Top 10 Finance Interview Questions and Answers for 2025

Ace your next interview with our expert guide to the top finance interview questions and answers. Covers DCF, LBO, valuation, and more for 2025.

Stepping into a high-stakes finance interview can feel daunting. From investment banking to private equity, the technical questions are designed to test not just what you know, but how you think. The ability to articulate complex financial concepts clearly and logically under pressure is the core skill every firm is evaluating. This guide provides a comprehensive breakdown of the most critical finance interview questions and answers, equipping you with the structured frameworks and deep understanding needed to demonstrate your analytical prowess.

We will move beyond rote memorization. For each question, you'll find a step-by-step approach, key concepts to emphasize, and common pitfalls to avoid. You will learn not just what to say, but why it matters in a practical business context. This list covers the foundational pillars of finance, including company valuation methods like Discounted Cash Flow (DCF), the interconnectedness of the three financial statements, and the mechanics of a Leveraged Buyout (LBO).

Mastering these core concepts is non-negotiable for anyone targeting a role in investment banking, private equity, or corporate finance. The goal is to provide you with a toolkit to handle any technical query with confidence and precision. Whether you are an undergraduate student seeking an internship or an experienced professional making a career pivot, the detailed answers and strategic advice in this article will help you prepare effectively and stand out from the competition. Let’s dive into the essential questions you need to master.

1. Walk Me Through a DCF (Discounted Cash Flow) Analysis

This question is a cornerstone of finance interviews, acting as a direct test of your core valuation skills. A Discounted Cash Flow (DCF) analysis is a method used to estimate a company's value based on its projected future cash flows. The core principle is that the value of any asset is the sum of its future cash flows, discounted back to their present value.

Interviewers use this question to gauge your understanding of valuation theory, financial modeling, and your ability to articulate a complex process logically and concisely. It’s fundamental for roles in investment banking, equity research, and corporate finance where you might use DCF to value acquisition targets or assess capital budgeting projects.

How to Structure Your Answer

A winning answer walks the interviewer through the process in a clear, step-by-step manner. Don't just list the steps; briefly explain the "why" behind each one.

- Project Unlevered Free Cash Flows (UFCF): Start by projecting the company's free cash flows for a forecast period, typically 5-10 years. UFCF is calculated as EBIT (1 - Tax Rate) + D&A - CapEx - Change in Net Working Capital. This represents the cash available to all capital providers (both debt and equity holders).

- Calculate the Discount Rate (WACC): The discount rate used is the Weighted Average Cost of Capital (WACC). This reflects the blended cost of capital for all providers, factoring in the cost of equity and the after-tax cost of debt. It represents the riskiness of the cash flows.

- Determine Terminal Value: Since a company operates beyond the forecast period, you must estimate its value at the end of that period. This can be done using the Perpetuity Growth Method (assuming a stable, long-term growth rate) or the Exit Multiple Method (applying a valuation multiple like EV/EBITDA to the final year's metric).

- Discount and Sum: Discount the projected UFCF and the Terminal Value back to the present using the WACC. The sum of these present values gives you the Enterprise Value (EV). To get to Equity Value, you would subtract net debt from the EV.

