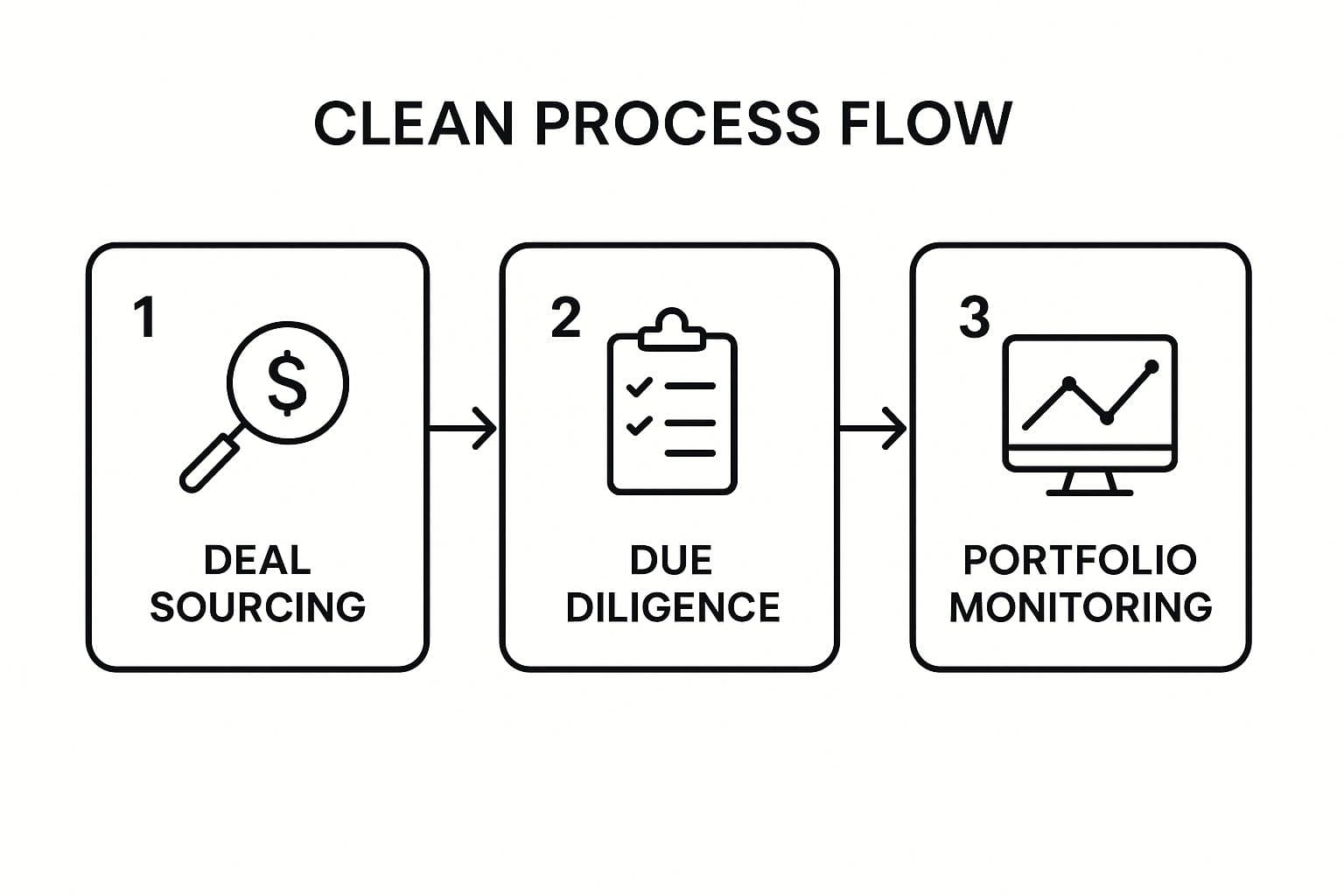

The following diagram illustrates the high-level workflow of a typical venture capital investment process.

This visual flow emphasizes that the investment process is a continuous cycle, moving from initial discovery and rigorous analysis to active management after the investment is made.

