7 Case Study Interview Examples to Master in 2025

Struggling with consulting interviews? Master these 7 detailed case study interview examples, from profitability to M&A, with frameworks & expert analysis.

The case study interview is the primary hurdle standing between you and a coveted role in consulting, finance, or strategic management. It's a high-stakes, real-time test of your analytical abilities, structured problem-solving skills, and business intuition. For many candidates, the ambiguity and pressure of this format can be intimidating. What frameworks should you use? How do you structure your thoughts on the fly? How do you deliver a compelling recommendation? The key to success isn't just practicing random problems; it's about mastering the core archetypes.

This guide is designed to be your strategic playbook. We will dissect seven of the most common case study interview examples, providing you with a clear roadmap for each. You won't find generic advice here. Instead, you'll get detailed, step-by-step solutions, replicable frameworks, and actionable insights that you can apply immediately. We’ll cover everything from market entry and profitability to mergers and acquisitions and pricing strategy.

By working through these examples, you will learn to identify the core issue, build a logical structure, ask insightful clarifying questions, and present a data-driven conclusion with confidence. Think of this as a targeted training session to build the mental muscle required to break down complex business problems under pressure. Forget guesswork and anxiety; it's time to develop a systematic approach that will set you apart from the competition and help you land the offer. Let’s dive into the cases.

1. Market Entry Strategy Case

A cornerstone of management consulting interviews, the market entry strategy case asks a fundamental business question: should our client enter a new market? This could be a new geographical area, a different product category, or a new customer segment. Candidates are expected to act as strategic advisors, evaluating the opportunity's viability and providing a clear "go" or "no-go" recommendation supported by rigorous analysis. This case type is a favorite among top firms like McKinsey, BCG, and Bain because it tests a wide range of analytical, strategic, and communication skills.

The core of this problem involves assessing whether an attractive market opportunity aligns with the client's unique capabilities and financial objectives. For instance, an interviewer might ask: "A U.S.-based luxury coffee chain is considering expanding its operations to China. Should they proceed, and if so, how?"

Strategic Breakdown and Framework

To tackle this, you need a structured approach. A common and effective framework involves analyzing three core pillars: The Market, The Company, and The Competition. This structure ensures you cover all critical aspects before making a recommendation.

- Market Analysis: How big is the potential market? What is its growth rate? Are there significant barriers to entry (e.g., regulations, high capital costs)? What are the key customer segments and their preferences?

- Company (Client) Analysis: Does the company have the capabilities (e.g., brand recognition, operational expertise, capital) to succeed? Does this move align with its overall corporate strategy? What are the financial implications?

- Competitive Landscape: Who are the major competitors? What is their market share? How are they likely to react to a new entrant? Can our client establish a sustainable competitive advantage?

Strategic Insight: A common pitfall is treating these pillars as a simple checklist. The real skill is in connecting the insights. For example, if the market is attractive but dominated by two fierce competitors, your analysis must focus heavily on whether the client’s capabilities offer a unique, defensible advantage that can disrupt the existing dynamic.

Actionable Takeaways

When you receive a market entry case, follow these tactical steps to deliver a standout performance:

- Start with a Framework: Immediately structure your thoughts. State your framework (e.g., Market-Company-Competition) to the interviewer to show you have a logical plan.

- Quantify the Opportunity: Begin by sizing the market. This demonstrates your quantitative skills and helps determine if the opportunity is even worth pursuing from a financial perspective.

- Analyze Synergies and Risks: Go beyond the numbers. Consider how this new venture fits with the client's existing business. What are the potential synergies? What are the implementation risks (e.g., cultural differences, supply chain challenges)?

- Conclude with a Clear Recommendation: Your final answer must be a definitive "yes" or "no," supported by your key findings. Also, briefly outline the next steps or a potential implementation plan to show forward-thinking.

Market entry problems are a foundational part of the interview process and mastering them is essential. To see more detailed solutions for these types of case study interview examples, exploring comprehensive resources can provide deeper insights and practice.