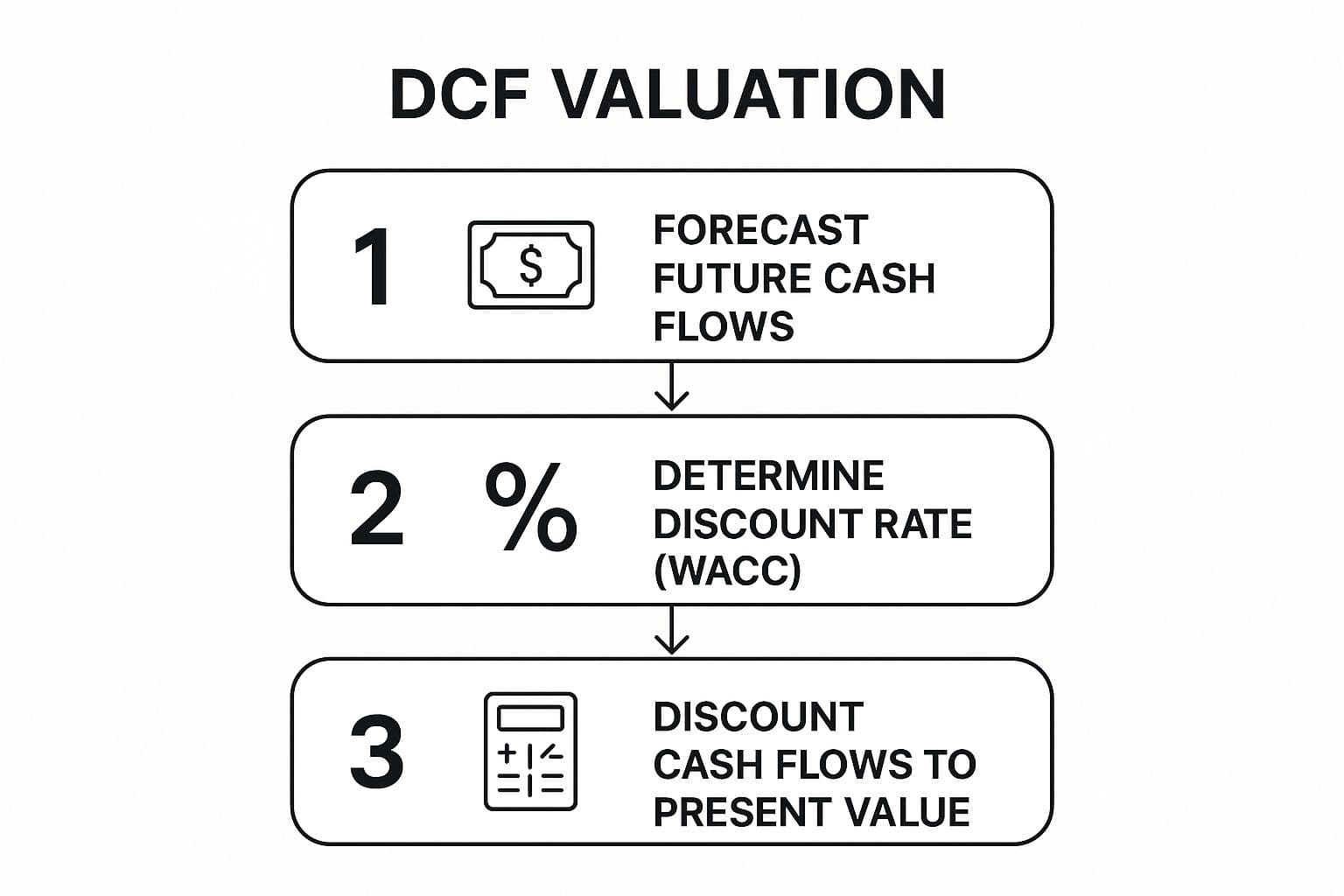

The following infographic illustrates the high-level workflow for conducting a DCF analysis.

This process flow visualizes the logical sequence, from forecasting future performance to calculating a final present value, which is central to a strong DCF explanation.

2. What Are the Three Financial Statements and How Are They Connected?

This question tests your fundamental accounting knowledge, a non-negotiable skill in any finance role. Interviewers want to see that you understand the bedrock of financial reporting before moving on to more complex topics like valuation or M&A. The three core financial statements are the Income Statement, the Balance Sheet, and the Statement of Cash Flows.

A strong answer not only names them but also clearly articulates how they dynamically interact with each other. This is crucial for roles in investment banking, corporate finance, and accounting, where building and interpreting financial models is a daily task. Demonstrating this understanding shows you can see the complete financial picture of a company, not just isolated data points.

How to Structure Your Answer

Your goal is to explain the links logically. Start by defining each statement, then use a key line item like Net Income to trace the connections through all three.

- Define the Three Statements: Briefly describe each statement's purpose. The Income Statement shows profitability over a period (e.g., a quarter or year). The Balance Sheet provides a snapshot of assets, liabilities, and equity at a single point in time. The Statement of Cash Flows reconciles the net income to the actual change in cash over the same period.

- Explain the Primary Link (Net Income): Net Income, the bottom line of the Income Statement, is the starting point for the Statement of Cash Flows. It also flows into the Retained Earnings account within Shareholders' Equity on the Balance Sheet, thus linking the period's performance to the company's cumulative position.