For a deeper dive into crafting your narrative for this crucial question, the video below offers excellent insights and examples.

2. Tell Me About a Recent Investment You Would Have Made (or Did Make)

This is one of the most critical venture capital interview questions, as it shifts from theory to application. It’s a direct test of your investment acumen, sector knowledge, and ability to articulate a compelling investment thesis. The interviewer wants to see if you can think like a VC, identifying and defending a real-world opportunity with rigor.

Your response reveals your proactive research, your understanding of market trends, and your ability to construct a persuasive narrative around a company. A weak answer is superficial, lacking key metrics and a clear thesis. A strong answer is a well-structured pitch that demonstrates you’ve done your homework and can defend your position against scrutiny.

Deconstructing Your Investment Pitch

A successful response is structured like a mini investment memo, guiding the interviewer through your logic from the big picture down to the specific risks. You must show a clear, defensible reason for why this company, in this market, at this time, is a generational opportunity.

- The Setup (Company & Market): Start with a concise overview. What does the company do? What problem does it solve? Define the market opportunity, including the TAM (Total Addressable Market), and articulate the “why now?” What macro trend or technological shift makes this the perfect time for this solution to succeed?

- The Core Thesis (Traction & Moat): This is the heart of your pitch. Present the company's traction, using specific metrics like user growth, revenue, or engagement. Crucially, explain the company’s competitive advantage or “moat.” Is it network effects, proprietary technology, a unique go-to-market strategy, or an exceptional team? This shows you can identify defensible business models.

- The Reality Check (Risks & Diligence): No investment is perfect. Acknowledge the key risks, such as competition, execution challenges, or market adoption hurdles. Then, briefly mention the due diligence you would conduct to get comfortable with these risks, such as customer reference calls or technical diligence. This demonstrates mature investment judgment.

Pro Tip: Structure your answer like a story. For example, "I've been following the vertical SaaS space and found a company called [Company Name] that's digitizing the logistics for mid-sized bakeries. Their current traction shows 20% month-over-month growth, but the key risk is their high customer acquisition cost. My next step would be to call 10 of their customers to validate the product's ROI."

This structured approach is similar to how deals are assessed in later-stage investing, requiring a detailed analysis of a company's financial health and strategic position. You can explore these advanced evaluation techniques in this comprehensive private equity interview guide.

3. How Do You Source Deal Flow?

This is a classic venture capital interview question designed to assess your proactivity, networking skills, and ability to generate proprietary deal flow. In a world where capital is abundant, the ability to find and access the best, often non-obvious, investment opportunities before anyone else is a VC’s superpower. Interviewers want to know if you can be a magnet for high-quality founders, not just a passive analyst.

A weak answer is generic, relying on "inbound leads" or "my network." A strong answer provides a specific, multi-channel strategy that demonstrates hustle, domain expertise, and a clear plan for building relationships. It shows you understand that sourcing isn't just a task; it’s a continuous, strategic effort that defines a firm's success.

Deconstructing Your Sourcing Strategy

A compelling answer breaks down your sourcing into a deliberate and repeatable framework. You should showcase a blend of both outbound (proactive) and inbound (reactive) methods, tailored to the firm’s investment thesis.

- Proactive & Thematic Sourcing: This demonstrates strategic thinking. Explain how you identify attractive market sub-sectors and then systematically map out the key companies, founders, and experts within them. This could involve building relationships with technical talent in open-source communities, attending niche industry conferences, or reaching out to PhDs commercializing their research.

- Network-Driven Sourcing: Who do you know, and how do you leverage them? Detail your relationships with other VCs, angel investors, founders, and industry operators. The key is to explain how you build and maintain these relationships so they become a source of warm, qualified introductions. This could involve hosting founder dinners or developing a scout program with former entrepreneurs.

- Inbound & Brand-Building: How do you get founders to come to you? This is where thought leadership comes in. Discuss publishing sector-specific research on platforms like Substack or Medium, being active on Twitter/X, or speaking on podcasts. This positions you as an expert and attracts relevant founders who see you as a value-add partner.