2. Profitability Case Study

A quintessential case interview problem, the profitability case study centers on a client whose profits are declining, stagnating, or lagging behind competitors. Your task is to diagnose the root cause of the issue and propose concrete, data-driven solutions to reverse the trend. This case type is a favorite in consulting interviews because it directly tests a candidate's ability to structure a complex problem, perform quantitative analysis, and develop actionable business strategies. It is a staple in interviews at firms like McKinsey, BCG, and Bain.

At its core, this problem requires breaking down profit into its fundamental components to isolate the source of the decline. An interviewer might present a scenario like: "Our client, a national retail chain, has seen its profits decline by 20% over the last year. What is happening, and what should they do about it?"

Strategic Breakdown and Framework

A logical and structured approach is critical for solving profitability cases. The most effective framework is the basic profit equation: Profit = Revenue - Costs. This equation can be broken down further into a "profitability tree" to guide your investigation.

- Revenue Analysis: Is the issue on the revenue side? This branch splits into Price and Volume (Quantity). Has the average price per unit decreased? Or has the volume of sales dropped? Further investigation could explore shifts in product mix, customer segments, or geographic performance.

- Cost Analysis: Is the problem rooted in rising costs? This branch divides into Fixed Costs (e.g., rent, salaries) and Variable Costs (e.g., raw materials, direct labor). You need to determine which specific cost drivers have increased and why.

- External and Internal Factors: A comprehensive analysis considers factors both within and outside the client's control. Are industry-wide trends (e.g., new competitors, changing consumer tastes, economic downturn) or company-specific issues (e.g., operational inefficiencies, poor marketing) to blame?

Strategic Insight: The key is to be hypothesis-driven, not just a fact-gatherer. Instead of asking for all the data, form a hypothesis (e.g., "I suspect the profit decline is driven by a drop in sales volume in our Northeast region") and then ask for specific data to test it. This demonstrates a targeted and efficient problem-solving mindset.

Actionable Takeaways

When faced with a profitability case, use these steps to structure your response and impress the interviewer:

- Start with the Profit Equation: State the Profit = Revenue - Costs framework at the outset. This immediately shows the interviewer you have a structured plan to dissect the problem.

- Segment and Isolate: Break down revenue and cost components. Ask clarifying questions to isolate where the problem lies. For instance, "Has the 20% profit decline been consistent across all product lines, or is it concentrated in a specific one?"

- Find the Root Cause: Don't stop at identifying the "what" (e.g., costs are up); dig deeper to find the "why" (e.g., a key supplier increased prices due to new tariffs). This uncovers the core issue that needs solving.

- Recommend Actionable Solutions: Your conclusion should directly address the root cause. If declining volume is the issue, propose solutions like a new marketing campaign or a loyalty program. Provide a clear, definitive recommendation backed by your analysis.

Profitability problems are a fundamental test of your business acumen. By mastering the breakdown of these case study interview examples, you can demonstrate the analytical rigor required for a top-tier consulting role.

3. Growth Strategy Case

A classic and versatile case type, the growth strategy case challenges candidates to devise a plan for a company to expand its business and increase revenue or market share. Unlike the more focused market entry case, a growth strategy problem is broader, requiring an exploration of multiple avenues for growth. The core question is: how can our client achieve its ambitious growth targets? This could involve organic methods like developing new products or inorganic ones like acquisitions. Firms such as McKinsey, BCG, and Bain value this case type because it tests creative problem-solving, strategic prioritization, and the ability to link recommendations directly to a company's core strengths.

The essence of this case is to identify, evaluate, and prioritize various growth levers. An interviewer might present a scenario like: "Our client, a mature consumer packaged goods company, has a goal to double its revenue in the next five years. What strategic options should they pursue to achieve this?"

