8 Essential Investment Banking Interview Questions for 2025

Ace your next interview with this deep dive into the top investment banking interview questions. Includes expert tips, answer frameworks, and common mistakes.

Stepping into an investment banking interview can feel like entering a high-stakes arena where every answer is scrutinized. The questions are designed not just to test what you know, but to rigorously evaluate your technical acumen, behavioral fit, and genuine passion for the industry. This guide demystifies the process by breaking down the most crucial investment banking interview questions you will almost certainly face.

We move beyond generic advice to provide structured frameworks, expert tips, and the critical 'why' behind each query. You won't just learn what to say, but how to construct compelling narratives and demonstrate sharp analytical thinking under pressure. From flawlessly narrating your resume to deconstructing a DCF on the spot, this listicle offers actionable strategies to help you prepare, build confidence, and articulate your value effectively.

Whether you're an undergraduate student seeking an internship or a seasoned professional making a career pivot, mastering these fundamental questions is the essential first step. This curated list is your playbook for navigating the interview gauntlet and securing a coveted analyst or associate role. We will cover the core questions that form the backbone of nearly every banking interview, ensuring you are ready to impress.

1. Walk Me Through Your Resume

This is often the very first of all investment banking interview questions you will face, acting as an icebreaker and a crucial first impression. It’s an open-ended prompt designed to assess your communication skills, the logic behind your career choices, and your ability to craft a compelling narrative that culminates in your interest in this specific role. A strong answer sets a positive tone for the entire interview.

Your goal is to present a chronological story that highlights relevant experiences and logically explains each transition. This isn’t just a verbal recitation of your resume’s bullet points; it’s your chance to connect the dots for the interviewer and show them why you are the ideal candidate.

How to Structure Your Answer

A winning response follows a clear, concise structure that should last no more than two to three minutes.

- The Beginning: Start with your "spark." This could be your university choice, a specific class, or an early internship that first ignited your interest in finance.

- The Middle: Guide the interviewer through two to three key professional or academic experiences. For each one, briefly describe your role and highlight a specific achievement or skill gained, directly linking it to the qualities of a good investment banker (e.g., analytical rigor, attention to detail, teamwork).

- The End: Conclude by connecting your past experiences to your future aspirations. Clearly state why you want to pursue investment banking, why you are interested in this specific firm, and how your background has prepared you to succeed in the role.

Pro Tip: Your story should build momentum. Each step should feel like a logical progression toward a career in investment banking, demonstrating deliberate choices rather than a random walk through different jobs.

Actionable Tips for Success

- Practice, Don't Memorize: Rehearse your story until it sounds natural and conversational, not like a pre-written script.

- Focus on the "Why": For every transition you mention (e.g., from one internship to another), explain why you made that move and what you learned from it.

- Quantify Achievements: When mentioning an experience, use numbers to demonstrate impact. For example, instead of "analyzed a company," say "built a valuation model for a $500M company."

2. Why Investment Banking?

This is one of the most fundamental investment banking interview questions you'll face. Interviewers ask this to gauge your true motivations and to filter out candidates who are only drawn to the industry's prestige or high compensation. Your answer must show a genuine, well-researched interest and a clear understanding of what the job actually entails.

A convincing response goes beyond generic praise for the industry. It connects your personal skills and career goals to the specific functions of an investment banker, demonstrating that you have realistic expectations about the high-pressure environment and the nature of the work.

How to Structure Your Answer

Your answer should be a concise, authentic, and compelling pitch that lasts around 60 to 90 seconds.

- The "Why" Behind Your Interest: Start with the core reasons you are drawn to the industry. This could be a passion for corporate finance, the desire to advise companies on strategic decisions, or an attraction to a fast-paced learning environment where you are constantly challenged.

- Connect to Your Skills & Experiences: Link your motivations to your background. Explain how a specific internship, class project, or personal quality (e.g., analytical mindset, strong work ethic) has prepared you for and confirmed your interest in this career path.

- Demonstrate Firm-Specific Knowledge: Conclude by explaining why you are specifically interested in this bank. Mention a recent deal they worked on, their reputation in a particular industry group, or a cultural aspect that resonates with you. This shows you've done your homework.

Pro Tip: Your reasoning should sound mature and considered. Focus on aspects like unparalleled learning opportunities, the chance to have a tangible impact on clients, and exposure to high-stakes transactions.