Pro Tip: Structure your answer around a "funnel" concept. For instance, "My sourcing strategy is a three-pronged funnel. The top of my funnel is broad, driven by thematic research and content I publish on AI in healthcare. The middle is about qualifying these leads by building relationships with founders well before they fundraise. The bottom of the funnel consists of warm introductions from my curated network of repeat founders and angels, which represent my highest-priority deals."

4. What Makes a Great Founder/Team?

This is one of the most critical venture capital interview questions because it probes your understanding of the most important asset in any early-stage company: the people. At the pre-seed or seed stage, there are few metrics, an unproven product, and a volatile market. The founding team is often the only constant, and their ability to execute, adapt, and lead is the primary driver of future success.

Your answer must demonstrate that you can assess human capital beyond a resume. A weak response lists generic traits like "passion" and "hard-working." A strong answer provides a framework for evaluating founder DNA, supported by specific examples and an understanding of how different qualities manifest in a high-pressure startup environment.

Deconstructing Founder DNA

A complete answer will balance aspirational qualities with tangible, observable attributes. You need to show how you would identify these traits during diligence calls and meetings.

- Founder-Market Fit: This is the bedrock. Does the founder have a unique, earned insight into the market they are targeting? This often comes from deep personal or professional experience with the problem they are solving. Think of Melanie Perkins at Canva, whose experience teaching design software revealed the need for a simpler, more accessible tool.

- Grit & Resilience: How does the team handle adversity? Startups are a series of near-death experiences. You should look for evidence of perseverance in a founder's past, whether in previous ventures, academic pursuits, or personal challenges. This quality is what separates those who fold from those who pivot and find a way forward.

- Vision & Storytelling: A great founder must be a compelling evangelist. They need to articulate a clear, ambitious vision that can attract top talent, persuade early customers, and, of course, convince investors. This isn't just about a polished pitch; it's about an authentic and magnetic ability to make others believe in a future that doesn't exist yet.

Pro Tip: Structure your answer by outlining your "founder scorecard." For example: "I evaluate founders across three key pillars: Founder-Market Fit, Execution Capability, and Leadership Potential. For Founder-Market Fit, I look for an 'earned secret' about the industry. For Execution, I probe for a bias toward action and data-driven decision-making. And for Leadership, I assess their ability to recruit A-plus talent."

A great founder combines technical or market expertise with an unwavering drive and the charisma to build a movement. Show your interviewer you know how to spot this rare combination.

5. How Do You Value an Early-Stage Company?

This is a classic technical question among venture capital interview questions, designed to test your blend of financial acumen and practical market knowledge. Interviewers know that valuing a pre-revenue or early-revenue startup is more art than science, as traditional methods like DCF are often irrelevant. They want to see that you understand the key drivers and methodologies used in the real world to arrive at a defensible valuation.

Your response should demonstrate that you grasp the qualitative and quantitative factors at play. A weak answer relies on a single metric or vague market sentiment. A strong answer synthesizes multiple valuation approaches, acknowledges the subjectivity involved, and connects the valuation back to the fund's specific ownership targets and portfolio construction strategy.

Deconstructing Early-Stage Valuation

A comprehensive answer shows you can triangulate a valuation using several reference points, rather than relying on a rigid formula. You need to prove you can justify a number based on market data, company-specific factors, and the deal's structure.

- Comparable Analysis (Comps): This is the most common method. Explain how you would look at recent, similar deals in the same sector, stage, and geography. For example, a pre-revenue B2B SaaS company might raise a seed round at a $10-25M post-money valuation, while a similar company with early traction (e.g., $1M ARR) might command a $30-80M valuation at Series A.

- Market-Based Multiples: For companies with revenue, you can apply industry-standard multiples. A growth-stage marketplace might be valued at 15-25x its annual revenue, whereas a high-margin SaaS business could see multiples of 10-20x its Annual Recurring Revenue (ARR). Mentioning specific, realistic ranges shows you are in touch with current market conditions.