Strategic Breakdown and Framework

A structured approach is essential to navigate the wide range of possibilities. A powerful way to frame your thinking is to consider growth along two dimensions: Products (existing vs. new) and Markets (existing vs. new). This is often visualized using the Ansoff Matrix, which provides four primary growth quadrants.

- Market Penetration (Existing Product, Existing Market): How can we sell more of our current products to our current customers? This could involve strategies like increasing marketing spend, adjusting pricing, or improving distribution channels to gain market share from competitors.

- Product Development (New Product, Existing Market): What new products or services can we offer to our existing customer base? This leverages brand loyalty and existing relationships to introduce new revenue streams.

- Market Development (Existing Product, New Market): How can we take our current products and sell them in new geographical areas or to new customer segments? This is similar to a market entry case but is considered one of several potential growth options.

- Diversification (New Product, New Market): This is the riskiest quadrant, involving developing new products for entirely new markets. This could be through internal development or, more commonly, through mergers and acquisitions (M&A).

Strategic Insight: The key is not just to list options from these four quadrants. A top-tier candidate will deeply analyze the feasibility, risk, and potential ROI of each option in the context of the client's specific capabilities, brand equity, and financial resources. For example, a company with strong R&D but a weak brand in new regions might find product development far more feasible than market development.

Actionable Takeaways

When faced with a growth strategy case, use these steps to build a compelling and structured response:

- Clarify the Growth Target: First, understand the specifics. Is the goal based on revenue, profit, or market share? What is the timeline? A 10% annual growth target requires a different approach than a goal to double revenue in three years.

- Structure Your Exploration: State your framework clearly. Mention that you will explore growth options through both organic (e.g., product development, market penetration) and inorganic (e.g., M&A) means.

- Prioritize with Criteria: Evaluate each potential growth lever against a consistent set of criteria. Good criteria include potential financial impact, implementation cost, associated risks, timeline to execute, and alignment with the client's core competencies.

- Recommend a Phased Approach: Conclude with a clear, prioritized recommendation. Instead of suggesting one path, propose a phased strategy. For instance, recommend focusing on "quick wins" like market penetration in Year 1 while simultaneously exploring longer-term, higher-impact options like new product development or a strategic acquisition.

4. M&A and Investment Decision Case

A high-stakes scenario common in private equity, investment banking, and corporate strategy interviews, the M&A case evaluates a candidate's ability to advise on a major capital decision. The core question is whether a client should acquire another company, merge with a peer, or make a significant strategic investment. This case type pushes candidates to think like investors, balancing strategic vision with financial rigor and operational reality. Firms like KKR, Blackstone, and the corporate finance practices at McKinsey and BCG use these cases to test a blend of valuation, strategic rationale, and risk assessment skills.

