Mastering Your Private Equity Interview Prep

Dominate your interviews with our complete private equity interview prep guide. Master LBOs, case studies, and behavioral questions to land your offer.

Getting into private equity is less about acing a test and more about proving you can think, act, and analyze like an investor from day one. This isn't a sprint you can cram for; it's a marathon of preparation built on a deep, intuitive grasp of technical finance and genuine business acumen. Forget memorizing formulas—we're talking about mastering advanced accounting, the subtle art of valuation, and the mechanics of M&A until they're second nature. This is how you show you can dissect a deal and articulate its value under intense pressure.

Building Your Private Equity Interview Foundation

Before you even think about tackling a complex LBO model, you have to lay the groundwork. The top PE firms aren't looking for walking calculators; they want future partners who can think critically about what makes a business tick. It's about getting past the textbook definitions and truly internalizing the "why" behind the numbers.

The competition is fierce for a reason. The global private equity market is on a trajectory to grow from roughly $13 trillion to over $20 trillion by the end of the decade. This massive expansion, driven by a global appetite for diversified capital, means firms have their pick of the litter. They need candidates who bring a truly exceptional skill set to the table. For a deeper dive, you can read the full research about private markets to get a handle on these dynamics.

Mastering the Technical Bedrock

Your first mission is to make your technical knowledge unshakable. This isn't about just knowing the concepts; it's about achieving total fluency. You need to be so comfortable with this stuff that you can apply it on the fly during a stressful case study or a timed modeling test.

Kick off your prep by zeroing in on three core areas:

- Advanced Accounting: Move way beyond debits and credits. You need to own concepts like deferred tax assets and liabilities, nuanced revenue recognition policies, and how to spot and adjust for non-recurring items that distort EBITDA.

- Valuation Methodologies: Get intimately familiar with Discounted Cash Flow (DCF), comparable company analysis ("comps"), and precedent transactions. More importantly, be ready to defend your assumptions, whether it’s your choice of multiples or the logic behind your discount rate.

- M&A and LBO Concepts: You have to know the mechanics of a leveraged buyout cold. Understand precisely how the key levers—purchase price, debt levels, operational improvements, and exit multiples—all work together to drive investor returns.

This table breaks down the core competencies you absolutely must nail. Think of it as your roadmap to technical mastery.

Core Competency Checklist for PE Interviews

| Skill Category | Key Topics to Master | Why It's Critical |

|---|---|---|

| Advanced Accounting | Revenue Recognition, Deferred Taxes (DTAs/DTLs), Working Capital, Non-Recurring Items, Stock-Based Compensation. | PE is about cash flow. You can't accurately project cash flow without understanding the accounting that drives it. |

| Valuation | DCF (unlevered/levered), Comps (EV/EBITDA, P/E), Precedents, Accretion/Dilution Analysis. | This is the language of investing. You must be able to value a business from multiple angles and defend your work. |

| LBO Modeling | Sources & Uses, Debt Schedules (Revolvers, Term Loans), Equity Waterfall, Returns Calculation (IRR, MOIC). | The LBO is the primary tool of the trade. Your ability to model one quickly and accurately is non-negotiable. |

| Commercial Acumen | Business Models, Competitive Advantages ("Moats"), Industry Trends, Risk Assessment, Growth Drivers. | Firms hire investors, not just modelers. You have to connect the numbers to a compelling investment thesis. |

Treat this checklist not just as a study guide, but as a measure of your readiness. If you can't speak fluently on every topic listed here, you have more work to do.

Thinking Like an Investor

Here’s a hard truth: technical perfection alone will not get you an offer. The candidates who truly stand out are the ones who pair financial chops with sharp commercial judgment. They demonstrate an investor's mindset.

The most common failure I see is candidates over-indexing on technical skills while completely neglecting commercial acumen and fit. Plenty of people can build a flawless model, but they crumble when you ask the simple question: "So, would you actually do this deal?"