- Founder-VC Negotiation Dynamics: A sophisticated answer acknowledges that valuation is often a negotiation. Discuss how factors like the "hotness" of a deal, the number of competing term sheets, and the founders' track records can heavily influence the final number. It’s also about what the market will bear.

Pro Tip: Always connect the valuation back to ownership. State that VCs often work backwards, asking, "How much do we need to invest to get our target ownership of 15-20%?" This often sets the valuation. For instance, a $3M investment for a 20% stake implies a $12M pre-money and $15M post-money valuation.

Valuing startups is a core skill that bridges finance and strategy. For a broader look at related topics, you can find more examples of finance interview questions and answers here. This context will help you build a more robust framework for tackling valuation discussions.

6. Why Are you Interested in Venture Capital?

This is one of the most critical venture capital interview questions because it probes your fundamental motivations and cultural fit. Interviewers use this question to separate candidates who have a romanticized view of VC from those who genuinely understand the industry's realities and are committed to its mission. They want to know if your interest is superficial or rooted in a deep-seated passion for technology and entrepreneurship.

Your response must be authentic and connect your personal story to the core functions of venture capital. A weak answer is generic, citing glamour or a desire to "work with smart people." A strong answer demonstrates a clear understanding of the role, aligns your past experiences with VC skills, and shows you've done your homework on the specific firm.

Deconstructing Your "Why VC" Story

A compelling narrative links your past, present, and future, showing why VC is the logical and passionate next step for you. It's not just about what you want to gain, but what you can contribute.

- Connect Your Past Experiences: Don't just list your resume. Explain how your experiences (whether in operating roles, finance, or founding a startup) gave you unique insights and a desire to support entrepreneurs. Frame your background as a training ground that prepared you to identify, evaluate, and assist high-growth companies.

- Show You Understand the Job: Acknowledge the realities of VC. Mention that it’s a service-oriented job focused on empowering founders. Show you know that the work involves long feedback loops, requires comfort with uncertainty, and involves saying "no" far more often than "yes." This demonstrates maturity and realistic expectations.

- Articulate Your Long-Term Vision: Explain where you see yourself in 10 years within the venture ecosystem. This shows the interviewer you’re not just looking for a two-year stint before moving on. Your long-term ambition should align with the apprentice-like nature of a career in venture capital, proving you're in it for the right reasons.

Pro Tip: Make it personal and specific to the firm. Instead of saying "I'm passionate about technology," say "My experience building go-to-market strategies for AI-powered logistics companies at my last job directly aligns with your firm's thesis in the future of supply chain, and I was particularly impressed by your investment in [Portfolio Company X]."

For a deeper look at how to structure this personal narrative, the video below provides an excellent framework for answering motivational questions.

7. What Trends or Sectors Are You Most Excited About?

This is one of the most revealing venture capital interview questions, as it tests your intellectual curiosity, market awareness, and ability to develop a forward-looking investment thesis. Interviewers want to see that you are not just a passive observer of technology but an active thinker who can identify nascent opportunities, connect disparate dots, and articulate a compelling vision for the future.

Your answer should go far beyond simply naming a hot sector like AI or climate tech. A strong response demonstrates deep, independent research and a unique perspective. It proves you can think like a partner by identifying specific, investable themes that align with the firm's strategy while also showcasing your own original insights.

Deconstructing Your Sector Thesis

A compelling answer requires a structured narrative that explains the "what," the "why," and the "why now." You need to show the interviewer that your excitement is backed by rigorous analysis, not just by headlines.

- Identify Your Conviction Areas: Choose two or three specific trends you can discuss with genuine depth. Instead of just "FinTech," narrow it down to "embedded insurance for vertical SaaS platforms" or "AI-powered compliance tools for regional banks." Specificity signals expertise.

- Articulate the "Why Now": What macro-level shifts (technological, regulatory, societal) make this trend an exceptional investment opportunity today? For example, advancements in LLMs, new data privacy regulations, or changing consumer behaviors could be key catalysts.