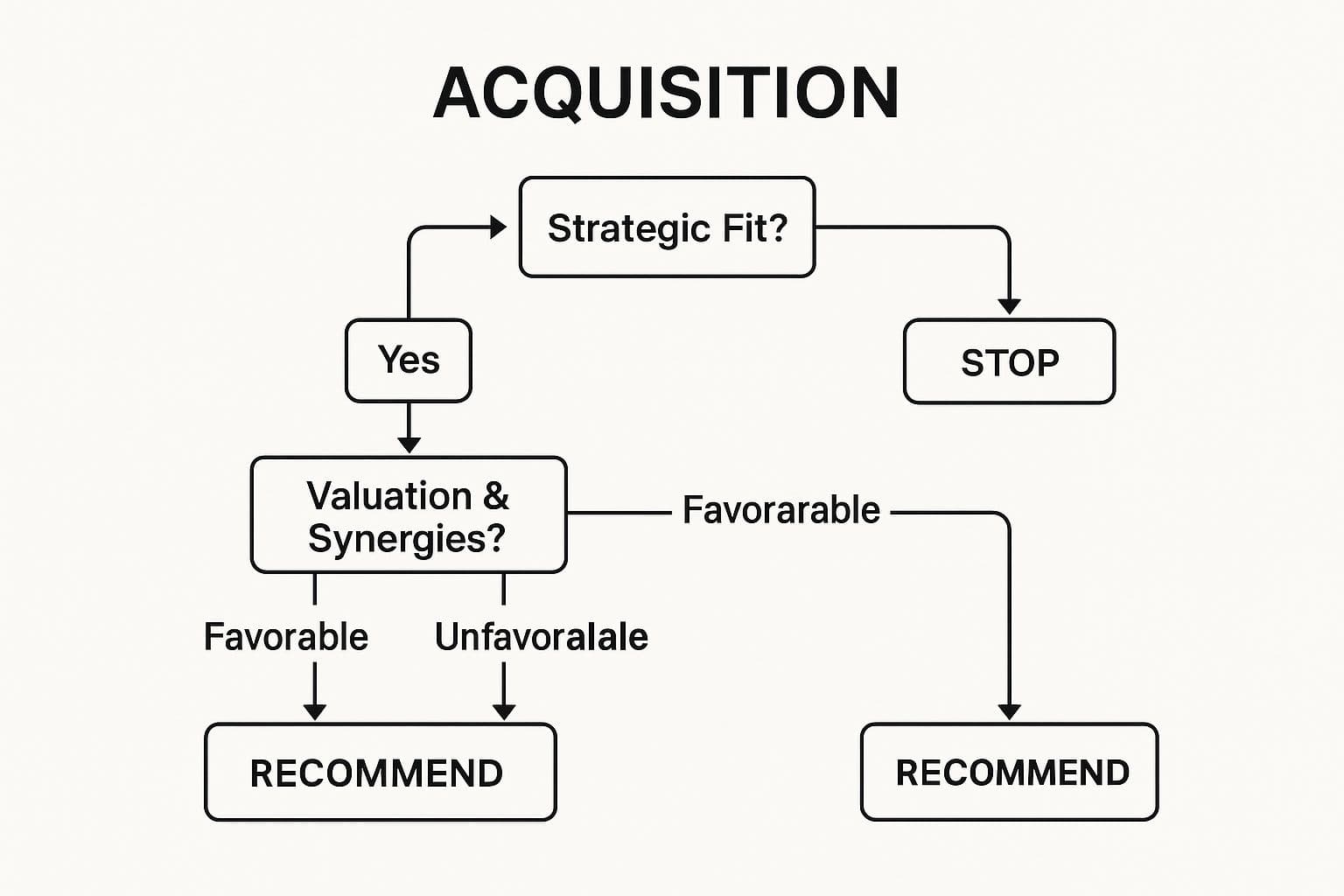

This decision tree visualizes the sequential logic required for a sound M&A recommendation, breaking down the complex evaluation into core decision points.

The flowchart emphasizes that a deal must clear multiple hurdles; a strong strategic fit is necessary but not sufficient if the financials or integration risks are unfavorable.

The problem could be framed in several ways, such as: "A private equity firm is considering acquiring a struggling retail chain. Should they proceed, and at what valuation?" or "Two mid-sized pharmaceutical companies are exploring a merger of equals. Advise our client, one of the companies, on whether this is a good move."

Strategic Breakdown and Framework

A robust framework for an M&A case should systematically evaluate the deal from multiple angles. A successful structure will address the Strategic Rationale, Financial Attractiveness, and Implementation Feasibility. This ensures your analysis is both comprehensive and logically sequenced.

- Strategic Rationale: Why is this deal being considered? Does the target company provide access to new markets, new technologies, or key talent? How does it fit with the client’s long-term vision? Would it strengthen the client's competitive position?

- Financial Attractiveness: What is a fair valuation for the target? What are the potential cost and revenue synergies, and can they be quantified? How will the deal be financed (debt, equity, cash)? Consider the deal's impact on the client’s earnings per share (EPS).