- Trace a Non-Cash Charge (Depreciation): Use an example to solidify the connection. Depreciation is expensed on the Income Statement, reducing Net Income. On the Statement of Cash Flows, it's a non-cash charge that is added back to Net Income. On the Balance Sheet, it reduces the value of Property, Plant & Equipment (PP&E) via Accumulated Depreciation.

- Connect Balance Sheet Changes: Explain that changes in Balance Sheet items, like Accounts Receivable or Inventory (Net Working Capital), are reflected on the Statement of Cash Flows to help reconcile net income to cash flow. The final cash balance on the Statement of Cash Flows becomes the cash balance on the next period's Balance Sheet.

3. How Would You Value a Company?

This is a classic, open-ended question designed to test your breadth of valuation knowledge and your business judgment. Rather than a single right answer, interviewers want to see if you can articulate a comprehensive valuation framework. They are assessing your ability to think critically about which valuation tools are appropriate for different scenarios and your understanding that no single method is perfect.

Interviewers use this question to determine if you can move beyond rote memorization of formulas and think like a true finance professional. A strong answer shows that you understand valuation is both an art and a science, requiring triangulation from multiple methodologies to arrive at a defensible range. This is a must-know for nearly all finance interview questions and answers, especially for investment banking roles.

How to Structure Your Answer

A winning answer frames valuation as a process of triangulation, using multiple methods to create a "football field" chart that shows a range of potential values. Explain that you would use a combination of intrinsic and relative valuation techniques.

- Start with a Summary: Begin by stating that you would use a combination of valuation methodologies to get a comprehensive view, as each has its own strengths and weaknesses. Mention the main three: Comparable Company Analysis, Precedent Transactions, and Discounted Cash Flow (DCF).

- Explain Intrinsic vs. Relative Valuation: Briefly distinguish between the two approaches. Explain that a DCF provides an intrinsic value based on a company's ability to generate cash flow. In contrast, Comps and Precedent Transactions provide a relative value by comparing the company to its peers or to similar M&A deals. This shows a deeper conceptual understanding.

- Detail Each Method: Briefly describe what each of the three main methods entails. For example, for Comps, you would identify similar public companies and trade multiples like EV/EBITDA or P/E. For Precedents, you'd look at recent M&A deals in the industry to see what multiples were paid.

- Consider the Context: A crucial step is to explain that the specific context of the company dictates which methods are most relevant. For a mature, stable company, a DCF might be heavily weighted. For a high-growth tech startup with no profits, you might rely more on revenue multiples from Comps. For an M&A scenario, Precedent Transactions become highly relevant. For a deep dive into valuation in M&A contexts, you can find more on investment banking interview questions.

4. What Happens to the Three Financial Statements When [Specific Transaction Occcurs]?

This question is a classic test of your accounting fundamentals and your grasp of how the three core financial statements are interconnected. Interviewers use it to see if you can think on your feet and trace a single transaction's journey through the Income Statement, Balance Sheet, and Cash Flow Statement.

These finance interview questions and answers are not just about memorization; they reveal your deep, mechanical understanding of accounting. A correct answer demonstrates that you can visualize the double-entry system and understand how one change inevitably affects another. This skill is critical for financial modeling, analysis, and understanding the financial health of a business.

How to Structure Your Answer

The key is a systematic, logical walk-through. State your assumptions (like the tax rate) and move through the statements in order, explaining each impact clearly. Always start with the statement most directly affected by the transaction.

- Start with the Income Statement: Ask yourself if the transaction affects revenue or expenses. If it does, calculate the impact on Net Income. For example, a $100 depreciation expense reduces Pre-Tax Income by $100. Assuming a 40% tax rate, Net Income decreases by $60.

- Move to the Cash Flow Statement: The top line of the CFS is Net Income. Start there, then adjust for any non-cash charges from the Income Statement (like adding back that $100 in depreciation). Finally, account for any actual cash changes in the appropriate section (Investing, Financing, or Operating).

- End with the Balance Sheet: Update the Balance Sheet based on the changes you’ve outlined. Cash will be adjusted based on the net change from the CFS. Net Income flows into Retained Earnings. Other line items like PP&E or Debt are adjusted directly. Crucially, ensure the Balance Sheet still balances (Assets = Liabilities + Shareholders' Equity).

Let's use an example: a company buys a $100 asset with cash.

- Income Statement: No immediate impact.

- Cash Flow Statement: Cash is down $100 from Cash Flow from Investing.