- Outline the Opportunity & Risks: Show a balanced perspective. Detail the potential market size (TAM), the business models that could thrive, and the moats companies can build. Crucially, also address the key risks, competitive threats, and potential roadblocks. This demonstrates critical thinking.

Pro Tip: Structure your answer like a mini investment thesis. Start with the high-level trend, explain the market drivers, identify a specific problem or unmet need, and then mention a few (real or hypothetical) startups that exemplify the solution. For instance, "I'm excited about the application of generative AI in drug discovery. While the macro trend is obvious, the specific opportunity I see is in platforms that de-risk preclinical trials. Companies like X and Y are tackling this by..."

Answering this question effectively is similar to the structured problem-solving required in other high-stakes fields. Developing this kind of thesis-driven mindset is crucial, and resources explaining how to break into consulting can provide a solid foundation for building these analytical communication skills.

For more guidance on how to identify and articulate compelling investment theses, the video below from Accel provides a partner's perspective on what makes a sector exciting.

8. Tell Me About a Company in Our Portfolio (or a Recent Deal We Did)

This is one of the most critical preparation-based venture capital interview questions. It’s a direct test of your genuine interest in the specific firm you're interviewing with. A generic answer reveals a lack of effort, while a thoughtful response shows you’ve done your homework, can think like an investor, and are truly motivated to join their team.

Interviewers use this question to gauge your research skills, analytical abilities, and alignment with their investment thesis. They want to see if you can reverse-engineer their decision-making process and articulate why a particular company was a compelling investment for them. A weak answer simply regurgitates the company’s "About Us" page. A strong answer is a concise analysis of the deal, touching on the market, team, product, and timing.

Deconstructing a Portfolio Company

Your goal is to present a mini-investment thesis for a company the firm has already backed. This requires you to look beyond the surface-level details and connect the investment back to the firm's strategy.

- Select & Research: Before the interview, choose 3-5 portfolio companies that genuinely interest you. Focus on recent investments or those that align with the specific partner you are meeting. Read the firm's blog post announcing the deal, news articles, and any public statements from the partner who led the round.

- Form Your Thesis: Explain why you believe the firm invested. Was it the exceptional founding team (e.g., the Collison brothers at Stripe)? Was it a bet on a massive, emerging market (e.g., mobile-first marketplaces with Uber)? Or was it perfect timing for a new technology trend (e.g., API-first B2B software)?

- Analyze & Critique: A top-tier answer doesn't just praise the investment. It also acknowledges potential risks or challenges. Discuss the competitive landscape, potential execution hurdles, or key metrics the company must hit to succeed. This demonstrates balanced, critical thinking.

Pro Tip: Frame your analysis from the perspective of an investor on their team. Conclude by mentioning how you would try to add value if you were on the board. For example, "What excites me about their investment in [Company X] is the bet on the creator economy. If I were involved, I'd focus on helping them build out their B2B partnerships by leveraging my network in the media space."

8 Key Venture Capital Interview Questions Comparison

| Question / Topic | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Walk Me Through Your Investment Process | Medium to High: Multi-step systematic flow | Moderate: Analytical tools and frameworks needed | Clear demonstration of structured thinking and process clarity | Evaluating investment approach and due diligence skills | Shows comprehensive VC process knowledge |

| Tell Me About a Recent Investment You Made | Medium: Requires deep case preparation | High: In-depth research and investment memos | Demonstrates investment judgment and industry insight | Showcasing personal investment thesis and acumen | Highlights sector knowledge and decision defense |

| How Do You Source Deal Flow? | Medium: Continuous networking and outreach | High: Extensive relationship-building effort | Reveals proactive sourcing ability and network strength | Assessing deal origination skills | Emphasizes entrepreneurial mindset and hustle |

| What Makes a Great Founder/Team? | Low to Medium: Qualitative assessment | Low: Mostly observation and experience-based | Demonstrates ability to judge talent fit and leadership | Talent evaluation and founder assessment | Focuses on human factors critical to early-stage VC |

| How Do You Value an Early-Stage Company? | Medium: Requires financial modeling skills | Moderate: Financial data and market comps | Shows valuation methodology knowledge and pragmatism | Early-stage investment appraisal | Balances quantitative rigor with VC realities |