To start building this muscle, get in the habit of analyzing businesses you encounter every day. When you read an article about a company, don't just be a passive consumer of information. Start asking the right questions:

- What's their real competitive advantage, their "moat"?

- How does this business actually generate cash?

- What are the top three things that could kill this company?

- Who holds the power in their supply chain—them, their customers, or their suppliers?

This simple habit is what transforms your private equity interview prep from a sterile academic exercise into the practical, real-world training that will actually get you hired.

Building a Flawless LBO Model Under Pressure

Let's be blunt: the Leveraged Buyout (LBO) model is the main event of the technical private equity interview. This isn't just about plugging numbers into a spreadsheet. It’s a full-on stress test of your financial chops, your precision, and your commercial instincts, all performed with a stopwatch ticking. You absolutely must be able to build a clean, dynamic, and error-free model from scratch in under an hour.

The real goal isn't just to spit out an Internal Rate of Return (IRR). It’s to prove you have a fundamental grasp of how a business actually generates cash and how piling on debt can juice returns. The interviewer is watching your thought process just as closely as they're watching your Excel formulas.

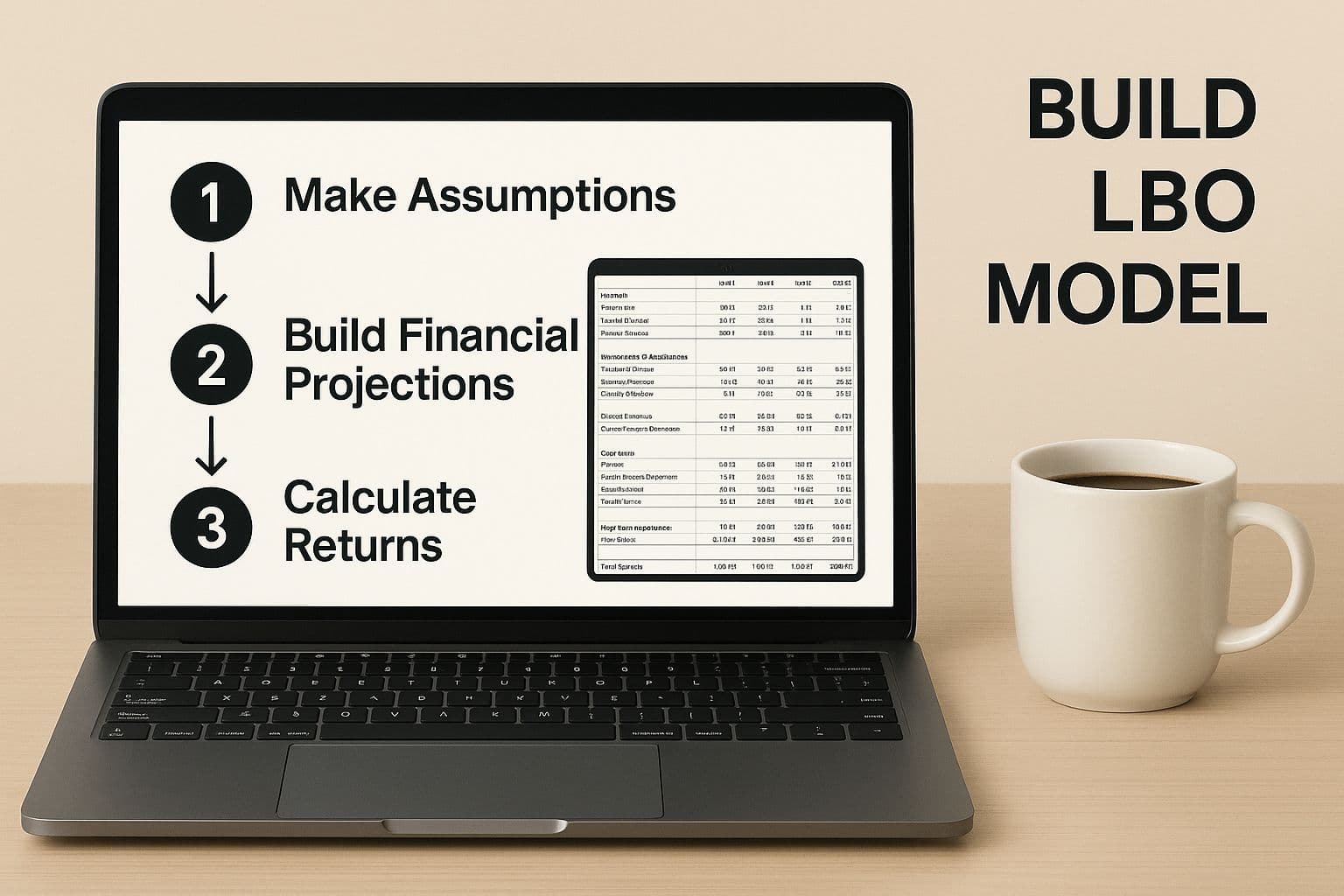

This infographic breaks down the typical workflow, showing how you move from initial assumptions all the way through to the final returns analysis.

Think of it as a logical sequence. Each piece you build sets the stage for the next, ultimately telling a complete story about the investment.

Nailing Your Assumptions and Transaction Structure

Before you even think about writing a formula, you have to lay out your core assumptions. This is where you take the story from the case prompt and turn it into hard numbers. A messy, disorganized assumptions tab is a huge red flag—it suggests a chaotic mind.

Get this part right by structuring it logically with crystal-clear labels. Your key inputs will almost always include:

- Purchase Price: Usually framed as an entry multiple, like 10.0x LTM EBITDA.

- Financing: You need to detail every piece of debt—Term Loan B, Senior Notes, etc.—along with their amounts, interest rates, and payback rules.

- Operating Projections: Keep it high-level. Think revenue growth drivers, margin targets, CapEx, and working capital needs.