Actionable Tips for Success

- Avoid Clichés: Stay away from generic answers like "I want to make a lot of money" or "I like to work hard." These show a lack of creativity and depth.

- Be Specific and Authentic: Connect your interest to a real-life event or experience. Did a particular M&A deal in the news fascinate you? Did a finance class spark your curiosity about valuation? Use that.

- Show You Understand the Demands: Acknowledge the challenging nature of the job. Mentioning your eagerness for the steep learning curve and dynamic environment shows you have a realistic perspective.

3. Walk Me Through a DCF (Discounted Cash Flow) Analysis

This is one of the most fundamental technical investment banking interview questions. A Discounted Cash Flow (DCF) analysis is a core valuation method used to estimate a company's value based on its projected future cash flows. Your ability to walk through this process demonstrates your technical competence, logical thinking, and understanding of what drives a company's intrinsic value.

A DCF model is built on the principle that the value of a business is the sum of its future free cash flows, discounted back to their present value. Interviewers use this question to gauge your grasp of accounting, finance theory, and your ability to articulate a complex process clearly and methodically.

How to Structure Your Answer

A strong answer will be a step-by-step guide through the DCF process. You should be able to explain each component and the assumptions behind it in a logical sequence.

- Project Free Cash Flows: Start by explaining that you would project the company’s unlevered free cash flows for a specific period, typically 5 to 10 years. This involves forecasting revenue, subtracting operating costs to get EBIT, applying a tax rate, adding back non-cash charges like D&A, and subtracting changes in working capital and capital expenditures.

- Calculate Terminal Value: Since a company operates beyond the projection period, you must calculate its Terminal Value. Explain the two main methods: the Gordon Growth Model (assuming a perpetual growth rate) or the Exit Multiple Method (applying a valuation multiple, like EV/EBITDA, to the final year's financials).

- Discount to Present Value: Finally, you discount both the projected free cash flows and the terminal value back to the present using a discount rate, which is typically the Weighted Average Cost of Capital (WACC). The sum of these present values gives you the company's Enterprise Value.

Pro Tip: Be prepared for follow-up questions on any part of the process. Interviewers will often probe your understanding of WACC components (Cost of Equity, Cost of Debt), how to calculate beta, or the logic behind your terminal growth rate assumption.