| Why Are You Interested in Venture Capital? | Low: Reflective and motivational answer | Low: Self-reflection and firm research | Exhibits genuine motivation and culture fit | Understanding candidate's VC commitment and fit | Demonstrates long-term career vision and authenticity |

| What Trends or Sectors Are You Most Excited About? | Low to Medium: Market research and synthesis | Moderate: Trend analysis and supporting data | Demonstrates market awareness and independent thinking | Testing insight into emerging investment themes | Showcases unique perspectives and proactive learning |

| Tell Me About a Company in Our Portfolio | Medium: Requires company and firm research | Moderate: Deep firm-specific research | Shows firm knowledge and critical investment thinking | Testing candidate’s research skills and firm alignment | Validates preparation and investment insight |

From Preparation to Partnership: Your Next Steps

Navigating the landscape of venture capital interview questions is less about memorizing formulas and more about demonstrating a specific, investor-oriented mindset. The questions we've explored, from walking through your investment process to dissecting a portfolio company, are all designed to test the same core attributes: your intellectual curiosity, your ability to build and defend a thesis, and your genuine passion for technology and entrepreneurship.

Success in these interviews doesn't come from having a single "correct" answer. Instead, it comes from showcasing a repeatable, rigorous framework for thinking. It's about proving you can move beyond surface-level analysis and connect disparate dots to form a unique, compelling investment perspective. The best candidates don't just know the trends; they can articulate why those trends are creating specific, venture-scale opportunities right now.

Key Takeaways: Beyond the Questions

As you refine your preparation, remember these foundational principles that underpin every question you'll face:

- Thesis-Driven Thinking is Paramount: Every answer, whether about a market trend or a specific startup, should be rooted in a clear, defensible thesis. Why this market? Why this team? Why now? This demonstrates you think like an investor, not just an analyst.

- Show, Don't Just Tell: Instead of saying you're passionate about a sector, prove it by discussing specific companies, founders, and technological shifts. When asked about your investment process, illustrate it with a concrete example of a company you've analyzed.

- Proactivity is the Ultimate Signal: The ability to source unique deal flow is a VC superpower. Highlighting how you build your network, track emerging trends, and identify promising companies before they become obvious is a powerful way to stand out.

Your Actionable Roadmap to Interview Success

Mastering the theory behind these venture capital interview questions is the first step. The second, more critical step, is putting that theory into practice. Your goal is to internalize these frameworks so they become second nature, allowing your authentic personality and unique insights to shine through.

To bridge the gap between preparation and performance, focus on these next steps:

- Develop Your "Personal Monopoly": Choose one or two specific sectors or technology trends that genuinely excite you. Go deeper than anyone else. Follow the key founders, read the technical papers, use the emerging products, and form a truly differentiated point of view. This will be your wellspring of examples and insights.

- Build Your Investment Memos: Don't just think about companies; write about them. For three to five startups you find interesting (one you'd invest in, one you'd pass on, and one on the fence), write a one-page investment memo. This forces you to crystallize your thinking on the team, product, market, and risks.

- Pressure-Test Your Narratives: Rehearse your answers out loud. Record yourself. The story you tell about your interest in VC, your investment philosophy, and your sector theses needs to be sharp, concise, and compelling. Practice articulating complex ideas in a simple, memorable way.

Ultimately, a venture capital interview is a conversation aimed at answering one fundamental question: "Would I want to be a partner with this person for the next ten years?" Every answer you give contributes to their conclusion. Your preparation isn't just about passing a test; it's about proving you have the raw materials-the intellectual horsepower, the drive, and the interpersonal skills-to become a trusted partner to both the firm and the founders you'll one day back.

Ready to move from theory to real-world practice? The best way to build confidence and refine your answers to these critical venture capital interview questions is through realistic, targeted practice. Soreno offers an AI-powered platform that simulates the VC interview experience, providing you with instant, detailed feedback on your communication, structure, and content. Start your preparation today at Soreno and turn your knowledge into a compelling performance.