With assumptions locked in, your next move is building the Sources & Uses table. It’s simple, but it's critical for making sure the deal math works. The Sources side shows all the incoming cash (new debt, seller equity, your firm's cash). The Uses side shows where it all goes (buying the business, paying bankers and lawyers). Your firm's equity contribution is almost always the "plug" that makes the two sides balance.

Projecting the Three Financial Statements

Now for the engine room of your model: the integrated three financial statements. Kick things off with the income statement, flowing from revenue all the way down to net income. This is where your growth and margin assumptions really come to life.

From there, you build the cash flow statement, which is frankly what a PE investor cares about most. You'll start with net income, add back non-cash expenses like D&A, and then factor in changes in net working capital. That gives you Cash Flow from Operations, which, after subtracting CapEx, tells you how much cash is left to pay down debt.

Finally, you have to link everything back to the balance sheet. Cash from operations flows to the cash balance, debt payments reduce liabilities, and net income boosts retained earnings. If you've done it right, your balance sheet will always balance: Assets = Liabilities + Equity.

Crafting the Debt Schedule and Returns Analysis

The debt schedule is where a lot of candidates fall apart. This section meticulously tracks the beginning balance, mandatory payments, and any optional prepayments for each type of debt. This is also where you'll likely run into a dreaded circular reference, since the interest you pay depends on a debt balance that hasn't been finalized yet.

You can handle this with an "interest toggle" or by enabling iterative calculations in Excel, but you better be prepared to explain why that circularity exists in the first place.

An LBO model without a proper debt schedule is just a projection; the debt schedule is what makes it a leveraged buyout analysis. It directly links the company's operational performance to the capital structure and, ultimately, to investor returns.

Once the debt schedule is solid, you can finally calculate the returns. This means projecting an exit value for the business, typically using an exit multiple on the final year's EBITDA. From that exit enterprise value, you subtract the remaining net debt to see what the equity is worth. The two metrics that matter are:

- Internal Rate of Return (IRR): The annualized return on your firm's initial cash investment.