- Implementation and Risks: What are the major integration challenges (e.g., cultural clashes, system migrations)? Is the post-merger integration plan viable? What are the key risks (e.g., market reaction, regulatory hurdles, overpaying)?

Strategic Insight: A critical error is focusing solely on the financial model. The best candidates integrate the "story" behind the numbers. For example, even if the valuation seems attractive, you must question why the asset is priced that way. High integration risk or a poor cultural fit can destroy any value created on paper.

Actionable Takeaways

To deliver a compelling analysis in an M&A or investment case, use these tactical steps:

- Lead with Strategic Fit: Before diving into valuation, first establish if the deal makes strategic sense. If the acquisition doesn't align with the client’s core strategy, the financial details are less relevant.

- Quantify Synergies: Be specific about where value will be created. Brainstorm and quantify potential cost synergies (e.g., consolidating back-office functions) and revenue synergies (e.g., cross-selling products to a new customer base).

- Acknowledge Post-Merger Integration: Show your business acumen by discussing the operational challenges of combining two organizations. Mentioning potential cultural clashes, IT system integration, and retaining key talent demonstrates a mature understanding of M&A.

- Provide a Clear "Buy/Don't Buy" Conclusion: Your final recommendation must be decisive. Support it with your top 2-3 arguments, state a potential valuation range, and briefly outline the most critical risks and next steps.

Mastering these M&A and investment scenarios is crucial, particularly for finance-oriented roles. For those looking to delve deeper into these types of case study interview examples, you can learn more about private equity case studies and the frameworks used to dissect them.

5. Pricing Strategy Case

A common yet complex challenge in business, the pricing strategy case asks candidates to determine the optimal price for a product or service. This goes far beyond just covering costs; it involves a deep understanding of value, competition, and customer psychology. Interviewers use this case to assess a candidate's ability to blend quantitative analysis with qualitative strategic thinking. Firms with strong pricing practices, like Simon-Kucher & Partners and the major consulting firms (BCG, McKinsey), frequently use these cases to test commercial acumen.

The core of a pricing problem is finding the sweet spot that maximizes profitability without sacrificing market share or brand perception. For example, an interviewer might ask: "Our client, a pharmaceutical company, is about to launch a new, patented drug for a chronic condition. How should they price it?"

Strategic Breakdown and Framework

To solve a pricing case, you must evaluate the problem from multiple angles. A robust framework involves analyzing three primary pricing methodologies: Cost-Based, Competition-Based, and Value-Based pricing. This structure ensures you consider the full context before arriving at a price point.

- Cost-Based Analysis: What is the total cost to produce, market, and distribute one unit of the product (including fixed and variable costs)? What is the minimum price needed to break even?

- Competition-Based Analysis: What are competitors charging for similar products or substitutes? How is our product differentiated? How might competitors react to our pricing strategy?

- Value-Based Analysis: What is the perceived value of the product to the customer? How much are they willing to pay? This can be quantified by considering factors like cost savings, increased revenue, or other benefits the product provides to the customer.

Strategic Insight: The most sophisticated answers prioritize value-based pricing. While cost and competition are important guardrails, the price a customer is willing to pay is ultimately tied to the value they receive. Your analysis should focus heavily on quantifying this value and using it as the primary anchor for your recommendation.

Actionable Takeaways

When faced with a pricing strategy case, apply these steps to deliver a comprehensive and compelling solution:

- State Your Framework: Open by outlining the three core pricing methodologies (Cost, Competition, Value). This immediately signals a structured and comprehensive approach to the interviewer.

- Analyze All Three Angles: Methodically work through each pillar. Start with cost-plus to establish a price floor. Then analyze competitors to understand market context. Finally, dive deep into value-based pricing, which will likely form the core of your recommendation.

- Segment the Customer Base: Not all customers perceive value the same way. Discuss how you might segment the market and potentially offer tiered pricing (e.g., basic, premium, enterprise) to capture maximum value from different groups.