- Balance Sheet: Cash is down $100, and PP&E is up $100. Assets remain unchanged, and the sheet balances.

5. Explain the Difference Between Enterprise Value and Equity Value

This is a fundamental concept in finance, and interviewers ask it to quickly assess your understanding of valuation and capital structure. It tests whether you can distinguish between the value of a company's core operations and the value attributable solely to its shareholders. A clear answer demonstrates a solid theoretical foundation.

Getting this question right shows you understand how a company is financed and how that financing impacts its total worth. It's crucial for roles involving M&A, LBO modeling, and comparable company analysis, where correctly applying valuation multiples like EV/EBITDA versus P/E is non-negotiable.

How to Structure Your Answer

Your response should be structured as a clear, comparative explanation. Define each term, present the formula that links them, and explain the "why" behind each component of the bridge.

- Define Equity Value: Start by explaining that Equity Value (also known as Market Capitalization for public companies) represents the value of the company's assets available only to common shareholders. It's the "sticker price" you would pay to buy all the company's stock.

- Define Enterprise Value: Next, define Enterprise Value as the value of a company's core business operations, available to all capital providers (equity holders, debt holders, preferred stockholders, etc.). It represents the theoretical takeover price of the entire company, independent of its capital structure.

- Provide the Bridge Formula: Walk the interviewer through the formula that connects the two: Enterprise Value = Equity Value + Total Debt + Preferred Stock + Minority Interest - Cash & Cash Equivalents.

- Explain the Key Adjustments: Briefly explain why you make these adjustments. You add debt because a new owner would have to assume it. You subtract cash because it's a non-operating asset that could be used to pay down debt or issue a dividend, effectively reducing the purchase price.

- Connect to Valuation Multiples: Mention that the distinction is critical for valuation. Enterprise Value is paired with unlevered metrics like EBITDA or EBIT (e.g., EV/EBITDA), while Equity Value is paired with levered metrics like Net Income (e.g., the P/E ratio). This ensures an "apples-to-apples" comparison.

6. Walk Me Through an LBO (Leveraged Buyout) Model

This question is a staple in private equity interviews, but it's also common in investment banking and other finance roles that interact with financial sponsors. A Leveraged Buyout (LBO) is the acquisition of a company using a significant amount of borrowed money (debt) to meet the cost of acquisition. The purpose of an LBO model is to determine the potential Internal Rate of Return (IRR) a private equity firm could achieve by acquiring and later selling a company.

Interviewers ask this to test your understanding of how PE firms create value, your grasp of capital structures, and your ability to think through a multi-year investment from entry to exit. It reveals whether you can connect a company's operations and cash flows to its financing structure and ultimate investment returns. Mastering this is crucial, and a comprehensive private equity interview guide can provide additional depth on this topic.

How to Structure Your Answer

A clear, chronological answer that walks from the initial purchase to the final sale is most effective. Explain each phase of the transaction logically.

- Assumptions and Entry: Start with the purchase assumptions. This includes the purchase price (often based on an EV/EBITDA multiple), and the financing structure, which is detailed in a "Sources and Uses" table. Sources show where the money comes from (e.g., various debt tranches, sponsor equity), while Uses show where it goes (e.g., acquiring equity, transaction fees).

- Financial Projections and Debt Paydown: Next, project the company's financial statements for the holding period (typically 3-7 years). The key is to project the free cash flow, which will be used to operate the business and, crucially, to pay down the acquisition debt. This deleveraging is a primary driver of equity value creation.

- Exit and Returns Calculation: Finally, determine the exit value. This is usually calculated by applying an assumed exit multiple (e.g., EV/EBITDA) to the company's LTM EBITDA at the end of the holding period. After subtracting the remaining net debt, you arrive at the exit equity value.

- Calculate Returns: With the initial equity investment and the final equity proceeds, you can calculate the two key return metrics: the Internal Rate of Return (IRR) and the Multiple of Invested Capital (MOIC). A successful LBO typically targets an IRR of 20-25% or higher.

7. What's the Difference Between EBIT and EBITDA? When Would You Use Each?

This is a fundamental accounting and valuation question that interviewers use to test your understanding of profitability metrics and their practical applications. It reveals whether you can move beyond simple definitions to grasp the nuances of how different expenses impact a company's reported earnings and perceived cash flow.