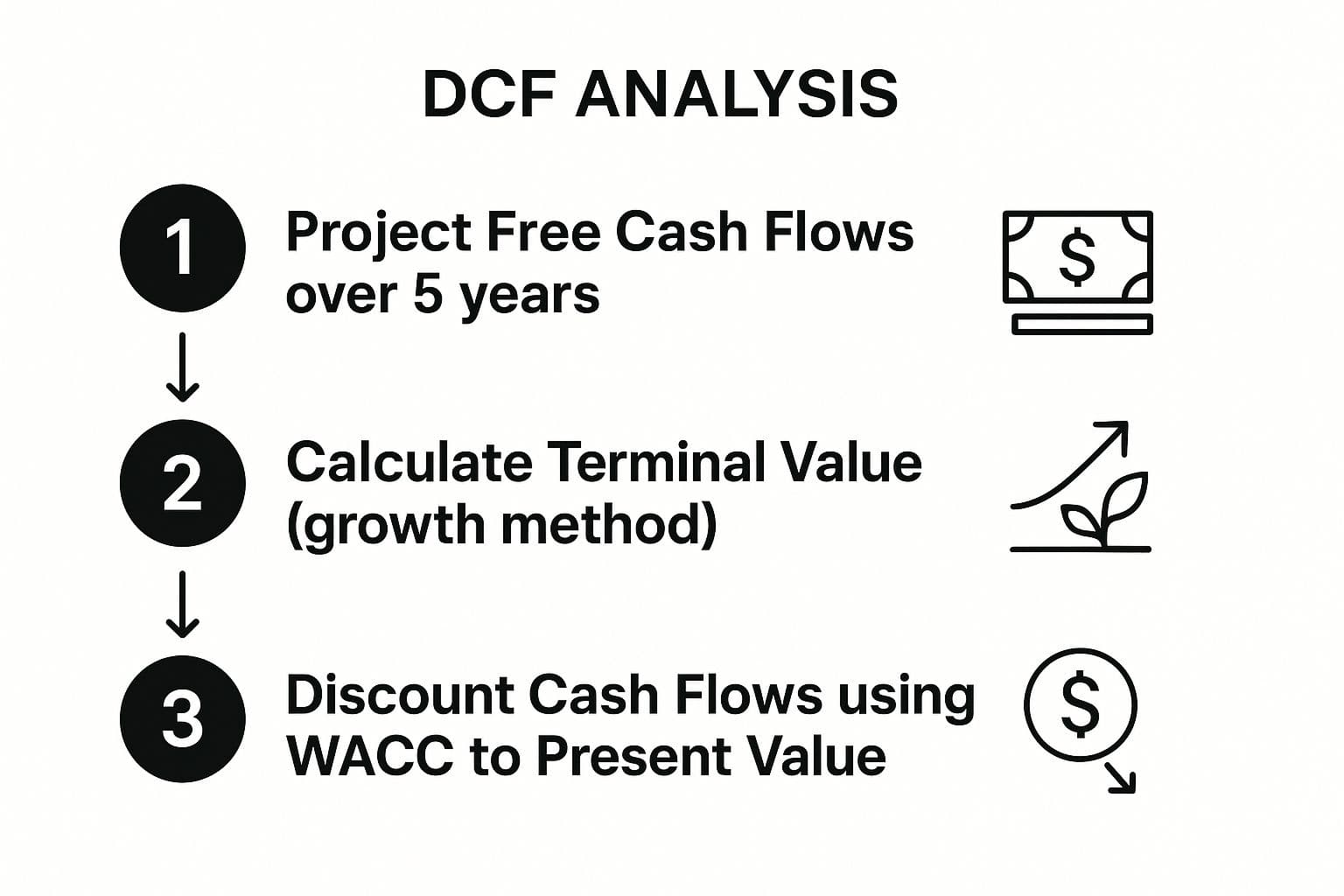

The infographic below illustrates the high-level process flow of a DCF analysis.

This visual shows how the valuation is built by first projecting near-term cash flows, then estimating long-term value, and finally discounting everything back to today's dollars.

Actionable Tips for Success

- Be Methodical: Walk through the steps logically. Start high-level and be prepared to dive into the details of any component if asked.

- Explain Your Assumptions: A DCF is only as good as its assumptions. Briefly mention key assumptions, such as the revenue growth rate or the terminal growth rate, and be ready to justify them.

- Connect to Enterprise Value: Clearly state that the result of a DCF is Enterprise Value. You can then subtract net debt and other items to arrive at Equity Value.

For a detailed visual walkthrough, check out this video:

4. How Would You Value a Company?

This is one of the most fundamental technical investment banking interview questions you'll encounter. It directly tests your core financial knowledge and understanding of how investment bankers determine a company's worth. Your ability to clearly articulate the main valuation methodologies demonstrates your technical competence and readiness for the analytical demands of the job.

Your goal is to show the interviewer you understand the "big three" valuation methods, their respective pros and cons, and how they are used together to arrive at a valuation range, not a single number. This is your chance to prove you have the foundational skills needed to contribute from day one.

How to Structure Your Answer

A strong response will systematically introduce and explain the three primary valuation techniques. You should aim to be clear, structured, and confident in your explanation.

- Introduce the Core Methods: Start by stating that there are three main ways to value a company: Comparable Company Analysis (Comps), Precedent Transactions, and Discounted Cash Flow (DCF) Analysis.

- Explain Each Method: Briefly describe how each one works. For Comps, mention using multiples like EV/EBITDA of similar public companies. For Precedents, explain it's similar but uses multiples from past M&A deals, often including a control premium. For DCF, describe projecting future cash flows and discounting them to the present.

- Provide Context: Explain when each method is most appropriate. For example, use Comps for a stable, mature company, Precedents for an M&A scenario, and DCF for a high-growth company with predictable cash flows. Mentioning a Sum-of-the-Parts valuation for a conglomerate shows advanced knowledge.

Pro Tip: Conclude by explaining that these methods provide a valuation range (often displayed in a "Football Field" chart). No single method is perfect, so bankers use them in combination to form a comprehensive and defensible view of a company's worth.