- Conclude with a Specific Price and Rationale: Don't end with a vague range. Recommend a specific price point or pricing structure. Justify your choice based on your analysis, and briefly mention key risks (e.g., competitive retaliation) and how to mitigate them.

Pricing cases are a fantastic test of business intuition and analytical rigor, making them a popular feature in case study interview examples. Mastering the three-pronged approach is key to success.

6. Operations and Process Improvement Case

The operations and process improvement case delves into the core mechanics of a business, focusing on enhancing efficiency, cutting costs, or boosting capacity. Whether it's a factory floor, a service delivery center, or a complex supply chain, candidates are tasked with diagnosing operational weaknesses and prescribing solutions. This case type is a staple in interviews for operations-focused consulting practices (like McKinsey Operations) because it rigorously tests a candidate's analytical precision, logical thinking, and ability to quantify impact.

The central challenge is to identify and resolve bottlenecks or inefficiencies within a given process. For example, an interviewer might present a scenario like: "A major e-commerce company's distribution center is struggling to meet its next-day delivery targets. Identify the root cause of the delays and recommend steps to improve throughput."

Strategic Breakdown and Framework

To solve an operations case, you must dissect a process into its constituent parts. A powerful approach is to map the entire process flow from start to finish, then analyze the performance of each step to identify the primary constraint or bottleneck.

- Process Mapping: What are the sequential steps involved in the operation (e.g., from order receipt to final delivery)? Visually laying this out is often the best first step.

- Capacity and Throughput Analysis: What is the maximum output (capacity) of each step in the process? What is the current output (throughput)? The step with the lowest capacity is the bottleneck that dictates the entire system's output.

- Waste Identification (Lean Principles): Where is there waste in the system? Look for wasted time (waiting), materials (defects), or motion (inefficient layouts). This involves analyzing labor utilization, machine uptime, and inventory levels.

Strategic Insight: The key to cracking these cases is realizing that improving a non-bottleneck step will not improve the overall system's output. All efforts must be concentrated on the single greatest constraint. For instance, making an upstream process 20% faster is useless if the downstream bottleneck can't handle the increased volume.

Actionable Takeaways

When you encounter an operations and process improvement case, use these tactical steps to guide your analysis and deliver a compelling solution:

- Map the Process: Start by drawing out the process flow. Ask the interviewer for the specific steps, the time each takes, and the resources involved. This creates a visual foundation for your analysis.

- Find the Bottleneck: Calculate the capacity for each step. This quantitative exercise will clearly reveal the system's primary constraint. State this finding explicitly to the interviewer.

- Brainstorm Solutions Around the Bottleneck: Focus your recommendations on alleviating the bottleneck. Solutions could include adding resources, improving efficiency at that specific step, or rerouting some workflow. Consider both short-term fixes and long-term strategic changes.

- Quantify Your Impact: Don't just suggest solutions; calculate their financial and operational impact. For example, "By adding a second packaging station, we can increase throughput by 30%, which translates to an additional $5 million in annual revenue."

Operations cases are a fantastic test of your ability to apply structured problem solving techniques to real-world business challenges. Mastering them demonstrates a practical, results-oriented mindset that is highly valued by consulting firms. You can explore more about these methods by reading about structured problem-solving techniques.

7. New Product Launch Case

A new product launch case challenges you to evaluate whether a client should introduce a new product and, if so, how to bring it to market successfully. This scenario tests a blend of strategic thinking, marketing acumen, and financial analysis. You must assess everything from the product’s core features to its pricing, promotion, and distribution channels. This case is frequently used in interviews for product management roles at tech firms like Google and Meta, as well as by marketing-focused consulting practices, as it mirrors the real-world decisions businesses make daily.

The central question revolves around creating a viable business case for a new offering. For example, an interviewer might pose: "A major food and beverage company is considering launching a new line of plant-based snacks. Should they proceed, and what would your go-to-market plan be?" This requires a comprehensive evaluation of the opportunity and a detailed launch strategy.