The question assesses your ability to differentiate between EBIT (Earnings Before Interest and Taxes) and EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) and, more importantly, to articulate when one is a more appropriate analytical tool than the other. This is crucial for roles involving comparative analysis, valuation, and credit assessment.

How to Structure Your Answer

A strong response will clearly define both terms, explain the core difference, and then provide specific use cases for each metric, demonstrating analytical depth.

- Define Each Metric: Start with precise definitions. EBIT, often called operating income, is calculated as Revenue - COGS - Operating Expenses. It measures a firm's core operational profitability before the effects of its capital structure (interest) and tax regime. EBITDA is calculated as EBIT + Depreciation & Amortization (D&A). It removes non-cash expenses from the profitability calculation.

- Explain the Key Difference: The primary distinction is the treatment of D&A. EBITDA is often used as a proxy for cash flow because it adds back these significant non-cash charges. This makes it useful for comparing companies with different capital expenditure policies or asset ages, as depreciation can vary significantly.

- Provide Use Cases for EBITDA: EBITDA is heavily used in valuation, particularly with the EV/EBITDA multiple. It's preferred for capital-intensive industries like manufacturing or telecommunications where large, historical capital investments can create depreciation figures that distort true operational performance comparisons. It's also a key metric in credit analysis for calculating leverage ratios like Debt/EBITDA.

- Provide Use Cases for EBIT: EBIT is a better measure of a company's pure operational profitability, as it includes the real economic cost of using assets (depreciation). It's used to calculate the operating margin (EBIT/Revenue) and is the starting point for calculating Unlevered Free Cash Flow in a DCF. It acknowledges that capital expenditures are a necessary and real expense required to maintain the business.

Ultimately, showing you understand the "why" behind using each metric is what separates a good answer from a great one. For a deeper dive into how these metrics are applied, you can learn more about related investment banking technical questions.

8. What Is Working Capital and Why Is It Important?

This question is a fundamental test of your grasp of operational finance and a company's liquidity. It probes your ability to connect the balance sheet to the cash flow statement, a critical skill for any finance professional. Working capital is the capital required to fund a company's day-to-day operations.

Interviewers ask this to see if you understand the mechanics of how a business uses cash. Your answer reveals whether you can analyze a company's short-term financial health and operational efficiency. It's a key concept in financial modeling, credit analysis, and valuation, as changes in working capital directly impact free cash flow.

How to Structure Your Answer

A strong response defines the concept clearly, explains its importance, and provides practical examples. The key is to demonstrate your understanding of its impact on cash flow.

- Provide a Clear Definition: Start by defining working capital in two ways. The high-level accounting definition is Current Assets - Current Liabilities. More importantly for finance interviews, explain the operational definition: (Accounts Receivable + Inventory) - Accounts Payable. This version focuses on the non-cash operating assets and liabilities.

- Explain its Importance (The Cash Flow Link): The crucial point is that changes in working capital affect cash flow. An increase in net working capital (e.g., buying more inventory or allowing customers more time to pay) is a use of cash. Conversely, a decrease in net working capital (e.g., collecting receivables faster or paying suppliers slower) is a source of cash.

- Discuss the "Why": Explain that managing working capital is a balancing act. A company needs enough to operate smoothly and avoid liquidity issues. However, excessive working capital can be inefficient, as that cash could be invested elsewhere for a higher return. The goal is to optimize the Cash Conversion Cycle - the time it takes to convert investments in inventory back into cash.

- Use an Example: Illustrate the concept. For instance, a fast-growing retailer like Lululemon must invest heavily in working capital by purchasing inventory before it can be sold, which consumes cash. In contrast, Dell historically had a negative cash conversion cycle, collecting cash from customers for a new computer before it had to pay its suppliers for the parts, effectively using its suppliers to finance its operations.

9. If You Could Have Only One Financial Statement, Which Would You Choose and Why?

This question is a classic test of your business acumen and understanding of the interplay between the three core financial statements. Interviewers aren't looking for a single "correct" answer; instead, they want to hear your reasoning and see if you can articulate the relative strengths and weaknesses of each statement. It reveals how you think about a company's health and what you prioritize in an analysis.

Your choice and justification signal your analytical perspective. For example, a private equity professional focused on leveraged buyouts would prioritize cash flow for debt service, while a growth equity investor might focus on the income statement's revenue trajectory. A strong answer demonstrates a nuanced understanding of accounting principles and practical business valuation.