- Multiple of Invested Capital (MOIC): How many times you get your money back. A 3.0x MOIC means you get $3 back for every $1 you put in.

At the end of the day, your LBO model is a tool for telling a compelling story. Every assumption has to be defensible, and every output should help you form an opinion on the deal. Mastering these models is a cornerstone of any serious private equity interview prep, as they're always paired with tough questions. To sharpen your conceptual knowledge, review our guide on common finance interview questions and answers, which breaks down many of the ideas that drive a great LBO analysis.

How to Ace the Private Equity Case Study

https://www.youtube.com/embed/57xcFQ3mPj0

The private equity case study is where the rubber meets the road. It's the crucible that separates the spreadsheet jockeys from the genuine investors. Whether it’s a pressure-cooker three-hour modeling test or a take-home assignment that consumes your entire weekend, this is your moment to prove you have real investor instincts.

You have to show you can cut through the noise of a dense information packet, form a strong conviction, and then defend it with confidence. Forget about finding the one "right" answer. The real goal is to showcase a structured, logical thought process—the same kind that plays out in actual investment committee meetings every day.

First Things First: Deconstruct the Prompt and Materials

The clock starts ticking the second you get the case. Before you even think about firing up Excel, your first job is to become a temporary expert on the business and the specific questions being asked. The time you invest here will pay off tenfold later on.

Your initial pass through the Confidential Information Memorandum (CIM) or management deck is all about triage. Don't get lost in the weeds. Instead, hunt for the big-ticket items that will form the foundation of your entire analysis.

- How does it make money? Is this a classic recurring revenue SaaS business, a lumpy project-based engineering firm, or something else entirely?

- What’s the industry like? Is the market growing or in decline? Who are the major players, and what makes them strong or weak?

- What do the numbers say? Get a feel for the historicals. Look for high-level trends in revenue growth, margin stability, and how much cash the business needs to operate.

This isn't about deep analysis yet; it's about pattern recognition. You're trying to quickly identify the handful of variables that truly drive this company's success or failure.

The Heart of the Matter: Forming a Coherent Investment Thesis

Once you’ve got the lay of the land, it’s time to develop your investment thesis. This is the central story that answers the most critical question: "Why should we actually buy this company?" A generic, flimsy thesis will sink your chances, no matter how flawless your LBO model is.

A powerful thesis needs to be specific, debatable, and backed up by facts from the materials you were given. It absolutely must hit on three key points:

- Investment Merits: What makes this a great deal? Maybe it’s a dominant position in a niche market, an incredibly loyal customer base, or some bulletproof IP.

- Key Risks: What could blow this up? Be upfront and specific. Acknowledge things like major customer concentration, the threat of technological disruption, or exposure to a nasty cyclical downturn.

- Value Creation Levers: How are we going to make money? Pinpoint exactly how the firm can create value—through specific operational fixes, a smart M&A strategy, or by positioning the company for a higher exit multiple.

Your investment thesis is the backbone of your entire case study. It's the narrative you're selling to the investment committee. Every single slide, chart, and number in your model must exist to support this core argument.

A weak thesis sounds something like: "We should buy this company because the software market is growing." It’s lazy and uninspired.

A much stronger thesis sounds like this: "We recommend acquiring this B2B software company because its 95% net revenue retention signals a powerful product moat. We can re-accelerate top-line growth from 15% to 25% by building out a direct salesforce to attack adjacent verticals. There's a clear path to a strategic exit in 3-5 years at a 12x EBITDA multiple." See the difference? It's specific and actionable.

Presenting Your Analysis Like an Executive

How you communicate your findings is just as crucial as the analysis itself. PE partners are notoriously short on time and patience. They need the key takeaways delivered in a clear, concise, and executive-ready format.