Strategic Breakdown and Framework

A robust structure for a new product launch case is crucial. A common approach is to analyze the Product, the Market, and the Strategy, which ensures a holistic assessment of the product's viability and the plan for its introduction.

- Product Analysis: What are the product's key features and benefits? How is it differentiated from existing solutions? Is it a standalone product or part of a larger ecosystem? Consider potential cannibalization of the client's existing product lines.

- Market Analysis: Who is the target customer? What is the size of the addressable market (TAM)? What are the prevailing trends and customer needs in this space? Who are the key competitors, and what are their strengths and weaknesses?

- Go-to-Market Strategy: This pillar covers the "4 Ps" of marketing. Product (features, branding), Price (pricing strategy), Place (distribution channels), and Promotion (marketing and sales tactics). It also involves building a financial case with revenue projections and cost estimates.

Strategic Insight: A common mistake is to focus too much on the product's features. The best candidates connect the product's unique value proposition directly to an unmet need within a specific customer segment. The key is demonstrating how the product will win, not just what it does.

Actionable Takeaways

When presented with a new product launch case, use these steps to structure your response and deliver a compelling analysis:

- Define the Customer First: Before sizing the market, clearly define the target customer segment. This shows a customer-centric approach and helps focus your subsequent analysis.

- Use the 4 Ps Framework: Explicitly structure your go-to-market plan around the 4 Ps (Product, Price, Place, Promotion). This provides a clear, comprehensive, and easy-to-follow logic for your interviewer.

- Address Cannibalization: Proactively identify and quantify the risk of the new product eating into the sales of the client's existing offerings. Suggest strategies to mitigate this risk.

- Conclude with a Phased Rollout: Instead of a simple "yes" or "no," propose a clear, phased launch plan. This could include a pilot program or a geographical rollout, demonstrating that you have considered implementation risks and are strategically cautious.

New product launch scenarios are excellent case study interview examples because they test your ability to bridge high-level strategy with on-the-ground execution.

Case Study Interview Types Comparison

| Case Type | Implementation Complexity 🔄 | Resource Requirements 💡 | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Market Entry Strategy Case | High – multiple variables and broad business knowledge required | High – market data, competitive analysis, financial estimates | Strategic recommendation on market entry feasibility and approach | Companies evaluating new markets, geographies, or product categories | Tests multiple analytical skills; reflects common real-world decisions |

| Profitability Case Study | Medium – structured framework but requires hypothesis testing | Medium – financial data and internal/external info | Identification of profit decline causes and improvement recommendations | Analyzing declining profits or margins | Clear, beginner-friendly structure; fundamental business application |

| Growth Strategy Case | High – broad options, requires balancing multiple criteria | High – diverse market and company data, portfolio analysis | Prioritized growth strategies to meet revenue or market share targets | Businesses aiming for revenue or market expansion | Broad CEO-level strategic thinking; fosters creative solutions |

| M&A and Investment Decision Case | High – complex financial and strategic analysis | High – detailed valuation, synergy quantification, integration planning | Go/no-go acquisition or investment decision with risk assessment | Private equity, investment banking, corporate finance decisions | Combines strategic and financial rigor; clear decision point |

| Pricing Strategy Case | Medium – requires economic and customer behavior assumptions | Medium – market pricing data, cost info, customer insights | Optimal pricing strategy aligned with business goals and competition | Product launches, pricing optimization, competitive repositioning | Direct impact on revenue; balances analytical and strategic skills |

| Operations and Process Improvement Case | Medium – technical with detailed process understanding | Medium – operational data, capacity info, KPIs | Actionable improvements in efficiency, cost, or capacity | Manufacturing, service delivery, supply chain optimization | Clear, measurable objectives; data-driven and widely applicable |

| New Product Launch Case | High – combines market, strategy, and execution planning | High – market sizing, competitive analysis, marketing mix | Comprehensive product launch plan covering market fit to financials | Companies deciding on new product introduction | End-to-end business skill test; encourages creativity and thoroughness |

From Theory to Offer: Your Next Steps

We've journeyed through a comprehensive collection of seven distinct case study interview examples, from navigating a complex market entry to optimizing a company's operational backbone. You've seen how to break down profitability issues, evaluate M&A targets, and strategize a new product launch. Each example provided not just a problem, but a replicable blueprint for structured, analytical thinking.