Actionable Tips for Success

- Know the Pros and Cons: Be prepared to discuss the advantages and limitations of each method (e.g., DCF is intrinsic but relies on many assumptions; Precedents reflect control premiums but market conditions change).

- Be Ready for a Deeper Dive: An interviewer might follow up with, "Which method usually gives the highest valuation?" (Typically Precedent Transactions due to the control premium).

- Mention Industry Nuances: Show advanced understanding by noting that certain industries have specific preferred multiples, like EV/EBITDAR for airlines or P/FFO for REITs. For more details on this topic, you can learn more about technical valuation questions.

5. Explain a Recent Deal or Market Event

This question is a direct test of your commercial awareness and genuine interest in the industry. Interviewers use it to gauge whether you actively follow the markets and can think critically about the strategic rationale behind major transactions. Simply knowing a deal happened is not enough; you must be able to articulate its key components, motivations, and implications.

A strong response demonstrates that you can synthesize information, understand financial metrics in a real-world context, and form an educated opinion. This is a core skill for any investment banker, making it one of the most important technical investment banking interview questions you might face.

How to Structure Your Answer

Prepare two to three recent deals in detail. For each, structure your explanation to cover the key points concisely.

- Overview of the Transaction: Start with a high-level summary. Name the companies involved (acquirer and target), the transaction size, and the form of consideration (e.g., all-cash, all-stock, or a mix).

- Strategic Rationale: Explain why the deal makes sense. This could involve revenue synergies (e.g., cross-selling), cost synergies (e.g., reducing headcount), market expansion, or acquiring new technology.

- Financial Details and Your Opinion: Discuss the valuation multiples (e.g., EV/EBITDA) and the premium paid. Conclude with your own brief analysis: Do you think it was a good deal? Was the price fair? What are the potential risks?

Pro Tip: Try to discuss a deal relevant to the bank you are interviewing with or the industry group you're interested in. This shows specific, targeted interest and preparation.

Actionable Tips for Success

- Read the News Daily: Follow sources like The Wall Street Journal, Financial Times, and Bloomberg to stay current.

- Know the Key Metrics: Be prepared to discuss the purchase price, premium paid, valuation multiples, and how the deal was financed.

- Form a Coherent Opinion: Back up your view on the deal with logical reasoning based on its strategic and financial aspects. This skill is also critical for private equity interviews.

- Keep it Simple: Practice explaining complex deal structures and financial concepts in a clear and easily understandable way.

6. What Are the Three Financial Statements and How Are They Connected?

This is one of the most fundamental technical investment banking interview questions. Your ability to answer it clearly and correctly demonstrates your core understanding of accounting, which is the bedrock of all financial modeling and valuation. The interviewer isn't just looking for definitions; they want to see that you grasp the dynamic relationship between the statements.

Your goal is to define the Income Statement, Balance Sheet, and Cash Flow Statement, and then, most importantly, explain how they link together. A strong answer moves from one statement to the next logically, showing how a change in one ripples through the others.

How to Structure Your Answer

A precise answer should be well-organized and easy to follow. Start with definitions and then methodically trace the key connections.

- Define Each Statement: Briefly explain the purpose of each of the three statements. The Income Statement shows profitability over a period, the Balance Sheet presents a snapshot of assets, liabilities, and equity at a single point in time, and the Cash Flow Statement tracks cash movements from operating, investing, and financing activities.

- Explain the Primary Link: Start with the most direct connection. Net Income from the bottom of the Income Statement flows into the top of the Cash Flow Statement and also links to the Balance Sheet as an increase in Retained Earnings under Shareholders' Equity.

- Detail Secondary Links: Explain other key connections. For example, show how non-cash charges like Depreciation and Amortization, found on the Income Statement, are added back to cash flow. Then, explain how Capital Expenditures from the cash flow statement increase Property, Plant & Equipment (PP&E) on the Balance Sheet.

Pro Tip: Structure your explanation like a story. Start at the top of the Income Statement with revenue and walk the interviewer down to Net Income, then show how that Net Income "travels" to the other two statements to make the Balance Sheet balance.

Actionable Tips for Success

- Memorize the Core Connections: You must know these links by heart. The primary connection is Net Income, but also be fluent in how Depreciation, Capital Expenditures, and changes in Net Working Capital affect all three.