Your presentation deck should be clean and scannable. Avoid walls of text. Use charts, tables, and call-out boxes to make your most important points pop. A logical flow is key, and this structure is a proven winner:

- Executive Summary: Start with the punchline. This one slide should have your recommendation, the core merits and risks, and the headline returns (IRR and MOIC).

- Company Overview: Briefly explain what the business does and where it sits in the market.

- Investment Thesis: Give your core argument its own dedicated slide.

- Financial Analysis: This is where you show your work—the operating model, returns summary, and key sensitivity analyses.

- Risks and Mitigants: Go deeper on the risks you identified and propose concrete plans to manage them.

- Conclusion: End by circling back to your recommendation and final thoughts.

During the actual presentation, brace yourself for interruptions. You will be grilled on every assumption. This isn’t personal; it's a test of your conviction and how well you handle pressure. Stay calm, listen to the question, and answer directly with data from your analysis. Defending your work with poise is a massive part of acing this stage of your private equity interview prep.

To see how these principles come to life, our comprehensive guide on the private equity case study breaks down more frameworks and provides detailed examples.

Answering Behavioral and Fit Questions

Sure, your LBO model can prove you’ve got the technical chops. But the behavioral questions? They’re designed to figure out if you're someone the partners actually want to work with for the next decade.

Private equity interviews are an endurance test of personality and drive. They’re looking for a very specific type of person: resilient, relentlessly curious, and deeply commercial. Each "tell me about a time when..." question is a surgical probe to see if you have the mental toughness for a grueling, high-stakes career. Canned answers will get you nowhere.

Beyond STAR and Into Storytelling

The classic STAR method (Situation, Task, Action, Result) is a fine starting point, but sticking to it too rigidly makes you sound like a robot. The best candidates take this framework and weave it into a compelling story that reveals their character.

Your real goal here is to show, not tell. Don't just say you're hardworking; tell them about the deal where you rebuilt a model at 3 AM and caught a critical error. Don't just claim you're a team player; describe that time you took on the grunt work to help a swamped teammate hit a crucial deadline.

A huge mistake I see candidates make is treating fit questions as an afterthought. In reality, they carry just as much weight as the technical rounds. I’ve seen technically brilliant people get dinged immediately because they came across as arrogant or lacking self-awareness.

This storytelling approach is everything. When they ask about a failure, they want to see genuine self-reflection and what you learned—not some fake story about a minor hiccup that was actually a success. Your ability to convey these experiences is a test in itself, which is why mastering your communication skills for interviews is so critical.

Decoding the Three Core PE Questions

While the exact wording can change, the fit interview almost always revolves around three core themes. Nailing your narrative for each one is an absolute must.

1. "Walk Me Through a Deal You’ve Worked On"

This is not a simple request for a chronological summary. It's a direct test of your commercial judgment and whether you can think like an owner.

- What they're really asking: "Can you cut through the complexity and explain the core investment merits and risks? Do you actually understand what drives value, or did you just plug numbers into Excel?"

- How to answer it right: Frame your response like you're presenting a mini-memo to the investment committee. Kick off with the company and the situation, then lay out the core investment thesis. Discuss the key diligence streams you ran, the biggest risks you flagged, and how it all played out. Most importantly, end with your own opinion on whether it was a good deal and why.

2. "Why Our Firm?"

This question is purely a screen for candidates who are just spraying and praying with their applications. It’s a test of your genuine interest.

- What they're really asking: "Did you do your homework? Do you get our specific strategy, and can you give me a real reason why you belong here and not at the firm down the street?"

- How to answer it right: Get specific. Really specific. You need to reference 2-3 deals they’ve actually done. Talk about why you found the investment thesis compelling in those situations. Connect their sector focus, fund size, or operational approach directly to your own experience or what you want to do next. Generic praise about their "great reputation" is an instant fail.