How to Structure Your Answer

The most common and strategically sound choice is the Statement of Cash Flows. Your answer should confidently state your choice, explain the "why" behind it, and briefly acknowledge the trade-offs of not having the other two statements.

- State Your Choice: Begin by clearly stating your selection. The most defensible choice is the Statement of Cash Flows.

- Justify the Choice: Explain that cash is the lifeblood of any business. The Cash Flow Statement provides a true picture of liquidity and solvency, showing exactly how a company is generating and using cash. Crucially, it is less susceptible to manipulation from accrual accounting practices (like revenue recognition policies) that can distort the Income Statement.

- Explain its Power: Mention that with the Statement of Cash Flows and a beginning Balance Sheet, you can actually recreate the Income Statement and the ending Balance Sheet. This technical point showcases a deeper level of understanding. Cash from Operations, for instance, links directly back to Net Income after adjusting for non-cash items and working capital.

- Acknowledge the Downsides: Briefly mention what you would miss. Without the Balance Sheet, you lack a snapshot of the company's assets and liabilities at a single point in time. Without the Income Statement, you lose the line-by-line detail of profitability and operational efficiency over a period. This balanced view shows you understand the complete picture.

10. How Do You Calculate WACC (Weighted Average Cost of Capital) and Why Is It Important?

This question directly probes your understanding of capital structure, risk, and valuation. The Weighted Average Cost of Capital (WACC) represents a company's blended cost of capital across all sources, including equity and debt, weighted by their respective proportions. It is the average rate of return a company is expected to pay to its security holders to finance its assets.

Interviewers ask this to test your technical precision and your grasp of a concept that underpins many financial decisions. WACC is a critical input for DCF analysis, serving as the discount rate to value a business. It also acts as a "hurdle rate" for internal investment decisions, meaning a project must generate returns higher than the WACC to create value.

How to Structure Your Answer

A strong answer defines WACC, presents the formula, explains each component, and then discusses its practical importance. This demonstrates both theoretical knowledge and commercial awareness.

- Define WACC and State the Formula: Start with a clear definition. State that WACC is the average rate a company pays to finance its assets. Then, write out the formula: WACC = (E/V × Re) + (D/V × Rd × (1 - Tc)).

- Explain Each Component: Systematically break down the formula.

- E/V and D/V: Explain that these are the proportions of equity and debt in the company's capital structure, emphasizing that you should use market values, not book values, for E (Market Cap) and D (Market Value of Debt). V is the sum of E and D.

- Re (Cost of Equity): Mention that this is the return equity investors require and is typically calculated using the Capital Asset Pricing Model (CAPM).

- Rd (Cost of Debt): This is the effective rate a company pays on its debt. For a company with publicly traded bonds, you can use the yield to maturity (YTM).

- (1 - Tc): Explain the tax shield. Interest expense is tax-deductible, which lowers the effective cost of debt. Tc is the corporate tax rate.

- Discuss Its Importance: Conclude by explaining why it matters. WACC is the appropriate discount rate to use for unlevered free cash flows in a DCF analysis because it reflects the risk of the entire company (to both debt and equity investors). It also serves as the benchmark or hurdle rate for evaluating potential investments and capital budgeting projects.

Top 10 Finance Interview Q&A Comparison

| Topic | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Walk Me Through a DCF (Discounted Cash Flow) Analysis | High - Multi-step modeling | High - Financial data & modeling | Accurate intrinsic company valuation | Investment banking, PE, corporate finance | Demonstrates deep valuation and modeling skills |

| What Are the Three Financial Statements and How Are They Connected? | Low to Medium - Basic concepts | Low - Understanding statements | Grasp of financial statement interrelations | Entry-level finance, accounting, analysis | Builds strong financial literacy foundation |

| How Would You Value a Company? | Medium to High - Multiple methods | Medium to High - Various data | Broad valuation ability with methodology awareness | IB, PE, corporate dev, VC, equity research | Shows strategic thinking and valuation breadth |

| What Happens to the Three Financial Statements When [Specific Transaction Occurs]? | Medium to High - Detailed effects | Medium - Accounting knowledge | Mastery of accounting flow and impacts | IB, PE, accounting, FP&A | Demonstrates technical accounting expertise |