- Use a Specific Example: Trace a $10 increase in depreciation through all three statements to demonstrate your understanding. This shows you can apply the concept practically.

- Prepare for Follow-Ups: Be ready for scenario-based questions like, "What happens if a company buys a new factory with debt?" or "How does a stock buyback affect the statements?"

7. Why This Bank/Firm?

This question is a crucial test of your genuine interest and diligence. Interviewers use it to separate candidates who have blast-emailed every firm on Wall Street from those who have thoughtfully considered why this specific bank is the right place for them. A generic answer is an immediate red flag, while a well-researched, specific response can significantly set you apart.

Your goal is to demonstrate a deep understanding of the firm's unique position in the market, its culture, and its recent activities. You need to connect these specific attributes directly to your own career goals and personal interests, proving that you are not just looking for any investment banking job, but a career at this particular institution.

How to Structure Your Answer

A compelling response should be well-researched and structured logically, ideally lasting around 60-90 seconds.

- The Big Picture: Start with a high-level statement about the firm's reputation, market position, or a specific area of strength that attracts you. This could be its leadership in a particular industry group (e.g., TMT, Healthcare) or its deal flow in a specific product area (e.g., M&A, Leveraged Finance).

- The Specifics: Provide two to three concrete, specific reasons for your interest. Mention a recent deal the bank advised on that you found particularly interesting, a senior banker whose work you admire, or a unique aspect of their training program or culture you've learned about through networking.

- The Personal Connection: Conclude by tying it all together. Explain how these specific aspects of the firm align perfectly with your skills, experiences, and long-term career aspirations, making it the ideal platform for you to contribute and grow.

Pro Tip: Your answer should show, not just tell. Instead of saying "you have a great culture," reference specific conversations with alumni or employees that gave you insight into the bank's collaborative environment.

Actionable Tips for Success

- Go Beyond the Homepage: Dig into recent press releases, quarterly earnings reports, and news articles about the bank. Know their latest significant M&A deals or IPOs.

- Leverage Your Network: Mentioning people you've spoken to at the firm is one of the most powerful ways to show genuine interest. Name-dropping shows initiative and a proactive approach.

- Connect to Your Niche: If you have a passion for the technology sector, highlight the bank's leading Tech M&A practice and mention a specific recent transaction they led. This shows alignment between your interests and their strengths. Tailoring your answer is a key part of your interview preparation, so learn more about crafting your career path to stand out.

8. Where Do You See Yourself in 5 Years?

This classic question is one of the most common investment banking interview questions designed to gauge your long-term commitment, ambition, and understanding of the industry's career trajectory. Interviewers want to see that you have thought about your future and that your goals align with the demanding, yet structured, path that investment banking offers. Your answer reveals your level of research and whether you see this role as a long-term career or just a stepping stone.

A well-crafted response demonstrates that you have realistic expectations about the analyst or associate program and a genuine desire to grow within the firm. It’s a chance to show you are a thoughtful candidate who is planning for a future in finance, not just looking for any high-paying job.

How to Structure Your Answer

A convincing answer is both ambitious and grounded in the realities of the banking career path. It should show a clear progression from your starting role.

- Acknowledge the Immediate Future: Start by expressing your excitement for the immediate role. Emphasize your focus on mastering the fundamentals, being a reliable team member, and adding value as an analyst/associate in the first couple of years.

- Outline a Realistic Progression: Describe your five-year goal within the context of the firm. A typical path involves promotion from Analyst to Associate, and then working towards becoming a Vice President. Show you understand this progression.

- Connect to the Firm: Align your goals with the firm's specific strengths or opportunities. Mention a desire to develop expertise in a particular industry group the bank is known for or to take on more client-facing responsibilities as you advance.

Pro Tip: Avoid mentioning a swift exit to private equity or a hedge fund. While it’s a common path, voicing this in an interview suggests a lack of commitment to the bank that is interviewing you. Frame your ambitions within the firm's structure.

Actionable Tips for Success

- Be Realistic, Yet Ambitious: Aiming for a promotion to Associate or Senior Associate within five years is a solid, achievable goal. Mentioning you want to be a Managing Director is unrealistic.

- Show Commitment to Learning: Express a desire to continuously learn, take on more responsibility, and perhaps mentor incoming analysts as you become more senior.