3. "Pitch Me a Company"

Welcome to the live-fire exercise. This is where they test your investor instincts in real-time. Can you find, analyze, and defend an investment idea under pressure?

- What they're really asking: "Do you think like an investor in your spare time? Can you identify a quality business and frame it as a private equity deal, not a stock tip?"

- How to answer it right: Pick a real, under-the-radar company—not Apple or Google. Your pitch has to be for a buyout. This means focusing on what makes it a good LBO candidate: stable cash flow, a defensive moat, non-core assets to divest, or operational improvements a PE owner could realistically make. And be ready for the follow-up questions, because they will absolutely grill you on valuation, risks, and your growth assumptions.

Talking Deals and Trends Like You're Already on the Inside

Nailing the technical questions gets you in the door, but proving you have real commercial sense is what gets you the offer. Interviewers are looking for more than just a model-builder; they want to see a future investor who actually follows the market.

This means you need to have sharp, defensible opinions on recent deals, market trends, and the economic climate. It’s the clearest way to show you have the intellectual curiosity and passion for investing that separates the top candidates from the rest of the pack. The goal is to talk shop with the fluency of someone already on the team.

Making Market Intelligence a Daily Habit

You can't cram for this. The only way to build this kind of knowledge is through consistent, daily engagement with the market. Skimming a few articles the night before an interview just won't cut it. You need to build a routine.

Think of your daily reading list as a balanced diet:

- The Big Picture: Start with publications like The Wall Street Journal and the Financial Times to stay on top of macro trends. You have to understand how things like interest rates, inflation, and geopolitical shifts affect dealmaking.

- The Deal Flow: Get into the weeds with sources like PitchBook, Axios Pro, and PE Hub. This is where you’ll find the real-time intel on transactions, fundraises, and industry gossip.

- The Firm's Playbook: Before you walk into any interview, you better have done your homework on them. Dig through their website—read their portfolio company case studies, press releases, and any white papers their partners have published.

How to Break Down a Recent Deal

When you’re asked to discuss a deal, just reciting the facts is a rookie mistake. You need to present a tight, structured analysis that screams "investor mindset." My advice is to pick two or three recent, interesting deals—and make sure at least one is in a sector the firm actually invests in.

For example, a big theme right now is how U.S. PE deal values are climbing despite lower volume, largely driven by massive deals in sectors like consumer and energy. This tells you the market is getting more selective. Knowing that context is key, especially since fundraising is also getting tougher for many funds. You can dig into a deeper analysis of the current U.S. PE market to really see these trends in play.

When it's time to talk about a specific deal, you need a framework. Below is a simple but powerful one I've seen countless successful candidates use. It helps organize your thoughts and ensures you hit all the key points.

Deal Analysis Framework

This table is your cheat sheet for breaking down any transaction like a seasoned pro. Use it to structure your prep on the 2-3 deals you plan to discuss.

| Component | Key Questions to Answer | Example Talking Point |

|---|---|---|

| Deal Thesis | Why did the PE firm buy this company? What's the core value creation story? | "The firm likely acquired the software company due to its 90%+ net dollar retention, seeing a clear opportunity to accelerate growth by expanding its sales team into the European market." |

| Purchase Price | Was the entry multiple fair? How does it stack up against public comps or recent deals? | "They paid 12.5x EBITDA, which seems high, but I think it's justified given the company's 25% year-over-year revenue growth and superior margin profile compared to its peers." |

| Structure | How did they finance it? What does the capital structure tell you about their risk tolerance? | "The deal was structured with 60% debt, which is fairly standard. However, the inclusion of a PIK note suggests they want to maximize cash flow for reinvestment in the early years." |

| Risks & Mitigants | What are the top 2-3 things that could go wrong? How would you manage them? | "The biggest risk is customer concentration, with one client representing 30% of revenue. The firm can mitigate this by aggressively pursuing new customer acquisitions post-close." |

Having a prepared, well-reasoned take on a deal shows you’re not just going through the motions. It signals that you’ve got the initiative and analytical mind for the job.