| Explain the Difference Between Enterprise Value and Equity Value | Medium - Conceptual clarity | Low - Analytical understanding | Accurate valuation multiples interpretation | IB, equity research, PE, corporate finance | Clarifies capital structure impact on valuation |

| Walk Me Through an LBO (Leveraged Buyout) Model | High - Complex multi-step model | High - Detailed financial models | Understanding of PE returns and deal mechanics | PE, IB (leveraged finance), credit analysis | Shows sophisticated knowledge of leveraged finance |

| What's the Difference Between EBIT and EBITDA? When Would You Use Each? | Low to Medium - Metric definitions | Low - Conceptual understanding | Clear profitability metric application | All finance roles, IB, equity research | Demonstrates grasp of operating performance metrics |

| What Is Working Capital and Why Is It Important? | Medium - Operational finance | Low to Medium - Balance sheet data | Insight into liquidity and cash flow dynamics | FP&A, corporate finance, IB, operations | Connects operations to cash management |

| If You Could Have Only One Financial Statement, Which Would You Choose and Why? | Medium - Analytical trade-offs | Low - Judgment-based | Prioritizes statement for business insight | All finance roles | Shows analytical reasoning and prioritization |

| How Do You Calculate WACC (Weighted Average Cost of Capital) and Why Is It Important? | High - Formula and theory | Medium - Market data needed | Correct discount rate understanding | IB, corporate finance, PE, equity research | Core to valuation and capital structure analysis |

From Preparation to Performance: Your Next Steps

Navigating the landscape of finance interview questions and answers can feel like studying for a final exam where every question is a make-or-break moment. You've now walked through the technical and conceptual frameworks for the most critical topics, from building a DCF and an LBO model to dissecting the three financial statements and calculating WACC. The goal was never to provide you with scripts to memorize; rather, it was to arm you with a repeatable, logical process for deconstructing any question an interviewer throws your way.

The true differentiator between a good candidate and a great one is not just knowing what the answer is, but demonstrating how you arrive at it. It's about showcasing your thought process, connecting disparate concepts under pressure, and communicating your analysis with clarity and confidence. The frameworks provided for valuing a company, explaining the link between financial statements, or defining Enterprise Value are your tools. Your ability to wield them effectively is what will ultimately secure the offer.

Bridging the Gap from Knowledge to Action

The journey from understanding these concepts to mastering their application is paved with practice. Simply reading through these finance interview questions and answers is the first step, but it’s insufficient for building the muscle memory required for a high-pressure interview environment. Your next objective is to move from passive learning to active application.

Here are the key takeaways to focus on as you continue your preparation:

- Structure is Everything: Before you dive into the numbers, always state your framework. Whether it’s outlining the steps of a DCF or listing the valuation methodologies you’ll consider, a structured approach shows the interviewer you are a clear, logical thinker.

- Think Out Loud: Interviewers are evaluating your analytical process as much as your final answer. Articulate your assumptions, explain your choices (e.g., "I'm using EBITDA here because it normalizes for non-cash expenses and capital structure differences"), and walk them through each step of your logic.

- Connect the Concepts: The strongest candidates demonstrate an integrated understanding of finance. When discussing a change in working capital, you should be able to fluidly explain its impact on the cash flow statement, which in turn affects the company's valuation in a DCF. Show them you see the whole picture.

- Anticipate the "Why": For every calculation or definition, be prepared for follow-up questions. Why is WACC important? Why would you use a specific valuation multiple for a particular industry? Why does depreciation have a tax shield effect? Deep understanding, not rote memorization, is the key to handling these follow-ups gracefully.

Your Final Step: Simulated, High-Stakes Practice

Mastering the content is half the battle; the other half is performance. The pressure of a live interview can easily derail even the most well-prepared candidate. You need a way to replicate that environment to identify and eliminate your blind spots. This means practicing your delivery, timing, and ability to handle unexpected questions in a setting that feels real. True readiness is achieved when your well-practiced frameworks become second nature, allowing you to focus on delivering a compelling and confident performance.

Transform your knowledge into a winning interview performance. Soreno provides an AI-powered platform where you can practice these exact finance interview questions and answers in a realistic mock interview setting, receiving instant, targeted feedback on your structure, communication, and technical accuracy. Visit Soreno to start building the confidence you need to land your dream role.