- Demonstrate Flexibility: While having a plan is good, also convey that you are flexible and open to opportunities that may arise within the bank, showing you are adaptable.

Top 8 Investment Banking Interview Questions Comparison

| Question / Topic | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Walk Me Through Your Resume | Low - open-ended narrative format | Low - personal preparation | Assess communication, career logic, genuine interest | Opening interview question to set tone | Allows personal branding; shows preparation |

| Why Investment Banking? | Low to Medium - requires industry insight | Low - research on industry and bank | Gauge motivation, knowledge, and commitment | Assess genuine interest in IB | Demonstrates passion and research depth |

| Walk Me Through a DCF Analysis | High - multi-step technical process | Medium to High - finance modeling skills | Test valuation knowledge and technical competency | Technical rounds focusing on valuation | Shows solid financial modeling and valuation skills |

| How Would You Value a Company? | High - broad question covering multiple methods | High - understanding of various methodologies | Evaluate strategic and technical understanding | Advanced technical interviews | Demonstrates comprehensive valuation knowledge |

| Explain a Recent Deal or Market Event | Medium - requires up-to-date market knowledge | Medium - continuous market monitoring | Assess market awareness, analytical and communication skills | Behavioral/market awareness rounds | Shows industry interest and analytical thinking |

| What Are the Three Financial Statements and How Are They Connected? | Low - foundational accounting question | Low - basic accounting knowledge | Test financial literacy and understanding of statement linkages | Early technical/basic finance rounds | Demonstrates fundamental financial literacy |

| Why This Bank/Firm? | Medium - focused research on specific firm | Medium - extensive bank-specific research | Assess fit, motivation, and competitive knowledge | Fit/cultural fit interviews | Shows thorough preparation and genuine interest |

| Where Do You See Yourself in 5 Years? | Low to Medium - career planning reflection | Low - personal career insight | Evaluate career goals, expectations, and commitment | Behavioral/career motivation interviews | Reveals ambition and career focus |

From Preparation to Offer: Your Next Steps

Navigating the landscape of an investment banking interview requires more than just knowing the right answers; it demands a synthesis of technical skill, personal narrative, and strategic thinking. Throughout this guide, we've dissected the foundational questions that form the backbone of nearly every discussion, from the narrative arc of "Walk Me Through Your Resume" to the technical precision required for a "Walk Me Through a DCF" analysis.

Mastering these questions is about building a comprehensive toolkit. Your ability to connect the three financial statements demonstrates your foundational knowledge, while your analysis of a recent deal showcases your genuine market awareness. Answering "Why This Bank?" and "Why Investment Banking?" with conviction proves your commitment and cultural fit. Each question is a distinct opportunity to prove you possess the multifaceted skills required to excel as an analyst or associate.

Turning Knowledge into Performance

The critical bridge between understanding these concepts and securing an offer is practice. Raw knowledge can falter under pressure, but well-rehearsed, structured responses build the confidence needed to perform at your peak. The goal isn't to memorize a script but to internalize the frameworks so your delivery is both polished and authentic.

Your next steps should be focused on active, repetitive practice to build this crucial muscle memory.

- Verbalize Your Answers: Don't just think through your responses. Speak them out loud, record yourself, and listen back to identify areas for improvement in your pacing, clarity, and tone.

- Simulate Interview Pressure: Practice with peers, alumni, or career services professionals. Ask them to challenge your assumptions and provide unvarnished feedback on both your technical accuracy and behavioral delivery.

- Refine Your Story: Ensure a consistent narrative thread runs through your answers. Your resume story, motivations for banking, and career goals should align to present a cohesive and compelling candidate profile.

- Stay Current: Continue to follow the markets daily. Your ability to discuss a recent M&A transaction or IPO intelligently is a powerful signal of your passion and commercial acumen.

Ultimately, excelling in these interviews is proof that you can think on your feet, communicate complex ideas clearly, and handle the high-stakes environment of finance. By rigorously preparing for the most common investment banking interview questions, you are not just readying yourself for a series of conversations; you are laying the groundwork for a successful career.

Ready to move from theory to real-world practice? Soreno provides AI-powered mock interviews that simulate the pressure and nuance of a real investment banking interview, offering instant, objective feedback to sharpen your technical and behavioral answers. Start your journey toward interview mastery today at Soreno.