However, the critical takeaway is this: knowing the frameworks is merely the price of admission. The candidates who receive offers are the ones who can fluidly adapt these mental models under pressure, communicate their logic with clarity, and project confidence even when faced with an unexpected data point or a challenging question from the interviewer. This guide has equipped you with the theoretical foundation; now, the real work of building practical mastery begins.

Synthesizing the Core Lessons

Across all the case study interview examples we analyzed, several core principles emerged as non-negotiable for success. Think of these as the strategic pillars supporting every successful case performance.

- Structure is Your Anchor: Whether it's a Profitability Framework, a 4 Ps model for pricing, or a custom issue tree for an operational bottleneck, a logical structure is your most powerful tool. It prevents you from getting lost, ensures you remain MECE (Mutually Exclusive, Collectively Exhaustive), and signals to your interviewer that you possess a disciplined, organized mind.

- Hypothesis-Driven Approach: Don't just explore data randomly. Start with a preliminary hypothesis and use your analysis to test, refine, or reject it. This proactive approach demonstrates commercial acumen and keeps your analysis focused and efficient, moving you toward a solution rather than just describing a problem.

- Communication is the Deliverable: Your brilliant analysis is worthless if you cannot articulate it clearly. Practice "thinking out loud" to guide the interviewer through your logic. Use signposting phrases like, "First, I'd like to explore...," "Now, let's turn to...," or "My key takeaway here is..." to create a coherent narrative.

Strategic Insight: The most impressive candidates treat the case not as a test, but as a collaborative problem-solving session. They actively engage the interviewer, ask clarifying questions, and use the conversation to build a stronger, more nuanced recommendation.

Turning Knowledge into a Competitive Edge

Reading through these detailed breakdowns is an excellent start, but passive learning has its limits. The gap between understanding a solved case and solving a new one in real-time is significant. To bridge this gap, you must transition from a theoretical mindset to a performance-oriented one.

Here is your actionable roadmap for the next phase of your preparation:

- Deconstruct and Rebuild: Take one of the case study interview examples from this article. Without looking at the solution, try to solve it yourself from scratch. Time yourself. Record your thought process. Afterward, compare your structure, calculations, and recommendation against our breakdown. Identify where you deviated and, more importantly, why.

- Drill the Fundamentals: The speed and accuracy of your quantitative analysis can make or break your performance. Dedicate time specifically to practicing "case math." This includes market sizing calculations, break-even analysis, and ROI computations. The goal is to make these calculations second nature, freeing up your mental bandwidth to focus on the bigger strategic picture.

- Simulate Interview Conditions: The ultimate test is performance under pressure. Find a partner to practice with, or leverage technology to simulate the experience. The objective is to get comfortable with the cadence of a real interview, from the initial prompt to the final recommendation. This is where you'll uncover your blind spots, whether it's a tendency to rush your calculations or a habit of not fully answering the "so what?" behind your findings.

Mastering the case study interview is a process of deliberate, repetitive practice. By internalizing the structures from these examples and relentlessly drilling their application, you transform academic knowledge into an instinctive, high-performance skill. You move from someone who knows about cases to someone who excels at them, ready to demonstrate your value and secure that coveted offer.

Ready to put theory into practice and get the reps you need? The Soreno AI-powered platform provides unlimited, on-demand case interview practice with instant, personalized feedback. Move beyond reading case study interview examples and start mastering them by practicing with a virtual interviewer at Soreno.