Having a thoughtful, independent view on a recent transaction is one of the most powerful ways to signal that you belong in private equity. It demonstrates initiative, analytical rigor, and a genuine passion for investing that can't be taught in a textbook.

Your private equity interview prep has to go beyond the models and the math. This is the piece that connects your technical skills with the commercial judgment that ultimately makes or breaks an investor.

Answering Your Top Private Equity Interview Prep Questions

As you get into the weeds of preparing for your private equity interviews, a lot of questions are bound to pop up. How long is this really going to take? What are the classic mistakes I need to avoid? Let's clear the air and tackle the most common questions head-on so you can focus your energy where it counts.

How Much Time Do I Really Need to Prepare?

For a candidate coming from a solid investment banking or consulting background, the sweet spot is usually a dedicated 2-3 month window. This isn't a full-time job, but it does mean putting in a consistent 10-15 hours per week.

A smart way to structure this is to break it down into phases.

- Month 1: The Technical Deep Dive. This is your time to go deep on advanced accounting and truly master LBO theory. You need this foundation before anything else.

- Month 2: Reps, Reps, Reps. Now you put that theory into practice. This month is all about hands-on LBO modeling and grinding through case studies until the mechanics feel like second nature.

- Month 3: Polish and Perform. The final stretch is for mock interviews, refining your personal story, and getting sharp on the current market. You should be able to talk intelligently about recent deals and macro trends.

What's the Single Biggest Mistake People Make?

Hands down, the most common pitfall is getting lost in the technical weeds and completely forgetting about commercial judgment. So many candidates can build a beautiful, error-free LBO model, but they completely freeze when asked the most important question: "So, would you actually do this deal?"

They can’t articulate a clear investment thesis or defend their assumptions with any real business sense. Remember, firms are hiring investors, not just human calculators.

Your model is a tool that supports your thinking; it isn't a replacement for it. The real test is proving you can connect the numbers on the page to a compelling story about why this is—or isn't—a good investment.

This is more critical now than ever. The market is shifting; recent data shows distributions to LPs outpaced capital calls for the first time in years, and dealmaking is picking back up with a focus on bigger bets. To learn more about these dynamics, check out the latest private markets report from McKinsey. You need to show you understand both the math and the story behind these trends.

Are Interview Prep Services Actually Worth the Money?

It really comes down to your level of self-discipline. Plenty of people land top-tier offers with nothing more than intense self-study, good online resources, and a few key textbooks. If you can create a strict plan and stick to it, you can absolutely get there on your own.

Where a coach or prep service really pays off is in providing structure and, more importantly, pressure. They excel at simulating the high-stakes environment of a real interview.

If you know you struggle to replicate that pressure cooker feeling or need an expert to give you brutally honest feedback on how you communicate, then spending the money on a few mock sessions with an industry vet can give you a serious edge.

How Important Is Networking for Getting an Interview?

It's absolutely critical, especially if you're targeting off-cycle roles that aren't run through headhunters. Private equity is a surprisingly small world driven by relationships. A warm introduction from a trusted contact will always beat a cold application dropping into an HR portal.

Even when headhunters are managing the main "on-cycle" process, a few well-placed informational chats with alumni or contacts at your dream firms can be the difference-maker that gets your resume moved from the "maybe" pile to the "must-interview" list.

The key is to approach these conversations with genuine curiosity. Your goal is to learn, not to ask for a job. Ask about their work, the firm's strategy, and their views on the industry. That's how you build real rapport and leave a positive impression that they’ll remember when a spot opens up.

Ready to transform your preparation with realistic, AI-powered mock interviews? Soreno provides an unlimited, on-demand practice platform with an MBB-trained AI interviewer that gives you pinpointed feedback on everything from your case structure to your communication style. Start your free trial and get the reps you need to land the offer at https://soreno.ai.